Im just mulling over the evolution of the digital asset space...

My thoughts are that obviously we are mid cycle in this bull run. The two big breakout developments this time were Defi and NFT's. 1/2

My thoughts are that obviously we are mid cycle in this bull run. The two big breakout developments this time were Defi and NFT's. 1/2

When we get the next down cycle, there will be a clean up in this space and the winners will be ready for their mass adoption phase.

We haven't even started with what NFT's will morph into. It is not about art. It is about attaching trust and verification to anything.

We haven't even started with what NFT's will morph into. It is not about art. It is about attaching trust and verification to anything.

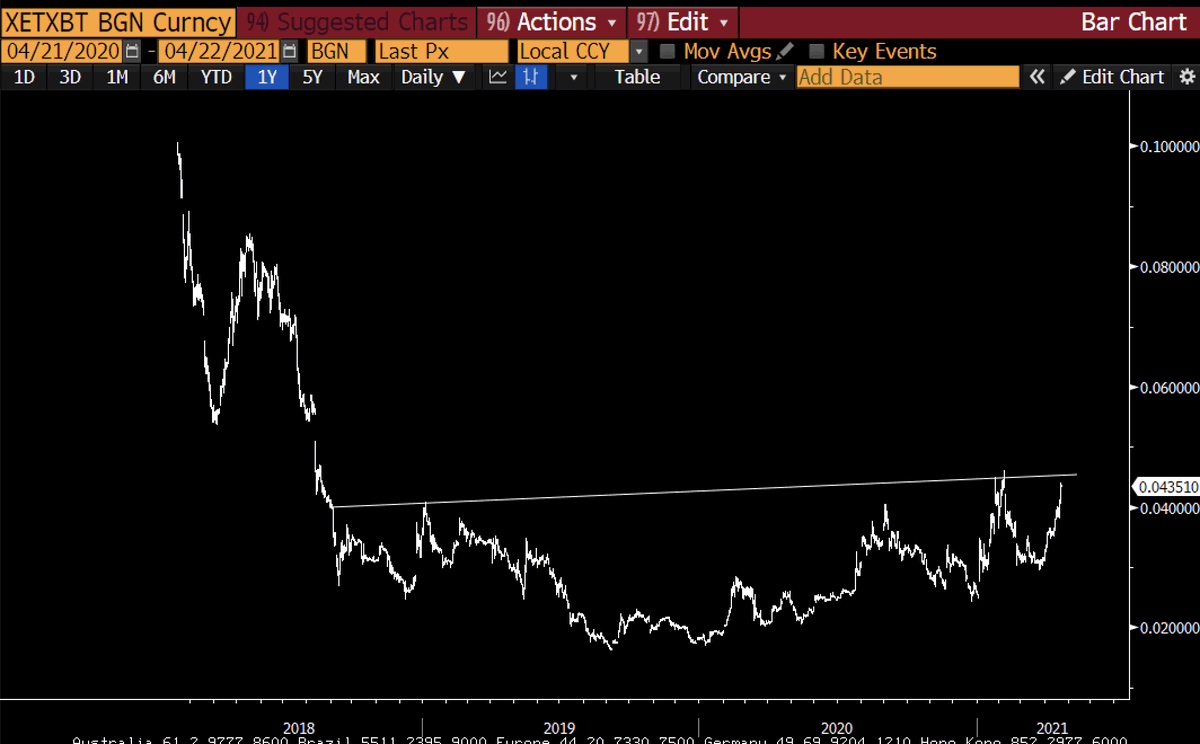

I literally have no idea what protocols outside of BTC and ETH will get actual meaningful adoption. None of us do but some will and some will become ghost chains.

But my eye is on community/creator token space which I think is the next ENORMOUS application. Bigger than most people realise. The first full global consumer experience using crypto rails.

These will be a total game changer, creating entirely new value layer above equity and will entirely change many industries, especially media, publishing, sports, entertainment, music and charities. In fact anything that has a large community...

We will also soon begin to see the tokenisation of the asset management industry, which will be GIGANTIC too. But that is going to get much bigger in the next cycle and maybe during the down cycle too as crypto people look to diversify but stay outside of old system.

Property will also begin to get tokenised more meaningfully.

Then we are into the tokenisation of IP, supply chains, insurance, legal and identity (+KYC).

Further into the future lies The Metaverse and tokenising people to help avoid debt.

Then we are into the tokenisation of IP, supply chains, insurance, legal and identity (+KYC).

Further into the future lies The Metaverse and tokenising people to help avoid debt.

All of this is actively underway and all of it will bring new ideas that we haven't even thought of yet, creating a new layer of value and disrupting the entire value chain from settlement to custody, from transfer to trusted ownership of everything.

It will cease being a separate relatively niche world world that is a bit clunky to use, to a full consumer seamless experience that you won't even know runs on crypto.

There will be huge booms and busts but over time everyone will migrate across to the new world.

There will be huge booms and busts but over time everyone will migrate across to the new world.

My guess is that we hit 1bn users by 2025 or earlier. Diem will be a massive accelerant to all of this and then it will be the role of CBDC's to add fuel to the fire.

If CB's are digital, everything, literally everything, will follow.

If CB's are digital, everything, literally everything, will follow.

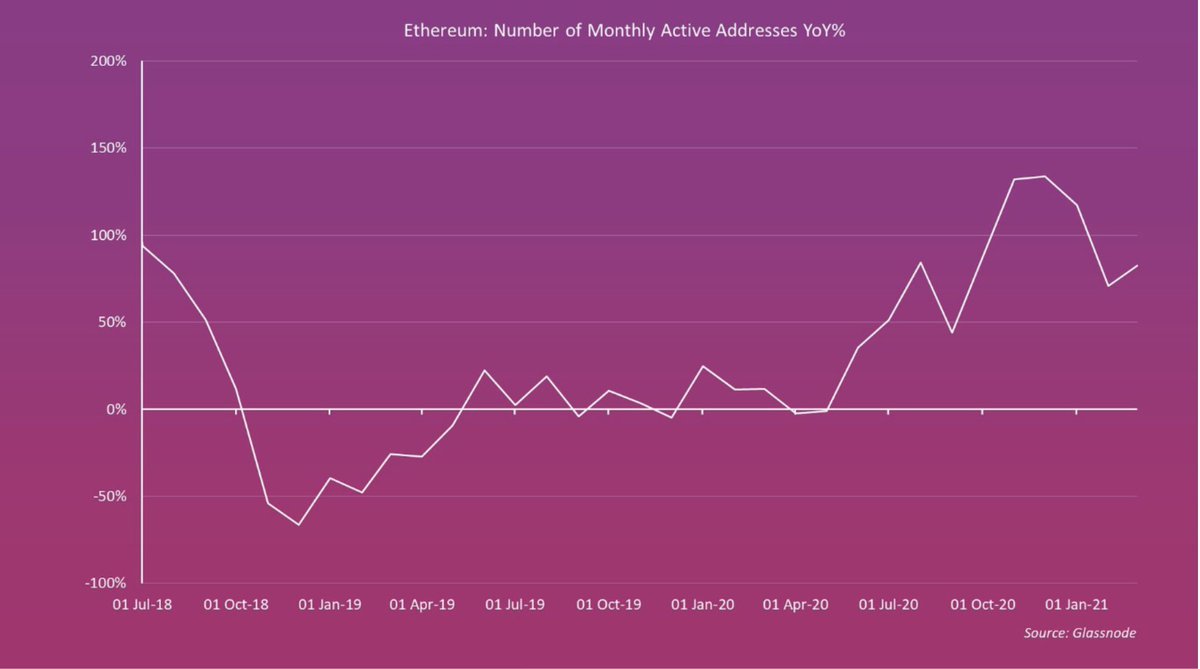

The crypto space is growing at 113% per year in terms of users. Even if it slows down to the 63% growth rate of network adoption the internet saw at the same stage, its going to lead to 4bn users by 2030 or earlier.

That is 200x from here.

I have never seen anything like this because nothing like this has ever happened in human history in such a short space of time.

I have never seen anything like this because nothing like this has ever happened in human history in such a short space of time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh