We're in the phase of the market where there's a lot of retail inbounds but not enough education about the Ethereum ecosystem and DeFi.

Next on deck: @MakerDAO, DeFi's "central bank" and the issuer of the DAI stablecoin. Arguably one of the most important dApps.

A 🧵

Next on deck: @MakerDAO, DeFi's "central bank" and the issuer of the DAI stablecoin. Arguably one of the most important dApps.

A 🧵

TL;DR: MakerDAO allows users to collateralize their Ethereum-based assets to issue the $DAI stablecoin in a permissionless manner.

MakerDAO is often seen as DeFi's "central bank."

MakerDAO is often seen as DeFi's "central bank."

1) Bitcoin and Ethereum are inherently assets used for transaction fees. ERC-20 tokens were, at least prior to this cycle, also w/o much utility.

Users would thus hold most crypto assets in expectation of price appreciation, not in expectation of a native yield or dividend.

Users would thus hold most crypto assets in expectation of price appreciation, not in expectation of a native yield or dividend.

2) Further, as much as many wished ETH was the unit of account, it wasn't (and still isn't - yet).

The industry lacked a monetary standard that would allow payments to be easily denominated and managed.

The industry lacked a monetary standard that would allow payments to be easily denominated and managed.

3) Retail users that wanted to make their crypto assets productive were relegated to centralized platforms.

4) While useful for institutional players, CeFi crypto lending institutions have some disadvantages:

- Tall KYC requirements

- Lack of variety in supported collateral

- Sometimes variable / high rates

- Not your keys, not your coins

- Unclear platform/protocol risk

- Tall KYC requirements

- Lack of variety in supported collateral

- Sometimes variable / high rates

- Not your keys, not your coins

- Unclear platform/protocol risk

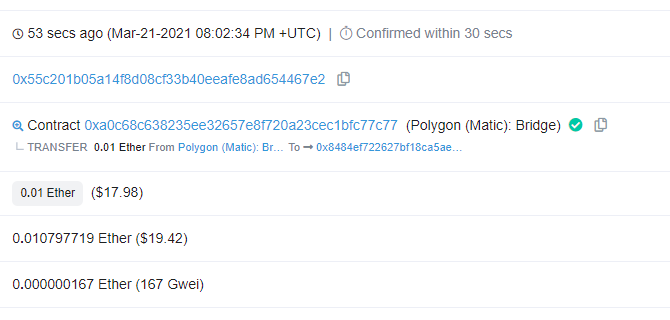

5) It's also worth noting where protocols like MakerDAO may lack against CeFi:

- Automatic loan liquidations (it can be argued this is a good thing)

- High collateralization requirements

- Gas fees!

- Automatic loan liquidations (it can be argued this is a good thing)

- High collateralization requirements

- Gas fees!

6) MakerDAO allows users to permissionlessly collateralize their Ethereum and other ERC-20 assets.

All loans are overcollateralized, and all loans are issued in DAI, a stablecoin pegged to the U.S. dollar through a number of monetary policy mechanisms.

All loans are overcollateralized, and all loans are issued in DAI, a stablecoin pegged to the U.S. dollar through a number of monetary policy mechanisms.

7) MakerDAO enables this through so-called "vaults" or CDPs—collateralized debt positions.

Users deposit collateral types accepted by the protocol into independent vaults, then use the collateral in these vaults to take out lines of credits in DAI.

Users deposit collateral types accepted by the protocol into independent vaults, then use the collateral in these vaults to take out lines of credits in DAI.

8) Before we get more into it, a recap on some key MakerDAO Vault terms:

- Stability fee: interest rate charged on loan

- Collateralization ratio: Loan-to-collateral value

- Liquidation penalty: The fee liquidators collect when a user's c-ratio falls below the vault threshold

- Stability fee: interest rate charged on loan

- Collateralization ratio: Loan-to-collateral value

- Liquidation penalty: The fee liquidators collect when a user's c-ratio falls below the vault threshold

9) These variables are adjusted based on an analysis of the chosen collateral by MakerDAO's risk community.

More "risky" or centralized collateral may be prescribed a higher stability fee and liquidation ratio to minimize the risk of protocol-level debt.

More "risky" or centralized collateral may be prescribed a higher stability fee and liquidation ratio to minimize the risk of protocol-level debt.

10) To keep this simple for this thread, let's just use Ethereum-A, MakerDAO's main CDP type as an example.

Ethereum-A has the following parameters:

- A 150% minimum collateralization ratio (liquidation ratio)

- A 5.5% stability fee

- A debt ceiling of 15 billion DAI

Ethereum-A has the following parameters:

- A 150% minimum collateralization ratio (liquidation ratio)

- A 5.5% stability fee

- A debt ceiling of 15 billion DAI

11) If a user with $100, wants to get the most out of Ethereum-A, they could borrow 66 DAI.

On that 66 DAI, they pay an annualized rate of 5.5% that accrues to the user's DAI balance

If Ethereum drops by a mere percent, their CDP may be at risk of being liquidated.

On that 66 DAI, they pay an annualized rate of 5.5% that accrues to the user's DAI balance

If Ethereum drops by a mere percent, their CDP may be at risk of being liquidated.

12) If the user's collateralization ratio is healthy, they can use the DAI comfortably within DeFi and beyond. Use cases for borrowed DAI include:

- Yield farming

- Paying off loans from other protocols

- Paying for physical goods

- Trading and arbitrage

- Leverage

- Yield farming

- Paying off loans from other protocols

- Paying for physical goods

- Trading and arbitrage

- Leverage

13) If a user's collateralization ratio falls into liquidation territory, so-called "Keepers" (liquidation bots) can pull collateral from a user's at-risk vault, sell it to cover the debt and the liquidation penalty.

The user's remaining collateral can be pulled at that point.

The user's remaining collateral can be pulled at that point.

14) The caveat here is that a user does have time to react:

Maker has a built-in Oracle Security Module that delays incoming prices by one hour.

This time lag allows users to add collateral to their CDP in case their c-ratio falls within liquidation.

Maker has a built-in Oracle Security Module that delays incoming prices by one hour.

This time lag allows users to add collateral to their CDP in case their c-ratio falls within liquidation.

15) So, what collateral does MakerDAO support?

ETH, USDC, WBTC, LINK, YFI, UNI, ZRX, renBTC, AAVE, and COMP to name the primary sources of DAI issuance.

The addition of collateral is up to governance and is influenced by the risk team.

ETH, USDC, WBTC, LINK, YFI, UNI, ZRX, renBTC, AAVE, and COMP to name the primary sources of DAI issuance.

The addition of collateral is up to governance and is influenced by the risk team.

16) While supported collateral types launch with parameters, they can be changed.

To limit risk to the protocol, there may be caps on certain collateral types seen as "risky" based on market liquidity and centralization of that collateral.

This is up to governance.

To limit risk to the protocol, there may be caps on certain collateral types seen as "risky" based on market liquidity and centralization of that collateral.

This is up to governance.

17) Another important part of the MakerDAO protocol is the surplus buffer.

The interest fees that users pay on their borrows accrues to a protocol vault called the surplus buffer.

The buffer is used as a protocol-level backstop and as a mechanism through which devs can be paid.

The interest fees that users pay on their borrows accrues to a protocol vault called the surplus buffer.

The buffer is used as a protocol-level backstop and as a mechanism through which devs can be paid.

18) Once the buffer reaches a certain threshold (determined by governance), the extra DAI is sold for MKR, MakerDAO's native governance token.

That MKR is subsequently burned, decreasing the supply of the asset.

That MKR is subsequently burned, decreasing the supply of the asset.

19) The important edge case to point out is that if the buffer is depleted and the protocol suffers a debt event (collateral improperly liquidated), MKR will be issued.

MKR holders are the lenders of last resort in a black swan event for MakerDAO.

MKR holders are the lenders of last resort in a black swan event for MakerDAO.

20) With all that being said, what exactly is DAI? How is it pegged to ~$1?

This probably could use its own thread, though let's keep it shorter and in this ongoing thread.

This probably could use its own thread, though let's keep it shorter and in this ongoing thread.

21) DAI is an overcollateralized stablecoin.

Each DAI is, on average, backed by over $3 worth of collateral.

It is meant to trade around $1 and often finds parity with USDC, USDT, and other stablecoins on protocols like Curve.

Each DAI is, on average, backed by over $3 worth of collateral.

It is meant to trade around $1 and often finds parity with USDC, USDT, and other stablecoins on protocols like Curve.

22) DAI's price is a byproduct of supply and demand, though MakerDAO governance has control over a number of incentives/levers to stabilize the price.

Roughly, the goal is to decrease DAI demand when the price is above peg and to increase DAI demand when the price is below peg.

Roughly, the goal is to decrease DAI demand when the price is above peg and to increase DAI demand when the price is below peg.

23) Let's go through the levers one by one:

Stability fees: To alter the demand for DAI, governance may seek to change stability fees on popular collateral types.

A sharp increase in the stability fee for ETH-A would likely decrease the supply of DAI, pushing up the price.

Stability fees: To alter the demand for DAI, governance may seek to change stability fees on popular collateral types.

A sharp increase in the stability fee for ETH-A would likely decrease the supply of DAI, pushing up the price.

24) Dai Savings Rate: The DSR allows users to lock their DAI and earn protocol-level interest.

Only DAI in the DSR can earn interest. It can be withdrawn at any time.

Raising the DSR increases the marginal demand for DAI., and vice-versa on the other side.

Only DAI in the DSR can earn interest. It can be withdrawn at any time.

Raising the DSR increases the marginal demand for DAI., and vice-versa on the other side.

25) Debt ceiling: Assuming it's within the risk community's parameters, the debt ceiling of different collateral types can be changed.

If ETH-A is maxed out and DAI is trading above peg, an increase in the ceiling can relieve the market by allowing for more DAI supply.

If ETH-A is maxed out and DAI is trading above peg, an increase in the ceiling can relieve the market by allowing for more DAI supply.

26) Peg Stability Module: The PSM is a specialized part of MakerDAO, where users can swap a collateral-type and DAI at a 1:1 ratio.

Right now, USDC is in use.

Users can mint DAI with no stability fee with USDC at a 1:1 ratio, and they can redeem DAI for USDC at a 1:1 ratio.

Right now, USDC is in use.

Users can mint DAI with no stability fee with USDC at a 1:1 ratio, and they can redeem DAI for USDC at a 1:1 ratio.

Fini/ As always, none of this is investment advice. Please take caution when interacting with protocols on-chain and understand all risks before doing so.

If you're using MakerDAO, please be wary of gas fees and make sure those c-ratios are healthy :)

If you're using MakerDAO, please be wary of gas fees and make sure those c-ratios are healthy :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh