Spent some time this evening thinking through Uniswap v3 a bit more.

Wanted to break down the basics of this upgrade and some effects it may have on the rest of the Ethereum DeFi ecosystem space.

👇

Wanted to break down the basics of this upgrade and some effects it may have on the rest of the Ethereum DeFi ecosystem space.

👇

Fees (1/4):

v2 popularized the model whereby 0.3% of each transaction accrues to liquidity providers.

v2 also has a fee switch where UNI holders are entitled to 0.05% of each transaction—or 16.6% of transaction fees.

v2 popularized the model whereby 0.3% of each transaction accrues to liquidity providers.

v2 also has a fee switch where UNI holders are entitled to 0.05% of each transaction—or 16.6% of transaction fees.

Fees (2/4):

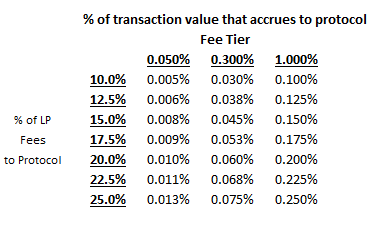

v3 introduces three "fee tiers" of 0.05%, 0.3%, and 1%. 1:1 assets may trade in the lowest category while high vol assets may sit in the highest category.

v3 also makes it so governance can set the % (10-25) of LP fees that accrue to protocol on a per-pool basis.

v3 introduces three "fee tiers" of 0.05%, 0.3%, and 1%. 1:1 assets may trade in the lowest category while high vol assets may sit in the highest category.

v3 also makes it so governance can set the % (10-25) of LP fees that accrue to protocol on a per-pool basis.

Fees (3/4):

This modularity in fee structure can give rise to Curve-like pools.

Curve currently charges 0.04% on each swap, where 50% of fees accrue to veCRV holders.

So, with the lowest v3 option being 0.05%, Curve has the edge. Expecting targeted competition with LM rewards.

This modularity in fee structure can give rise to Curve-like pools.

Curve currently charges 0.04% on each swap, where 50% of fees accrue to veCRV holders.

So, with the lowest v3 option being 0.05%, Curve has the edge. Expecting targeted competition with LM rewards.

Fees (4/4):

The fact that governance has to approve fees on a *per-pool* basis is fascinating.

On SushiSwap, ETH-ALCX pool generated $50kworth of protocol fees in its first 3 days. Uniswap's governance model probably limits fee capture for new pools.

The fact that governance has to approve fees on a *per-pool* basis is fascinating.

On SushiSwap, ETH-ALCX pool generated $50kworth of protocol fees in its first 3 days. Uniswap's governance model probably limits fee capture for new pools.

User-defined AMM terms (1/4):

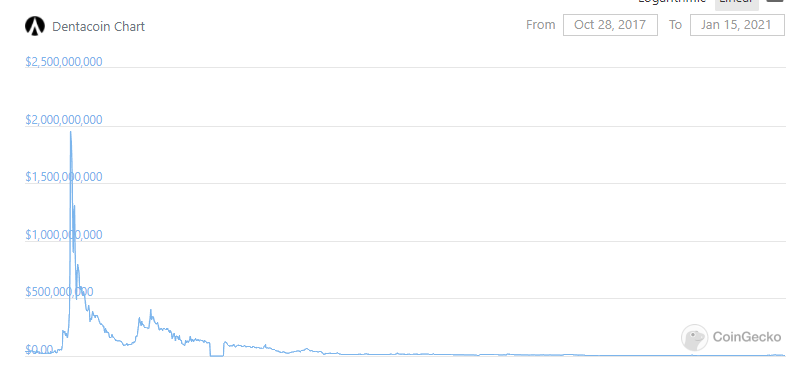

When you provide liquidity to Uniswap v2, your assets are allocated across the pool from 0 to infinity.

The reality is most assets don't trade in a range from 0 to infinity.

Thus, providing liquidity to most pairs is *capital inefficient*.

When you provide liquidity to Uniswap v2, your assets are allocated across the pool from 0 to infinity.

The reality is most assets don't trade in a range from 0 to infinity.

Thus, providing liquidity to most pairs is *capital inefficient*.

User-defined AMM terms (2/4):

Take this example: ETH has traded between 0.015 BTC and 0.045 BTC over the past 2.5 years.

A big range, sure, though, far from 0 to infinity.

With a WETH/WBTC v2 pool, only a small portion of your assets are being used to trade this range.

Take this example: ETH has traded between 0.015 BTC and 0.045 BTC over the past 2.5 years.

A big range, sure, though, far from 0 to infinity.

With a WETH/WBTC v2 pool, only a small portion of your assets are being used to trade this range.

User-defined AMM terms (3/4):

With v3, users can provide LP in price ranges.

In the WBTC/ETH example, a user may allocate their liquidity to the 0.015-0.045 range.

Their liquidity is only tradable within the range and thus has a higher utilization rate per trade vs. v2.

With v3, users can provide LP in price ranges.

In the WBTC/ETH example, a user may allocate their liquidity to the 0.015-0.045 range.

Their liquidity is only tradable within the range and thus has a higher utilization rate per trade vs. v2.

User-defined AMM terms (4/4):

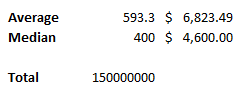

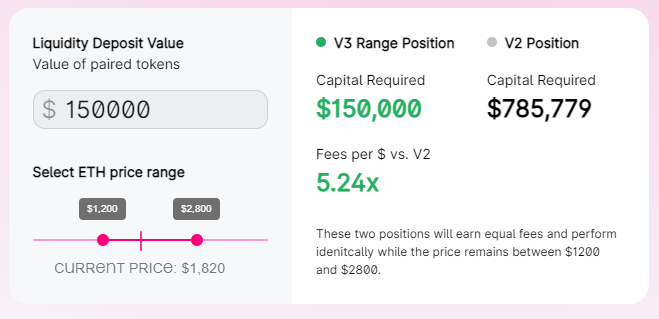

This capital efficiency allows a user who supplied liquidity within a traded price range to capture more fees for each dollar deposited.

A theoretical example here with the handy calculator Uniswap built into the latest blog post.

This capital efficiency allows a user who supplied liquidity within a traded price range to capture more fees for each dollar deposited.

A theoretical example here with the handy calculator Uniswap built into the latest blog post.

Customizable exit points (1/2):

Liquidity providing into a CFMM is actually a way for users to exit a position.

When the price of one asset diverges to the upside, it is partially sold for the other asset in the pool.

The issue is that with v2, it is selling at all prices.

Liquidity providing into a CFMM is actually a way for users to exit a position.

When the price of one asset diverges to the upside, it is partially sold for the other asset in the pool.

The issue is that with v2, it is selling at all prices.

Customizable exit points (2/2):

With v3, you can set your liquidity at specific price ranges, meaning you can exit positions between user-identified price points.

I assume there will need to be a lot of tooling and analytics here to kind of make an "order book" visualization.

With v3, you can set your liquidity at specific price ranges, meaning you can exit positions between user-identified price points.

I assume there will need to be a lot of tooling and analytics here to kind of make an "order book" visualization.

