So @santiagoroel and I have been scrapping for followers over the past few weeks. I'm still 3k ahead.

To keep it that way, I'm hijacking his @UpOnlyTV fame by sharing 9 key points about DeFi and crypto he made during his interview with @CryptoCobain & @ledgerstatus.

👇

To keep it that way, I'm hijacking his @UpOnlyTV fame by sharing 9 key points about DeFi and crypto he made during his interview with @CryptoCobain & @ledgerstatus.

👇

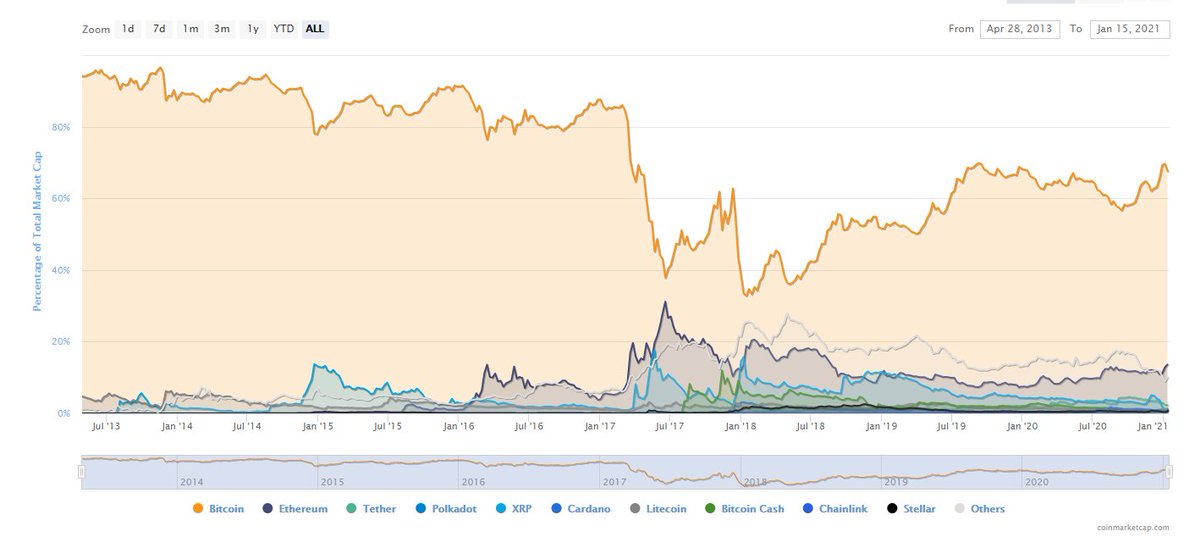

1. Ethereum struggled for a while with product-market fit until Maker, then the other money legos that we now call "DeFi" today.

I did a thread in the past on this subject about how much has changed since crypto was last in this range.

I did a thread in the past on this subject about how much has changed since crypto was last in this range.

https://twitter.com/n2ckchong/status/1350328538646212608

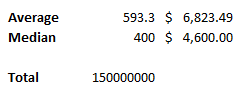

2. "In this industry, if you're not humble, it will teach you humility really quickly."

Generally, this may be why "OGs" naturally have an edge in this market.

They've been here, been taught humility a few too many times, and know how to avoid humbling mistakes.

Generally, this may be why "OGs" naturally have an edge in this market.

They've been here, been taught humility a few too many times, and know how to avoid humbling mistakes.

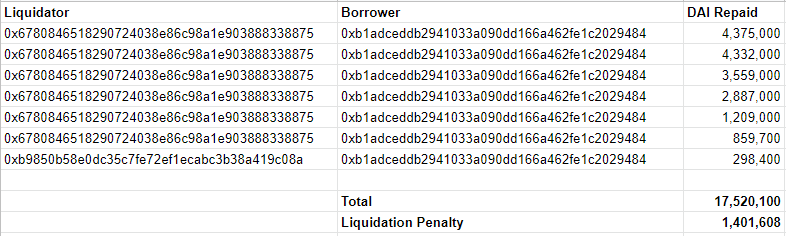

3. "Maker made DeFi to some extent"

As much as we want ETH to be a UOA, the introduction of a stable unit of account to act as a base lego for DeFi spurred the creation of money legos that needed to be denominated in U.S. dollars.

