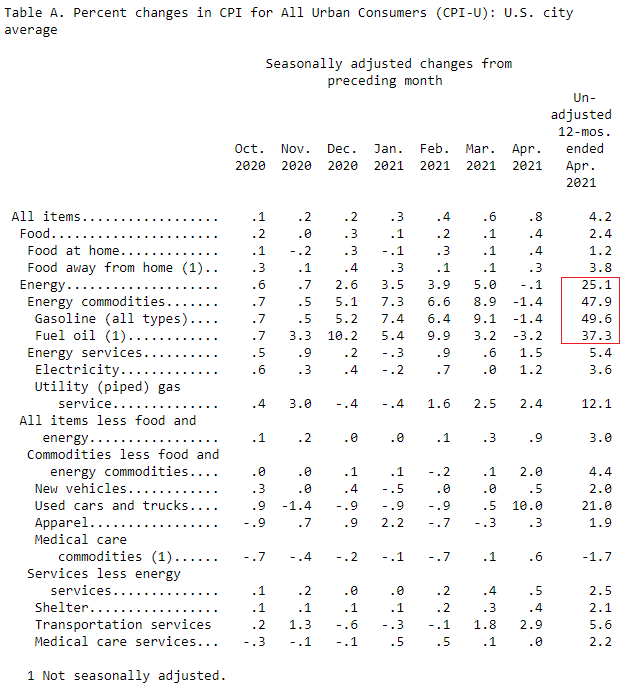

BREAKING: US consumer price inflation for April comes in at 4.2% y/y - above average estimate of economists polled by Reuters of 3.6%

Core inflation 3% y/y vs estimate of 2.3%

👇

Core inflation 3% y/y vs estimate of 2.3%

👇

...in response, 10 year US Treasury yields up a couple of basis points to 1.645%...

dollar index spikes...

Suggest markets pricing in possibility of Fed rate hike sooner than expected...

dollar index spikes...

Suggest markets pricing in possibility of Fed rate hike sooner than expected...

...Manifestly big base effects at work - look at those massive y/y energy price rises (reflecting price slumps at the height of the pandemic/lockdowns)...bls.gov/news.release/c…

...though also true that core inflation (excluding energy prices) also up sharply, highest reading since 1996...

...So the $20 trillion question: should the Federal Reserve/the world be getting worried about US inflation?

Answer: Probably not yet.

Short-term spikes in prices are consistent with supply bottlenecks created by booming economy coming out of severe slump....

Answer: Probably not yet.

Short-term spikes in prices are consistent with supply bottlenecks created by booming economy coming out of severe slump....

...time to worry is when high inflation expectations become baked in among public & Fed shows unwillingness/inability to act in response - no sign of that yet.

• • •

Missing some Tweet in this thread? You can try to

force a refresh