Clarification -

The major indices are still in a bull-market (although ripe for a pullback).

The unwind is isolated to the hyper-growth stocks + SPACs which had appreciated significantly last year and become very over-extended.

Those names are now correcting prior excesses.

The major indices are still in a bull-market (although ripe for a pullback).

The unwind is isolated to the hyper-growth stocks + SPACs which had appreciated significantly last year and become very over-extended.

Those names are now correcting prior excesses.

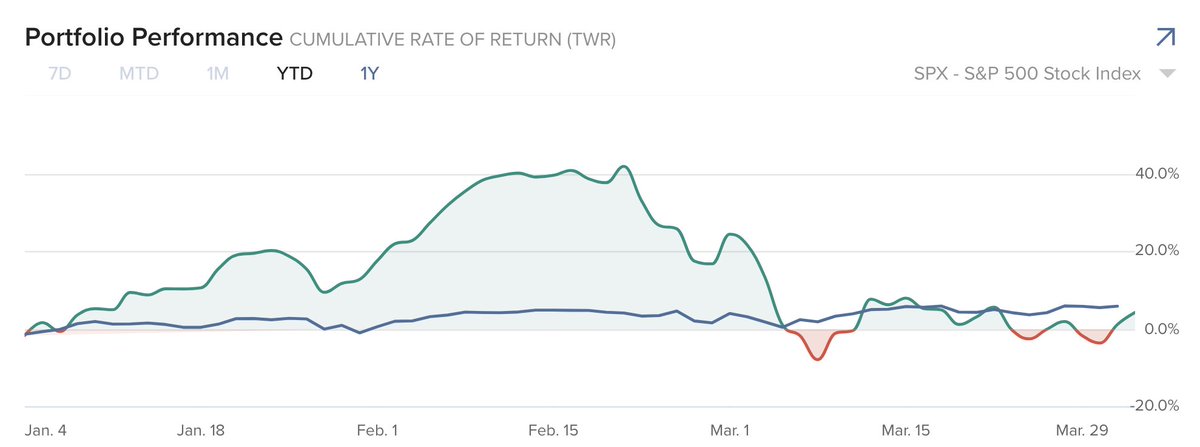

Late last year and in Jan/Feb, I kept saying that 400-500% gains in a year were NOT normal - normally stocks appreciate so much in 5 years (or more)!

So, ongoing sell-off is normal. So far ARK ETFs have given back ~35% of the entire gain, 50-62% retracement can't be ruled out.

So, ongoing sell-off is normal. So far ARK ETFs have given back ~35% of the entire gain, 50-62% retracement can't be ruled out.

Whenever an asset or market experiences gravity defying gains in a short period of time and that move ends with euphoria, 'this time is different' and price acceleration, the result is always the same - perfect bell curve and brutal decline/bust.

This is how bubbles form + pop.

This is how bubbles form + pop.

Final thought -

Whenever over-extended stocks in one area start tanking after posting stellar operating results, that is a clear sign that the best has already been discounted.

Stocks top and bottom ahead of fundamentals (when best and worst have been discounted).

Whenever over-extended stocks in one area start tanking after posting stellar operating results, that is a clear sign that the best has already been discounted.

Stocks top and bottom ahead of fundamentals (when best and worst have been discounted).

• • •

Missing some Tweet in this thread? You can try to

force a refresh