As more retail enters DeFi, more capital will flow toward yield farms as users seek to capture the best return on their idle assets.

I don't claim to have it all figured out, though here are a few tips I've learned over the past year.

A 🧵

I don't claim to have it all figured out, though here are a few tips I've learned over the past year.

A 🧵

1) Watch your favorite follows' favorite follows and their likes.

While many DeFi chads may be tight-lipped in their feeds about the farms they're in, some (mistakenly?) follow the farms they enter or are watching on Twitter. Likes matter too.

While many DeFi chads may be tight-lipped in their feeds about the farms they're in, some (mistakenly?) follow the farms they enter or are watching on Twitter. Likes matter too.

2) Keep a close eye on this chad. He leaks alpha all the time.

Issue is, he isn't straightforward about it. Read his tweets closely. Google synonyms / related terms. Try out those terms then add a .finance or .fi.

twitter.com/Cryptoyieldinfo

Issue is, he isn't straightforward about it. Read his tweets closely. Google synonyms / related terms. Try out those terms then add a .finance or .fi.

twitter.com/Cryptoyieldinfo

3a) Don't get mislead by high headline yields.

When you look at a yield farm, don't get carried away by the headline yield.

Watch out for impermanent loss, deposit fees, withdrawal fees, and the risk of your principal being taken away due to protocol mechanics.

When you look at a yield farm, don't get carried away by the headline yield.

Watch out for impermanent loss, deposit fees, withdrawal fees, and the risk of your principal being taken away due to protocol mechanics.

3b) Impermanent loss occurs when you deposit two coins into an AMM that diverge in price.

This loss can eat away at your deposit in dollar terms.

More from @jonwu_ here:

This loss can eat away at your deposit in dollar terms.

More from @jonwu_ here:

https://twitter.com/jonwu_/status/1389782646000078850

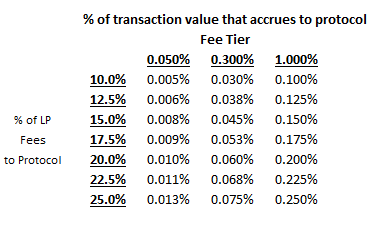

4) Remember to factor in yield compression.

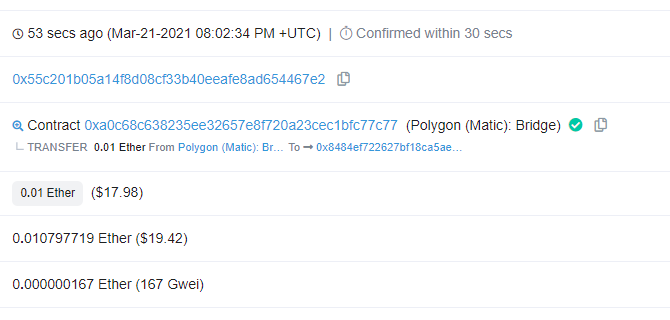

Gas fees on Ethereum eat into your profits, even for larger farmers.

Just because something may say 10,000% APR doesn't mean it will last for long. It requires some experience, but you'll get a feel for compression over time.

Gas fees on Ethereum eat into your profits, even for larger farmers.

Just because something may say 10,000% APR doesn't mean it will last for long. It requires some experience, but you'll get a feel for compression over time.

5) Never bet the whole farm on a farm.

Just don't! Even reputable and audited protocols have been rugged. The best way to hedge rug risk is to spread risk across a number of protocols.

You can't win 'em all.

Just don't! Even reputable and audited protocols have been rugged. The best way to hedge rug risk is to spread risk across a number of protocols.

You can't win 'em all.

6) Find a group of alpha leakers.

As I indicated in my last thread, friends are important. Not only can they support you emotionally in your crypto journey, but they also tend to leak alpha.

Find your group. Find farms together. Ape together.

As I indicated in my last thread, friends are important. Not only can they support you emotionally in your crypto journey, but they also tend to leak alpha.

Find your group. Find farms together. Ape together.

https://twitter.com/n2ckchong/status/1387949472651485188

7) APR AND APY ARE NOT THE SAME.

APR = non-compounding yield

APY = compounding yield

To attract depositors, some protocols calculate if you sold rewards and compounded every day. Often, it's unfeasible to do so.

Don't let them trick you.

APR = non-compounding yield

APY = compounding yield

To attract depositors, some protocols calculate if you sold rewards and compounded every day. Often, it's unfeasible to do so.

Don't let them trick you.

Tips aside, aren't protocols that calculate yields as if you sold protocols rewards and compounded every day just incentivizing users to dump their native tokens?

stonks?

stonks?

8/ Don't sell all farmed tokens.

Some tokens that were farmable at one point have shot dramatically higher since farming ended/slowed down.

To name a few, YFI, ROOK, BAO, and SUSHI.

Some tokens that were farmable at one point have shot dramatically higher since farming ended/slowed down.

To name a few, YFI, ROOK, BAO, and SUSHI.

https://twitter.com/Darrenlautf/status/1390496460668497926

• • •

Missing some Tweet in this thread? You can try to

force a refresh