THREAD: ARK Update - How the Reflexivity Trade Works in Reverse. As ARK ETFs are ripping off the lows today, here's an update on how things have gone over the last few weeks. The first chart is the state of inflows/redemptions for the 6active ARK ETFs on a 5day/21d rolling basis:

2/As you can see, this is the worst it has ever been on a 21-day basis, having eclipsed $3billion in redemptions thru yesterday. Still, it's tip of the iceberg kind of stuff relative to the peak we saw in inflows late-2020/early'21...

3/Next chart shows this more clearly - this is annual cumulative inflows into ARK active ETFs for 2020 and 2021 ytd. As you can see from the chart, cumulative inflows peaked at just ~$18bn, but ARK is still sitting on >$14bn of inflows YTD, which is remarkable. Here's the chart:

4/Two other things about that chart: 1. Inflows actually peaked on 4/15 due to the launch/ramp of $ARKX -it pulled in ~$700m to the ARK ETF fam in only 2+ weeks. Remember ARKX has 72% position overlap w/other ARK ETFs, so most of those flows went right into...

5/...other ARK stocks (eg $TRMB, $PRNT, $NVDA, $KRTOS, $IRDM, etc). 2. They are ONLY ~$3.5bn off the peak in terms of INFLOWS, which is remarkable when you think about how far the ETFs/holdings have come off since the highs:

https://twitter.com/bespokeinvest/status/1392931236541341698?s=21

6/Said another way, redemptions are worse than they've ever been but outflows as a % of net assets are only down -6% on a 21-day basis. What would happen if 15% of AUM was redeemed? What about if flows actually went negative on the year (inflows wiped out)? I shudder to think...

7/For all the hoopla around ARK's BTFD process/selling FANG to buy fav names/getting more concentrated on pullbacks blah blah blah, we really haven't seen it. In fact what we have seen is the opposite - the reflexivity of highly correlated/overlapping ETFs working in reverse...

8/What this means as that funds as flowed OUT of ARK ETFs, the result has been ARK selling stocks while those stocks are going down. Now, they aren't "actively" selling these stocks - the selling is being done by their APs. But ARK funds are defacto net sellers of their positions

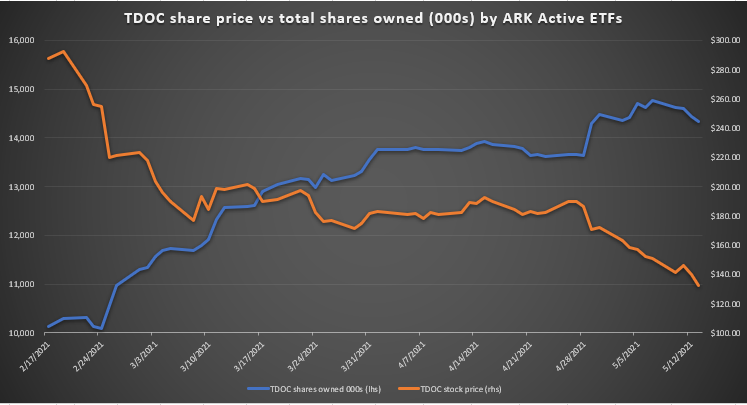

9/One great example is $TDOC. The stock has been slaughtered, cut more than in half from it's Feb'21 highs. ARK followed their typical playbook and has been BTFD-ing it all the way down, as you wld have guessed...that is, until this past week's big leg down...

10/Below is a chart of ARK's TDOC holdings (shares held) vs the stock price. What you can see is ARK's aggregate position went from ~10m shares to 14.7m shares as the stock cratered from Feb thru April. Here's the chart:

11/Now focus on the last couple of weeks - ARK's position in terms of shares held peaked on 5/5. $TDOC's share price dropped another 15.5% thru yesterday, and during this last leg down, ARK's share ownership has actually declined. Why? Because Redemptions...

12/This is the power of reflexivity. ARK owns almost 10% of $TDOC shares oustanding. It's a 6% position in ARKK, 7% in ARKG, 4.5% in ARKW, and 1% in ARKF. They own it everywhere. The only way to keeping BTFD'ing TDOC at ARK's current AUM is to take their share ownership over 10%.

13/Another part of the ARK myth is their supposed dedication to concentrating in their best ideas when the chips are down. Everyone knows this narrative: on big pullbacks they sell FANG stocks and double down in their fav "Innovation" names...

14/While this might have been true back in the day when ARK was a sub-$5bn fund complex, this simply IS NOT TRUE any longer. Want proof? Look at March of 2020 vs today. As of 3/29/20, ARKK's top 10 positions represented 58% of the portfolio...

15/Fast forward to today: top 10 position size for ARKK is 48%. ARKG is even worse - top 10 was 60% at the end of March'20; it's now 44% as of yesterday. This is pretty much the same story across all the active ETFs. Here's the chart:

16/Wait so what about doubling down on our best ideas during a drawdown, why is this happening?? Easy answer: AUM today is too big to execute the same strategy that worked back when AUM was a fraction of what it is now. Just look at ARKK...

17/As of 3/31/20, 6 out of the top 10 names in $ARKK had market caps of $2.6bn or less! The top10 back then included NTLA ($600m mkt cap) and SSYS ($870m cap). Why? Because $ARKK was only running $2bn in AUM! The top 10 in aggregate back then were only $1.2bn of capital...

18/Today $ARKK is running $19 billion, almost 10x the size that it was only a year ago. Even at lower concentration, the top10 positions in ARKK account for over $9 billion of capital. There's not a single stock in the top10 today UNDER $20 billion of market cap!

19/The smallest POSITION in $ARKK's top10 today ($U) is $600 million. That is, $ARKK's position size in their 10th largest holding today is as big as the ENTIRE MARKET CAP of their 10th largest position in March 2020!! And that's just in one ETF...

20/Bottom line, I know I sound like a broken record, but the game for ARK has just totally changed. It's not to say ARK can't generate returns from here (esp after this most recent massive drawdown). It's just that the way ARK generated returns in the past is not how they will...

21/...generate returns in the future...because AUM and math. And, as we have seen, even relatively small pullbacks in fund flows result in very severe drawdowns, including forced selling of stocks that are already down. If inflows were to spike back up again, obv ARK..

22/...would see the benefit of position overlap/correlation work in their favor once again. Given AUM size/top10 position market cap, it's unlikely to have the dramatic impact it had on performance last year, however. On the flip side, redemptions to-date have been modest...

23/...yet the impact to the ETFs/holdings has been dramatic. The real question will be what happens if redemptions ever hit a similar scale as inflows over the last 2 years...

END THREAD

END THREAD

• • •

Missing some Tweet in this thread? You can try to

force a refresh