As much as we want ETH to be a UOA, the introduction of a stable unit of account to act as a base lego for DeFi spurred the creation of money legos that needed to be denominated in U.S. dollars.

4. Those that seriously "made it" in crypto didn't "have to be right 100 times—they only needed to be right about something once by being committed to it."

Sizing fairly into high conviction bets is what the winners in DeFi have done well.

Sizing fairly into high conviction bets is what the winners in DeFi have done well.

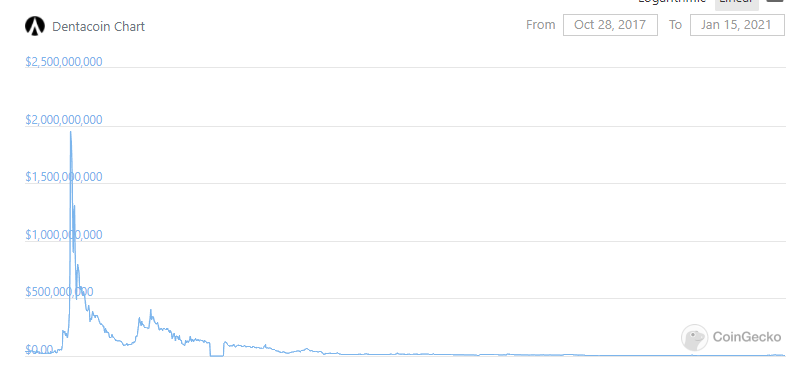

5. The DeFi train probably hasn't left yet.

DeFi is perhaps the socioeconomic change since the industrial revolution.

Bitcoin is early. Ethereum is earlier. DeFi is even earlier.

Only ~3.5% of active Ethereum addresses use DeFi today, according to one stat.

DeFi is perhaps the socioeconomic change since the industrial revolution.

Bitcoin is early. Ethereum is earlier. DeFi is even earlier.

Only ~3.5% of active Ethereum addresses use DeFi today, according to one stat.

6. Trends to watch for the coming year:

- Layer-two scaling solution

- Capital efficiency within DeFi

- Undercollateralized loans (reputation layer, Ironbank, etc.)

- New primitives like flash loans

- Bridging TradFi and DeFi

- Better code standards and improved insurance

- Layer-two scaling solution

- Capital efficiency within DeFi

- Undercollateralized loans (reputation layer, Ironbank, etc.)

- New primitives like flash loans

- Bridging TradFi and DeFi

- Better code standards and improved insurance

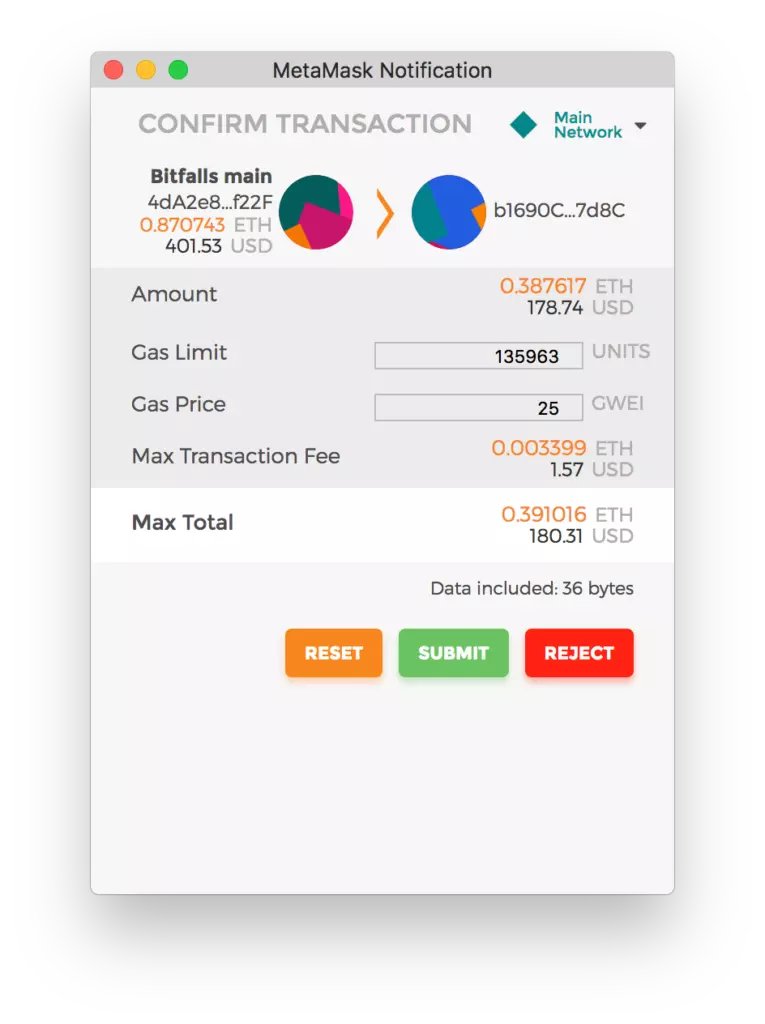

7. High gas fees are a sign of DeFi PMF.

"There's this sentiment that high gas fees are going to be the demise of Ethereum. But hold on a minute: are you telling me users are willing to jump through barbed wire and pay exorbitant fees. Isn't that telling you there is clear PMF?"

"There's this sentiment that high gas fees are going to be the demise of Ethereum. But hold on a minute: are you telling me users are willing to jump through barbed wire and pay exorbitant fees. Isn't that telling you there is clear PMF?"

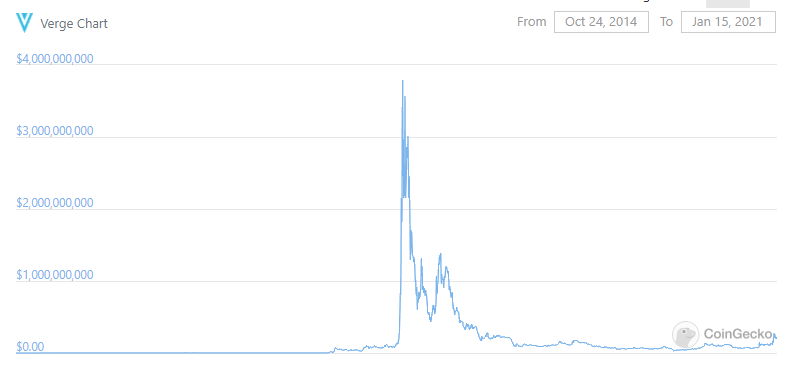

8. On DeFi vs. Bitcoin:

On one side, you have non-productive crypto (Bitcoin, etc.). On the other, you have productive assets that you're lending, borrowing, insuring against, etc.

DeFi is still less than 5% of all value in crypto assets.

On one side, you have non-productive crypto (Bitcoin, etc.). On the other, you have productive assets that you're lending, borrowing, insuring against, etc.

DeFi is still less than 5% of all value in crypto assets.

9. Advice to people looking to get involved:

Get your hands dirty, get into Discords and Telegrams. Start helping out around the community, asking questions, and making connections.

You'll find that people here are nicer than they appear on Twitter.

Get your hands dirty, get into Discords and Telegrams. Start helping out around the community, asking questions, and making connections.

You'll find that people here are nicer than they appear on Twitter.

All this being said, a message from @paraficapital compliance:

None of this is financial advice. Assets mentioned in the interview may be held by ParaFi.

None of this is financial advice. Assets mentioned in the interview may be held by ParaFi.

My initial jab at our follower war aside, everyone follow @santiagoroel. Also, if you have time, listen to the full interview.

I work with this guy and I still learn new things anytime he's on a podcast. A true alpha leaker.

I work with this guy and I still learn new things anytime he's on a podcast. A true alpha leaker.

• • •

Missing some Tweet in this thread? You can try to

force a refresh