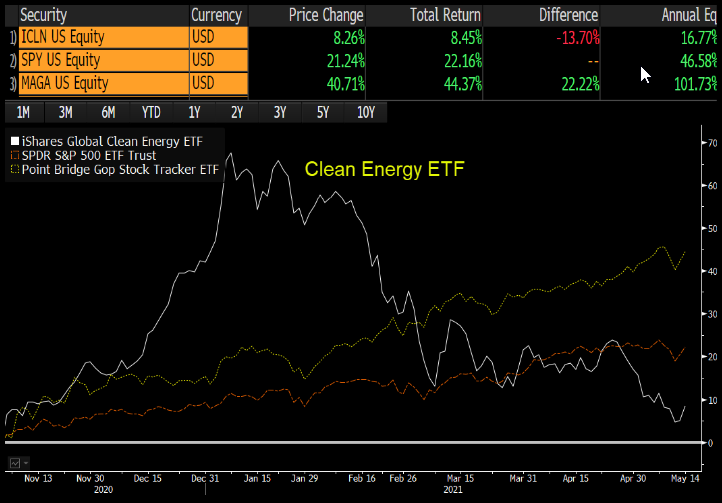

Ironically, the $MAGA ETF is crushing since Biden won, up 45%, double SPX and Dow, easily beating RSP, SUSA. It just holds all the right the stuff rn (industrials, energy, financials, value & no tech/comm) thx to strategy of screening for cos that donate the most to GOP..

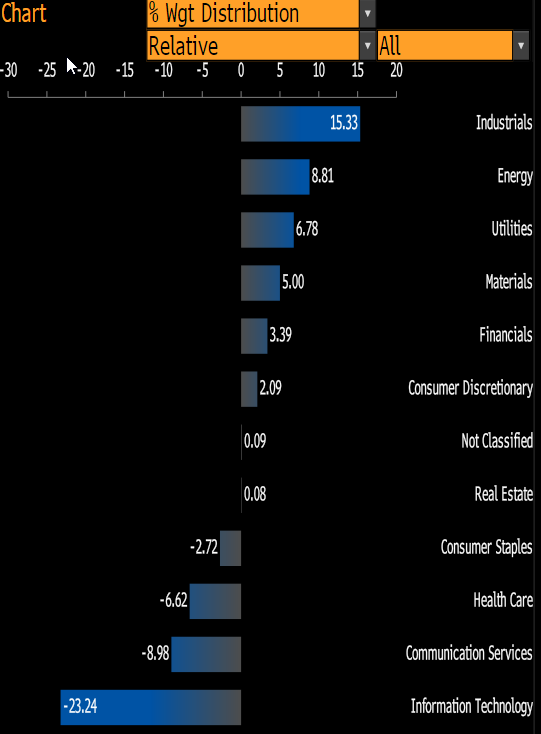

Here's the relative sector differences with the S&P 500, which was poison under Trump but gold under Biden. What a world.

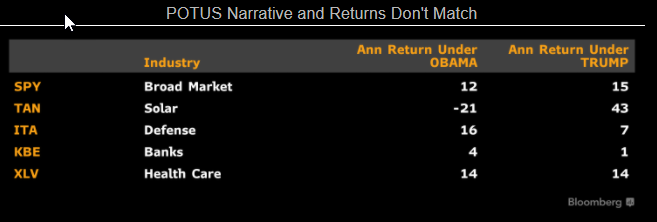

We tried to warn people in October to lay of "how to play" POTUS/Blue Wave ideas. Not only does it rarely work, it's almost better idea to do polar opposite of what makes sense narratively, check out Obama vs Trump:

Coincidentally, WSJ has story on conservatives looking to push "un-woke" funds eg $ACFV (altho $MAGA is doubling that ETF's perf too) Yet still no flows. IMO, you take same holdings but call it "anti-ESG" or "ESG rejects" and it would prob sell better wsj.com/articles/trump…

• • •

Missing some Tweet in this thread? You can try to

force a refresh