1/ Injective is far bigger than a DEX, it's a protocol that will allow anyone to build any type of exchange on top. From Institutional grade exchanges to entry level. Whether it be Spot, Derivatives, NFT's, Equities, Commodities, any market can be traded without restrictions $INJ

2/All the necessary tools will be provided and there will be shared / decentralised order book enabling liquidity to be shared between every exchange

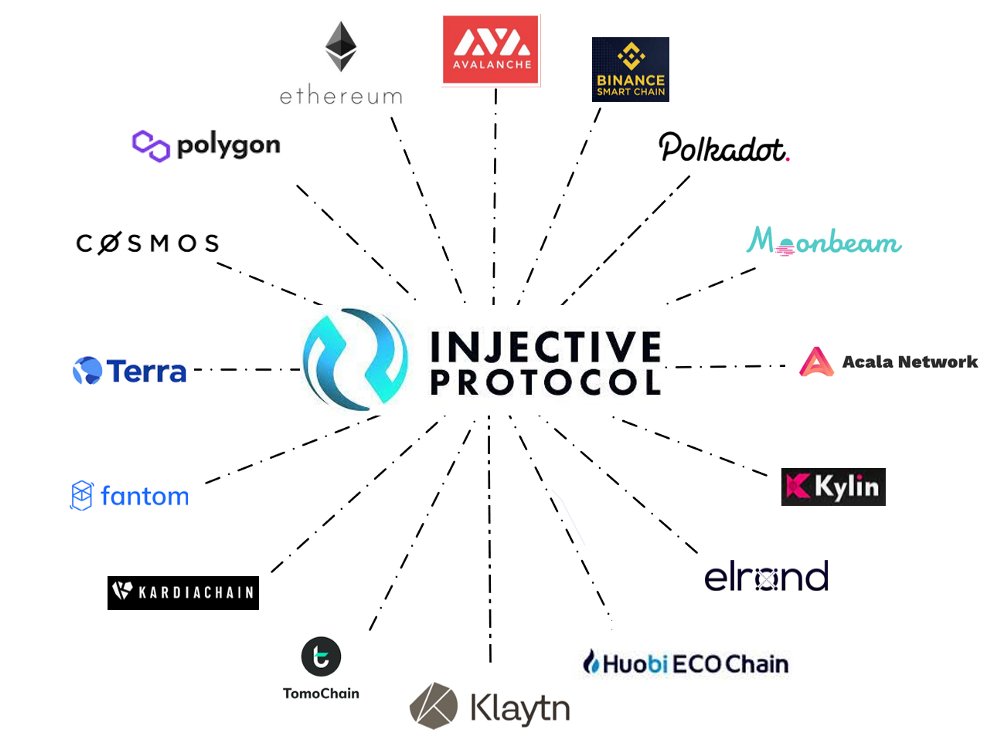

With trustless bridges connected to all the major blockchain platforms enabling seamless, composable cross-chain interoperability

With trustless bridges connected to all the major blockchain platforms enabling seamless, composable cross-chain interoperability

3/Exchanges who originate orders in the shared orderbook are rewarded with 40% of the trading fees, whereas the other 60% are used to buy and burn $INJ

The 40% referral fees could be used to buy and burn the referring exchange's token or through other rewards back to their users

The 40% referral fees could be used to buy and burn the referring exchange's token or through other rewards back to their users

4/Any market can be added through governance, no huge listing fees or being at the mercy of centralised exchanges, whilst having unrestricted access to markets worth quadrillions without KYC and regardless of originating country

$INJ is going to be huge🚀

cryptoseq.medium.com/why-injective-…

$INJ is going to be huge🚀

cryptoseq.medium.com/why-injective-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh