Why #ETH is More Scarce than #BTC

This 16-tweet thread summarizes the first of four arguments in my essay "Why ETH Will Win Store of Value"

michaelmcguiness.com/essays/why-eth…

This 16-tweet thread summarizes the first of four arguments in my essay "Why ETH Will Win Store of Value"

michaelmcguiness.com/essays/why-eth…

In "Why Bitcoin Makes Sense" I write: money is technology that makes our wealth today available for consumption tomorrow. The best money gives its holder the most purchasing power over time. Several factors influence this but the most important is scarcity michaelmcguiness.com/essays/why-bit…

Why has gold been the predominant store for the last 3000 years?

Scarcity. Its supply growth rate is ~2%. Only silver comes close at 5-10% (~20% today). Low supply growth allowed gold to maintain its purchasing power better than anything else & the world converged on it as a SoV

Scarcity. Its supply growth rate is ~2%. Only silver comes close at 5-10% (~20% today). Low supply growth allowed gold to maintain its purchasing power better than anything else & the world converged on it as a SoV

For thousands of years gold was the best we could do.

Then BTC created the first truly scarce money to ever exist (only 21 million will exist). It took what gold did better than anything else & improved on it by an order of magnitude. Yet ETH could improve on this even further.

Then BTC created the first truly scarce money to ever exist (only 21 million will exist). It took what gold did better than anything else & improved on it by an order of magnitude. Yet ETH could improve on this even further.

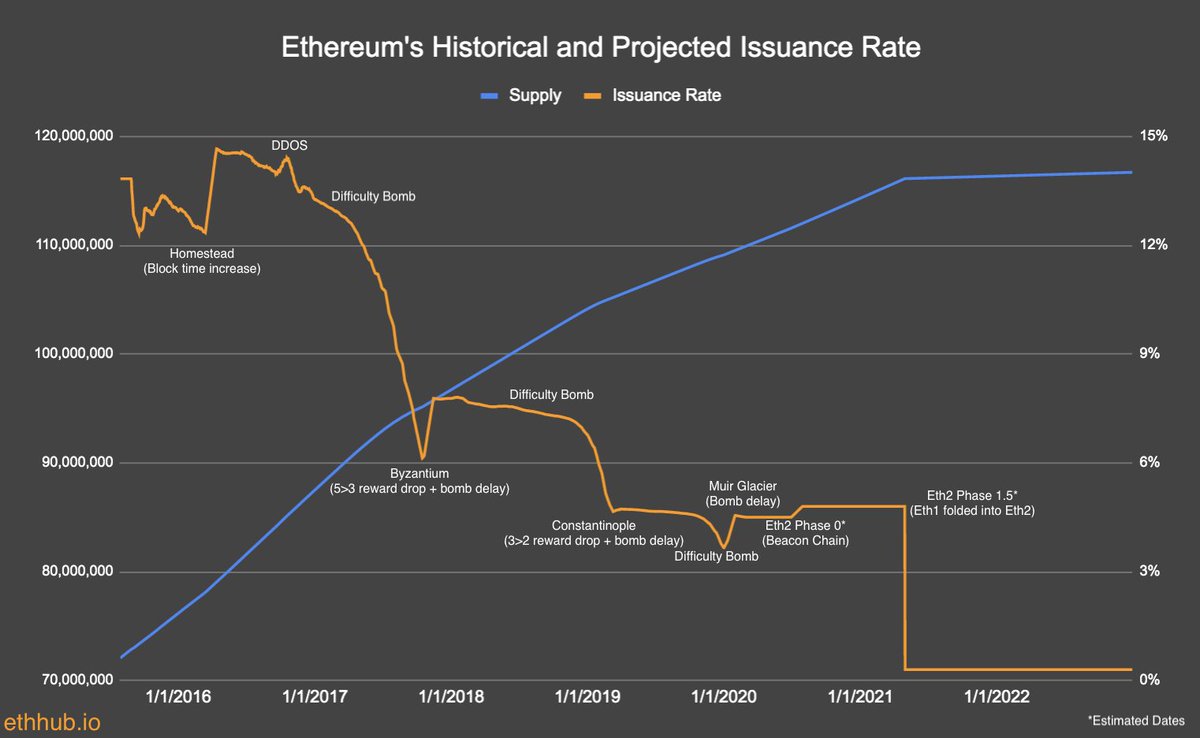

Ethereum's current yearly network issuance (inflation rate) is ~4.5%. It doesn't have a fixed supply bc that would require a fixed security budget for the network. Rather than arbitrarily fix security, ETH chose a "minimum issuance to secure the network" monetary policy.

