Panic selling once can destroy years of good investment decisions in an instant

but keeping your head on straight when your portfolio is tanking is hard

Here are 13 investing tips/tricks/principles that I use to keep calm when my portfolio is in free fall:

but keeping your head on straight when your portfolio is tanking is hard

Here are 13 investing tips/tricks/principles that I use to keep calm when my portfolio is in free fall:

1/ Know what you own and why you own it

You can borrow stock ideas from other investors, but you can’t borrow conviction

You must understand the bull AND bear case upfront, otherwise you won’t have the conviction to hold when the price is going down

You can borrow stock ideas from other investors, but you can’t borrow conviction

You must understand the bull AND bear case upfront, otherwise you won’t have the conviction to hold when the price is going down

Research builds conviction

Conviction enables patience

Patience builds wealth

If a 20% drop shakes your confidence in a business, you didn’t do enough research

Conviction enables patience

Patience builds wealth

If a 20% drop shakes your confidence in a business, you didn’t do enough research

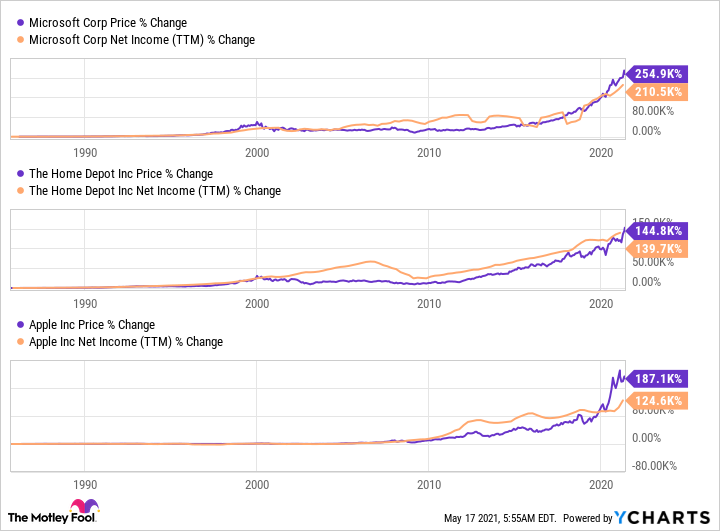

2/ Know what drives long-term stock returns

In the short-term, emotions & computer algorithms determine stock prices

In the long-term, profit growth determine stock prices

This is a core investing principle that you must fully embrace

In the short-term, emotions & computer algorithms determine stock prices

In the long-term, profit growth determine stock prices

This is a core investing principle that you must fully embrace

Look at these long-term charts of $MSFT, $HD, and $AAPL

Net income growth & stock price growth are closely linked in the long-term

That’s not a coincidence — profit growth IS WHAT DRIVES long-term value creation

Net income growth & stock price growth are closely linked in the long-term

That’s not a coincidence — profit growth IS WHAT DRIVES long-term value creation

3/ Buy in stages

It’s tempting to want to go “all-in” when you find an exciting new stock idea

But, what if you are wrong about the business or management?

Or, what if you are right about the business but wrong about the valuation?

It’s tempting to want to go “all-in” when you find an exciting new stock idea

But, what if you are wrong about the business or management?

Or, what if you are right about the business but wrong about the valuation?

Force yourself to scale into a stock over time

My personal process is to buy in 0.5% increments and add over months/years as my conviction builds

If I’m right, a little is all I need to do great

If I’m wrong, I won’t be hurt much

My personal process is to buy in 0.5% increments and add over months/years as my conviction builds

If I’m right, a little is all I need to do great

If I’m wrong, I won’t be hurt much

4/ Study market history

Every great stock — WITHOUT EXCEPTION! — will get killed at some point

This isn’t a bug — it’s how investing works

You must embrace the fact that volatility is NORMAL

Every great stock — WITHOUT EXCEPTION! — will get killed at some point

This isn’t a bug — it’s how investing works

You must embrace the fact that volatility is NORMAL

Consider $AMZN’s history:

It has declined:

10% - 30 times

20% - 14 times

30% - 8 times

40% - 5 times

50% - 4 times

90% - 1 time

Returns since IPO: 164,400%

It has declined:

10% - 30 times

20% - 14 times

30% - 8 times

40% - 5 times

50% - 4 times

90% - 1 time

Returns since IPO: 164,400%

5/ Increase trading friction

Trading is tempting when it’s on your phone & easy to do

My broker is Interactive Brokers

It’s a PAIN to log in

It's a PAIN to place a trade

I love the friction -- I have to really want it to trade

Trading is tempting when it’s on your phone & easy to do

My broker is Interactive Brokers

It’s a PAIN to log in

It's a PAIN to place a trade

I love the friction -- I have to really want it to trade

6/ Keep some cash on the sidelines

Cash is a drag on returns during bull markets

Cash is the raw material of superior returns in bear markets

Cash is a drag on returns during bull markets

Cash is the raw material of superior returns in bear markets

7/ Avoid margin & options

Handling the emotional swings of common stock ownership is hard

Those swings get much, much wilder when you use margin and/or options

Compounding interest is all the leverage you need!

Handling the emotional swings of common stock ownership is hard

Those swings get much, much wilder when you use margin and/or options

Compounding interest is all the leverage you need!

8/ Connect with other long-term investors

Never invest alone!

A good community is worth its weight in gold

Ask: Does your social media feed make you calmer or stressed out?

If it is stressed out, upgrade your feed!

Never invest alone!

A good community is worth its weight in gold

Ask: Does your social media feed make you calmer or stressed out?

If it is stressed out, upgrade your feed!

These FinTwit follows will make you calmer:

@awealthofcs

@dmuthuk

@iancassel

@michaelbatnick

@orangebook_

@TMFStoffel

These podcasts can help:

@awealthofcs

@dmuthuk

@iancassel

@michaelbatnick

@orangebook_

@TMFStoffel

These podcasts can help:

https://twitter.com/BrianFeroldi/status/1380155789785059333?s=20

9/ Keep your personal finances conservative

Markets are volatile during economic downturns

Economic downturns are also when your job is most at risk

That’s A LOT to deal with if you have debt & 1 source of income

Eliminate debt, build cash, & create new sources of income

Markets are volatile during economic downturns

Economic downturns are also when your job is most at risk

That’s A LOT to deal with if you have debt & 1 source of income

Eliminate debt, build cash, & create new sources of income

10/ Force yourself to journal BEFORE you transact

I keep a simple investing journal

Before I buy/sell, I have to write down WHY

It slows me down, but forces me to think things through

I keep a simple investing journal

Before I buy/sell, I have to write down WHY

It slows me down, but forces me to think things through

11) Make your investment decisions on the weekend

The weekday is full of distractions

Eliminate that factor by making all your important financial decisions on the weekend

The weekday is full of distractions

Eliminate that factor by making all your important financial decisions on the weekend

12) Stop watching the news

Voluntarily watching the news is like inviting Debbie Downer into your home and asking her to talk non-stop

If the news is really that important, it will find you!

Voluntarily watching the news is like inviting Debbie Downer into your home and asking her to talk non-stop

If the news is really that important, it will find you!

13/ Zoom out

Whenever I feel bad about my near-term returns, I zoom out and look at my long-term returns

It always makes me feel better

Whenever I feel bad about my near-term returns, I zoom out and look at my long-term returns

It always makes me feel better

Stocks are the best asset class over the long-term

But the price of that returns is:

1⃣Perpetual Short-term Volatility

2⃣Perpetual Uncertainty

PAY IT!

But the price of that returns is:

1⃣Perpetual Short-term Volatility

2⃣Perpetual Uncertainty

PAY IT!

Enjoy this thread?

I regularly tweet about money, investing, and self-improvement

If those topics interest you, follow me @brianferoldi

You may enjoy all the other threads that I’ve written

I regularly tweet about money, investing, and self-improvement

If those topics interest you, follow me @brianferoldi

You may enjoy all the other threads that I’ve written

https://twitter.com/BrianFeroldi/status/1386309937597321218?s=20

If you want to learn more about investing,

I teach beginners how to researching investments on my YouTube Channel

youtube.com/c/brianferoldi…

I teach beginners how to researching investments on my YouTube Channel

youtube.com/c/brianferoldi…

Summary:

1: Know what you own

2: Know what drives returns

3: Buy in stages

4: Study history

5: Increase trading friction

6: Cash!

7: Avoid margin & options

8: Community!

9: Personal finances

10: Journal

11: Make decisions on the weekend

12: Stop watching the news

13: Zoom out

1: Know what you own

2: Know what drives returns

3: Buy in stages

4: Study history

5: Increase trading friction

6: Cash!

7: Avoid margin & options

8: Community!

9: Personal finances

10: Journal

11: Make decisions on the weekend

12: Stop watching the news

13: Zoom out

• • •

Missing some Tweet in this thread? You can try to

force a refresh