European official data (Eurostat) and UK official data (ONS) have shown a somewhat different picture on post-Brexit trade patterns.

🚄🚚🇬🇧🇪🇺

What's going on?

A thread...1/11

🚄🚚🇬🇧🇪🇺

What's going on?

A thread...1/11

...This discrepancy has been flagged by @thom_sampson ...2/11

https://twitter.com/thom_sampson/status/1384052894224187392?s=20

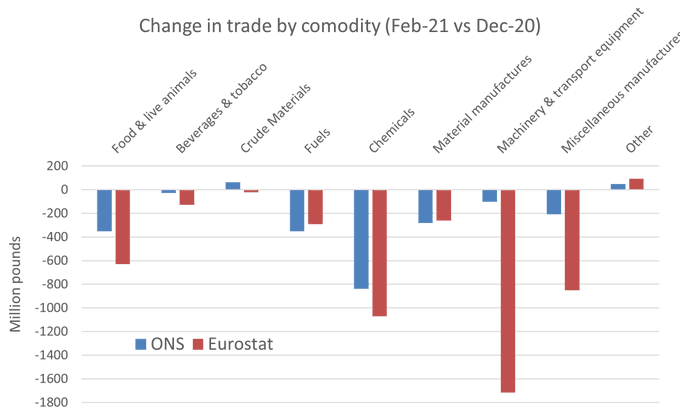

...the Eurostat data shows a significantly larger fall in UK to EU goods exports than the ONS data

(Note: this comparison doesn't include March - Eurostat data for that month isn't out yet though ONS's is)...3/11

...

(Note: this comparison doesn't include March - Eurostat data for that month isn't out yet though ONS's is)...3/11

...

...Why?

The @ONS has put out a useful blog today looking at why there might be a divergence...5/11

blog.ons.gov.uk/2021/05/14/tra…

The @ONS has put out a useful blog today looking at why there might be a divergence...5/11

blog.ons.gov.uk/2021/05/14/tra…

...Since January ONS started using data from UK customs declarations to measure exports rather than (as previously) Eurostat's survey - but it carried on using Eurostat survey for imports.

That probably helps explains why the imports picture is closer than for exports...6/11

That probably helps explains why the imports picture is closer than for exports...6/11

...But what about that exports difference?

Well, it turns out the ONS measures exports by disregarding intra-company goods transfers - whereas Eurostat includes every item that crosses a border...7/11

Well, it turns out the ONS measures exports by disregarding intra-company goods transfers - whereas Eurostat includes every item that crosses a border...7/11

...To illustrate, ONS cites an example of a car company moving an engine between factories in different countries.

That would be registered as trade in the data by Eurostat but not by ONS...8/11

That would be registered as trade in the data by Eurostat but not by ONS...8/11

...It's a pertinent example because manufacturing exports do seem (as per @thom_sampson 's calculations) to be the big driver of the divergence between the two series...9/11

...ONS says "one approach is not better or worse than another" for measuring trade.

But if we think intra-company goods exports are just as important for UK firms and business as inter-company ones we might prefer the Eurostat approach of measuring *all* goods movements...9/11

But if we think intra-company goods exports are just as important for UK firms and business as inter-company ones we might prefer the Eurostat approach of measuring *all* goods movements...9/11

...and if leaving the single market and customs unions has undermined the position of UK factories within pan-EU corporate supply chains that's something we should want to track and recognise...10/11

...We will need to continue to monitor this, but it's at least arguable that the official ONS trade data is flattering the post-Brexit picture on UK goods exports to the EU.

ENDS

ENDS

• • •

Missing some Tweet in this thread? You can try to

force a refresh