Bitcoiners hate this ambiguity.

They believe the base layer of a financial system should be stable. Bitcoin is intentionally careful & slow, & only 21 million BTC will ever exist.

But the ETH community believes they're sacrificing near-term stability for long-term security

They believe the base layer of a financial system should be stable. Bitcoin is intentionally careful & slow, & only 21 million BTC will ever exist.

But the ETH community believes they're sacrificing near-term stability for long-term security

Furthermore, the move to PoS will allow for a drastic reduction of Ether issuance while maintaining the same level of network security. This @VitalikButerin essay explains how PoS is able to offer more security for the same cost. vitalik.ca/general/2020/1…

With PoS, annual network issuance (inflation rate) will fall from ~4.5% today to less than 1%.

But that's still more than Bitcoin, which is capped at 21 million BTC & has a long-run inflation rate of 0%. So how exactly is Ethereum more scarce?

But that's still more than Bitcoin, which is capped at 21 million BTC & has a long-run inflation rate of 0%. So how exactly is Ethereum more scarce?

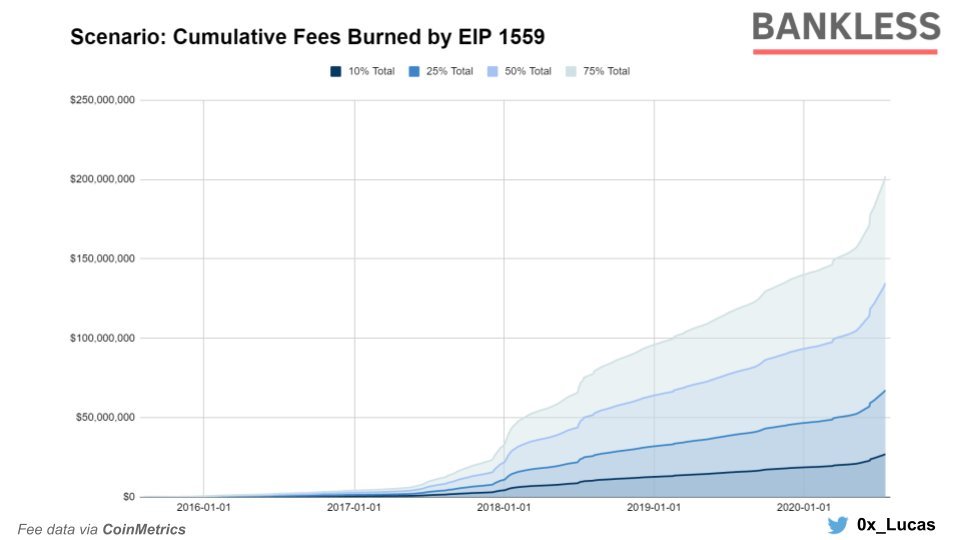

Well, there's more. ETH has begun to address many of the concerns around its monetary policy w/ the upcoming release of EIP-1559, which has been called "Ethereum's scarcity engine" or "ETH's burn mechanism".