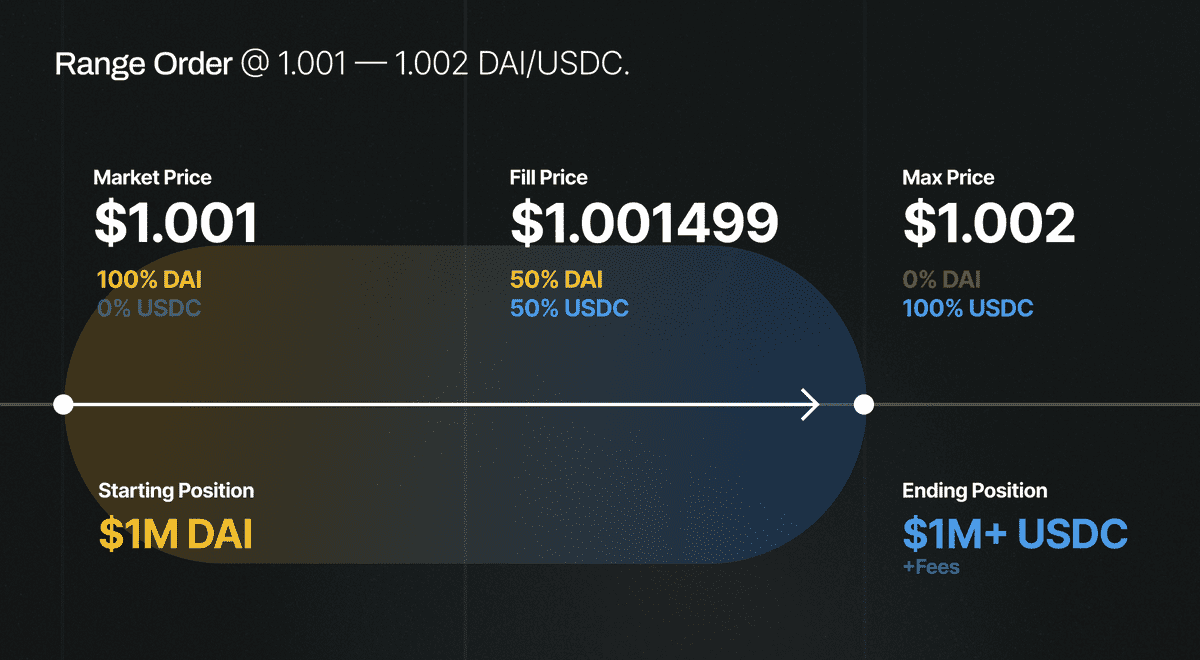

Range orders:

Uniswap is implementing some iteration of limit orders, though adding the added dimension of a range orders can fill at.

Say you want to play DAI swings, you can buy at peg, seed single-sided liquidity at 1.001-1.002 range, then capture the spread.

Uniswap is implementing some iteration of limit orders, though adding the added dimension of a range orders can fill at.

Say you want to play DAI swings, you can buy at peg, seed single-sided liquidity at 1.001-1.002 range, then capture the spread.

Composability (1/2):

Probably need to do another thread on this later, though Uniswap v3 throws the composability of LP tokens in the air.

Modularity in the price range when liquidity is active, fees, and so on will require an NFT to represent each LP position.

Probably need to do another thread on this later, though Uniswap v3 throws the composability of LP tokens in the air.

Modularity in the price range when liquidity is active, fees, and so on will require an NFT to represent each LP position.

Composability (2/2): These individual NFTs on their own will be almost impossible to add as collateral or to add to any composable yield farm without a wrapper.

Probably going to see a lot of work with NFT index projects and yield aggregators in generalizing these LP shards.

Probably going to see a lot of work with NFT index projects and yield aggregators in generalizing these LP shards.

As always, none of this is investment advice. We may hold UNI or other assets mentioned in this thread.

Just wanted to contextualize some things here and to explain a bit for those that have not read the blog post yet.

Just wanted to contextualize some things here and to explain a bit for those that have not read the blog post yet.

Some other thoughts:

May see the rise of professional on-chain market makers that acquire or run books of user LP tokens to maximize fees on certain assets.

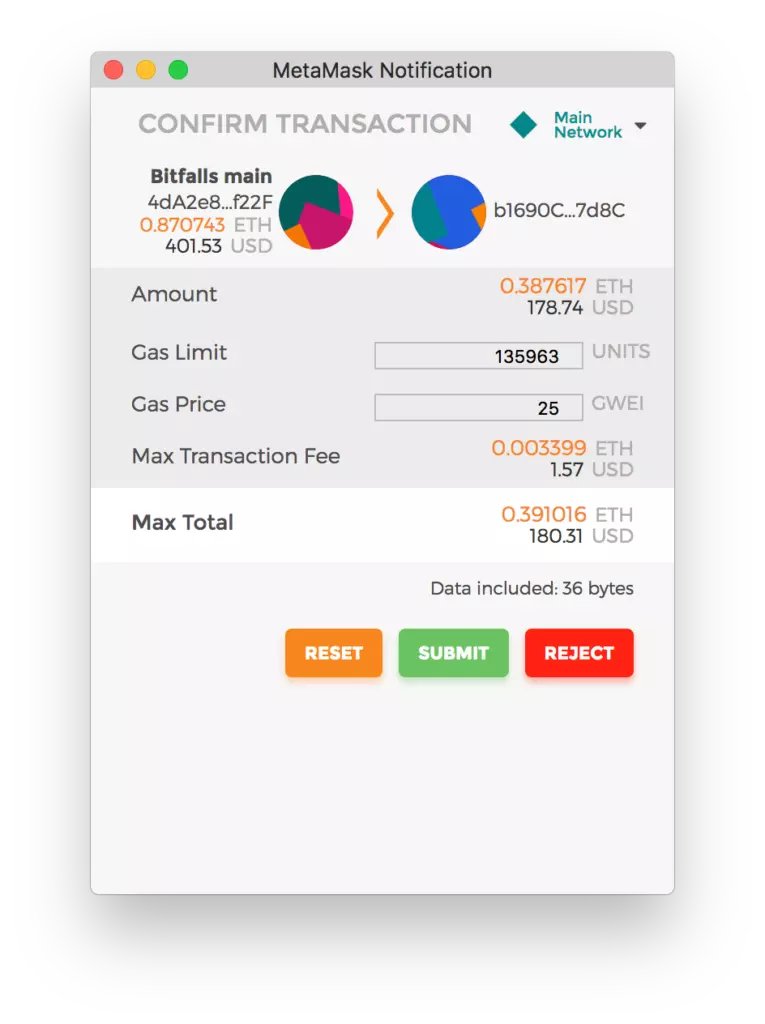

Retail LPs may get the short end of the stick here, especially if gas fees for changing liquidity price ranges are high.

May see the rise of professional on-chain market makers that acquire or run books of user LP tokens to maximize fees on certain assets.

Retail LPs may get the short end of the stick here, especially if gas fees for changing liquidity price ranges are high.

How will UNI LM rewards work with this new system?

Would it be based on pro-rata of active liquidity over x days, pro-rata liquidity of whole pool (probably not), or what...

Interested to see where this rounds out.

Would it be based on pro-rata of active liquidity over x days, pro-rata liquidity of whole pool (probably not), or what...

Interested to see where this rounds out.

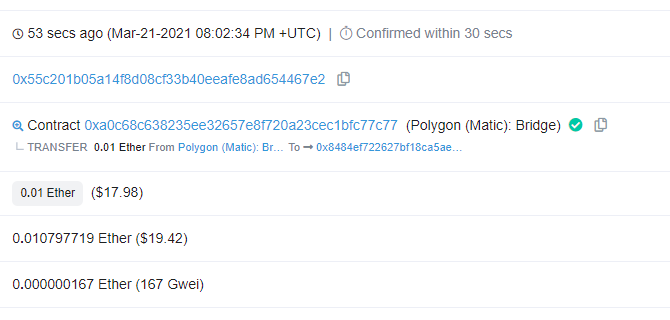

There's also the added component of Uniswap on Optimism, expected to launch in ~May.

I imagine this will do wonders for the likely high gas costs affiliated with managing liquidity under this new system.

I imagine this will do wonders for the likely high gas costs affiliated with managing liquidity under this new system.

• • •

Missing some Tweet in this thread? You can try to

force a refresh