A thread compiling some of the most cost-inefficient Ethereum transactions seen on chain.

Aside from these transactions being a silly way to spend precious $ETH, high gas fees + continual usage may be a sign of strong PMF, as @santiagoroel said in his recent @UpOnlyTV show.

👇

Aside from these transactions being a silly way to spend precious $ETH, high gas fees + continual usage may be a sign of strong PMF, as @santiagoroel said in his recent @UpOnlyTV show.

👇

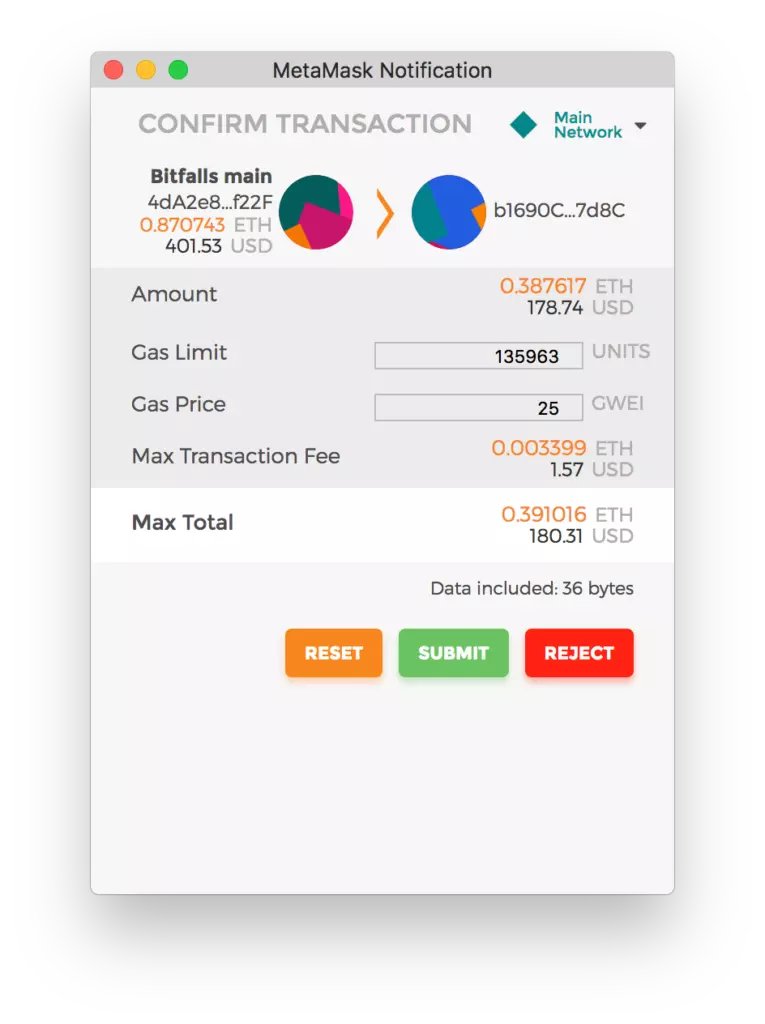

0x74e spent $42.05 worth of gas to deposit approximately $160 into Uniswap.

The pool is currently yielding 26% in fees per Uniswap. It will take one year, assuming no IL and consistent fees, for this user to recuperate his transaction fee.

The pool is currently yielding 26% in fees per Uniswap. It will take one year, assuming no IL and consistent fees, for this user to recuperate his transaction fee.

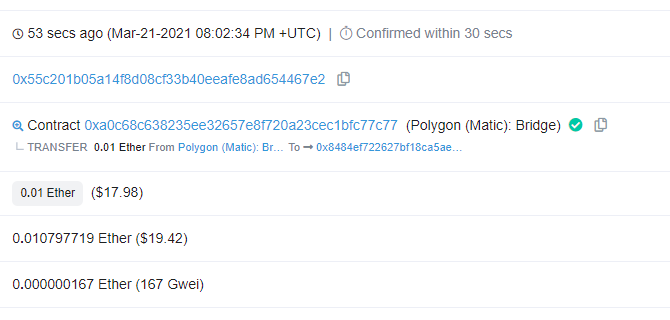

0x55c spent $19.42 worth of gas to deposit $18 worth of ETH into Polygon.

It'll be around $40-50 on the way out if this user decides to withdraw from Polygon at a later date.

It'll be around $40-50 on the way out if this user decides to withdraw from Polygon at a later date.

0x30a spent $6 on a failed swap of $18 worth of ETH into another token.

The gas limit was set at 174,204, so assuming it was a normal Uniswap swap, it would have cost more than the swap amount.

The gas limit was set at 174,204, so assuming it was a normal Uniswap swap, it would have cost more than the swap amount.

The point on how cost-inefficiency in smaller txes may show PMF aside, there's a lot to get excited about when it comes to layer-two solutions.

Existing sidechains have seen a parabolic explosion in liquidity and usage while there are a number of rollup solutions inbound.

Existing sidechains have seen a parabolic explosion in liquidity and usage while there are a number of rollup solutions inbound.

• • •

Missing some Tweet in this thread? You can try to

force a refresh