Set for release in July, it will burn a portion of ETH transaction fees

Set for release in July, it will burn a portion of ETH transaction fees

Last year, EIP-1559 would've burned almost 1% of all Ether

As demand for ETH block space grows, many expect this number to increase over time

Thus, when combined w/ lower issuance for PoS (< 1%), ETH will actually have a deflationary monetary policy

h/t @BanklessHQ

As demand for ETH block space grows, many expect this number to increase over time

Thus, when combined w/ lower issuance for PoS (< 1%), ETH will actually have a deflationary monetary policy

h/t @BanklessHQ

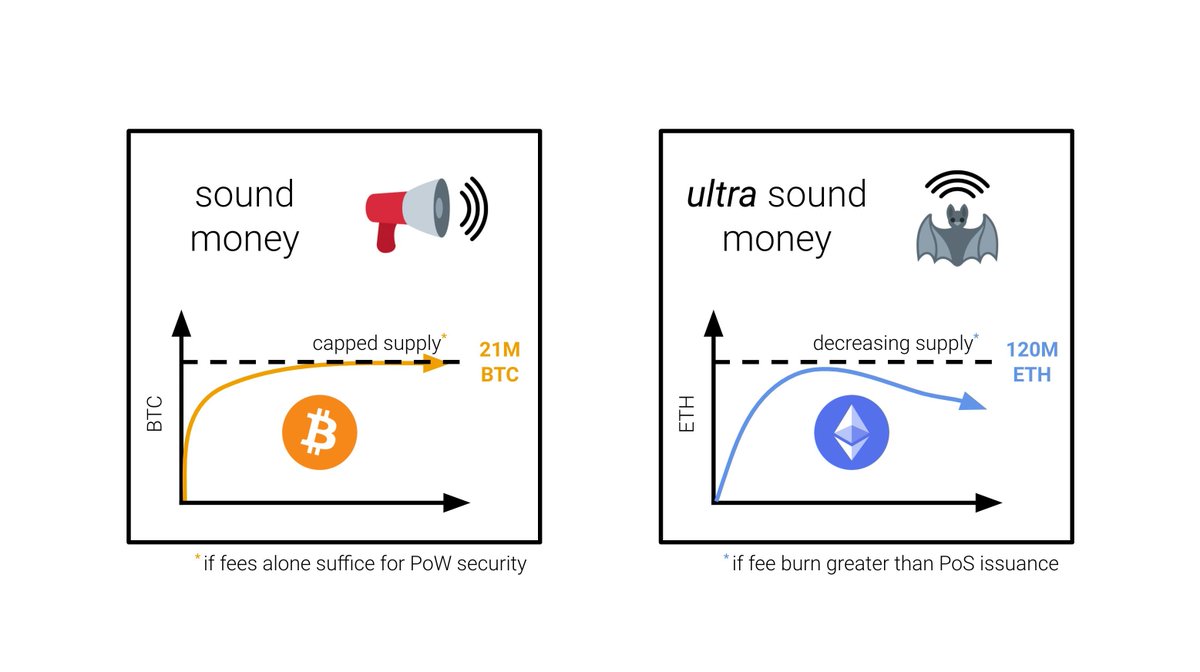

This has led to the new meme in the Ethereum community of "ultrasound money", coined by @drakefjustin

It's a little silly, but the point is:

If BTC is "sound money" bc its supply is capped at 21 million, then ETH w/ decreasing aggregate supply should be "ultrasound money"

It's a little silly, but the point is:

If BTC is "sound money" bc its supply is capped at 21 million, then ETH w/ decreasing aggregate supply should be "ultrasound money"

In the long run, ETH will be the more scarce asset.

Yet, I'm even more bullish shorter term. w/ removal of PoW, ETH’s issuance will drop ~90%. This will have the equivalent impact on miner selling pressure as 3 Bitcoin "halvings"

h/t @SquishChaos

Yet, I'm even more bullish shorter term. w/ removal of PoW, ETH’s issuance will drop ~90%. This will have the equivalent impact on miner selling pressure as 3 Bitcoin "halvings"

h/t @SquishChaos

https://twitter.com/SquishChaos/status/1383435336978558985?s=20

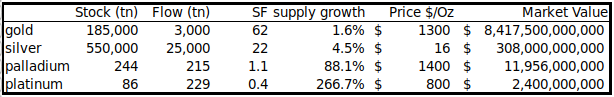

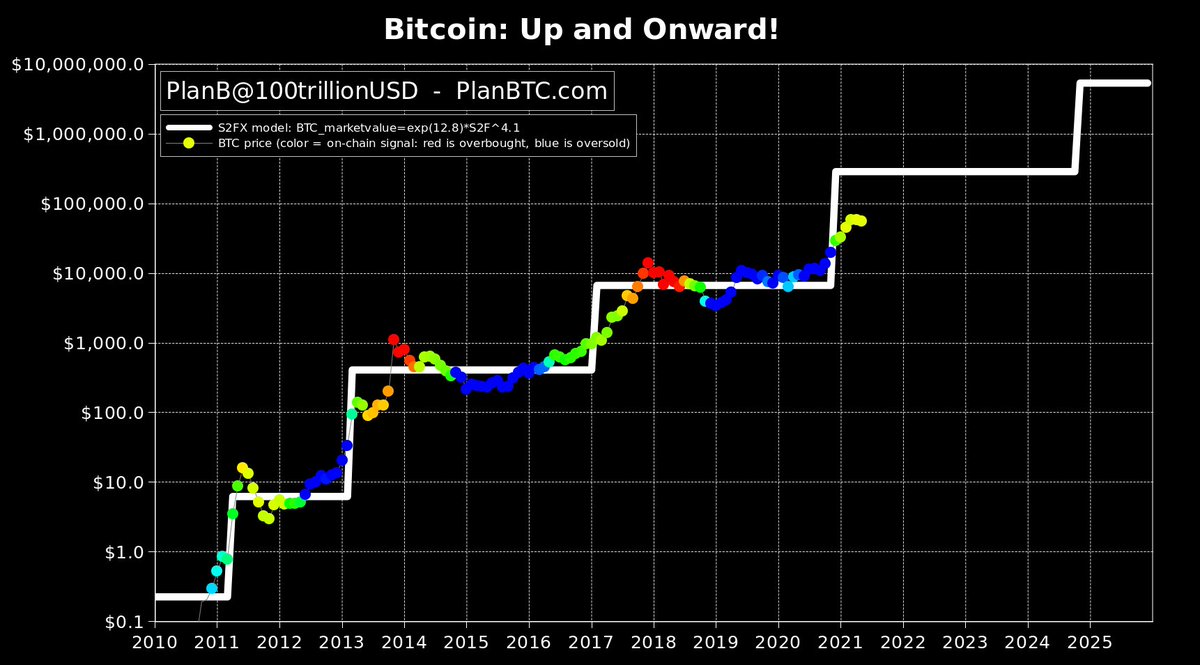

The best attempt at quantifying Bitcoin's scarcity & using it to model Bitcoin's value comes from @100trillionUSD's s2f model.

He argues that scarcity directly drives value.

The more scarce an asset is (lower supply growth rate), the more valuable it is.

He argues that scarcity directly drives value.

The more scarce an asset is (lower supply growth rate), the more valuable it is.

This model has held up shockingly well in the 2 yrs since published.

As we can see, there are large jumps in BTC's modeled value every 4 years (every time block reward to miners is cut in half).

This is bc it directly cuts selling pressure from miners in half.

As we can see, there are large jumps in BTC's modeled value every 4 years (every time block reward to miners is cut in half).

This is bc it directly cuts selling pressure from miners in half.

w/ such a large supply shock it makes sense for BTC price to skyrocket until a new equilibrium is reached at the reduced inflation rate

ETH uses PoW today as well. But when it transitions to PoS, ETH's 4.5% inflation will drop to less than 1% (vs BTC's 3.2% -> 1.6% in May 2020)

ETH uses PoW today as well. But when it transitions to PoS, ETH's 4.5% inflation will drop to less than 1% (vs BTC's 3.2% -> 1.6% in May 2020)

Of course there are other drivers of value than just scarcity. But scarcity is most important for salability across time.

Security is also crucial. An asset that's not around in a few decades wouldn't be much of a SoV

I'll discuss ETH's security advantages in my next thread.

Security is also crucial. An asset that's not around in a few decades wouldn't be much of a SoV

I'll discuss ETH's security advantages in my next thread.

Check out the full memo on @JoinCommonstock and follow me there for my writing on markets, crypto and all things investing.

share.commonstock.com/C9m7g06Ejgb

share.commonstock.com/C9m7g06Ejgb

• • •

Missing some Tweet in this thread? You can try to

force a refresh