There used to be little correlation between crypto and global markets in general. But the sell-off in Nasdaq futures overnight does look (very and unusually) correlated to the breakdown in crypto space

[here illustrated with BTC (green) and ETH(yellow), vs Nasdaq (white)]

[here illustrated with BTC (green) and ETH(yellow), vs Nasdaq (white)]

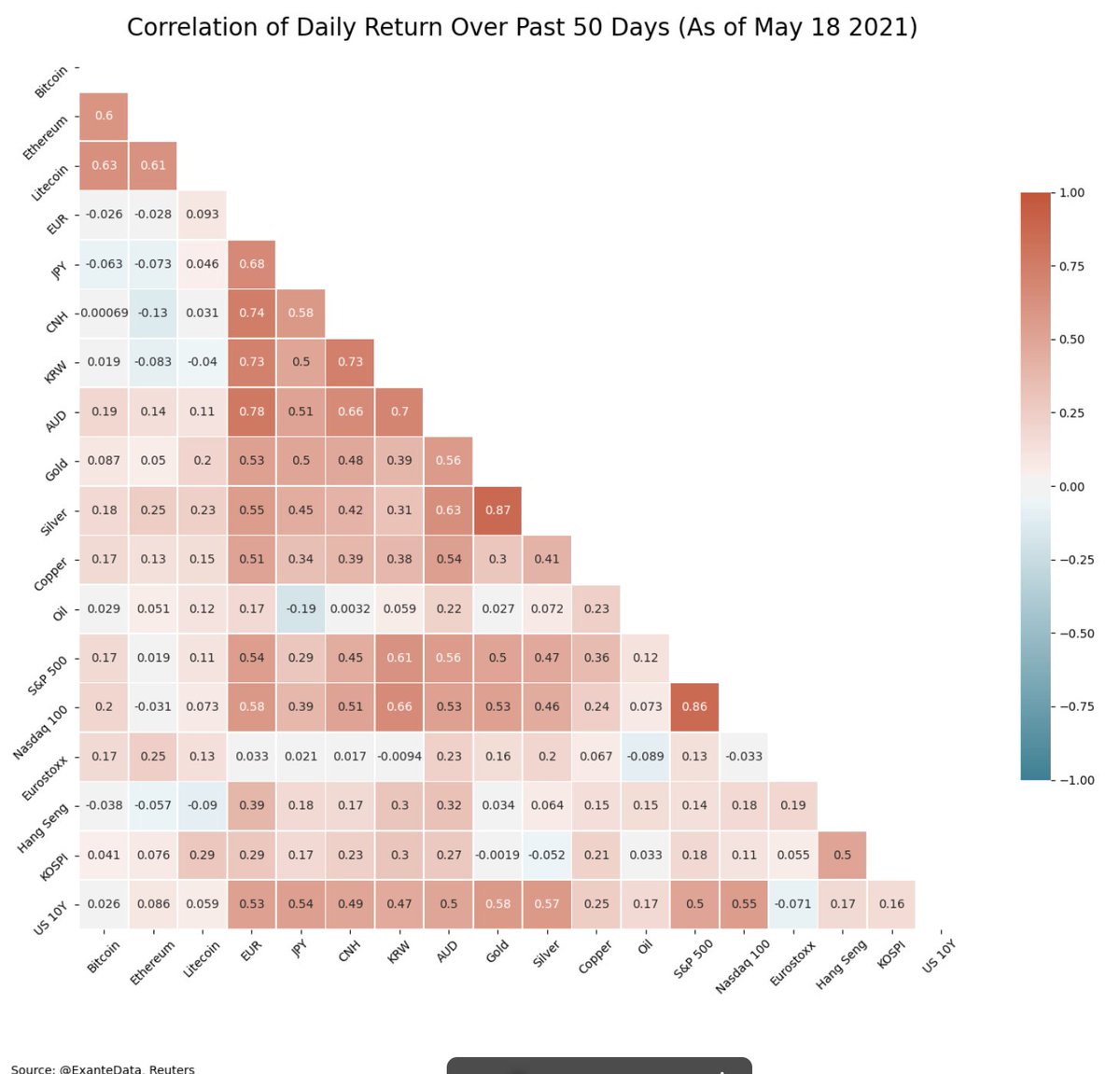

Here is the correlation matrix, for reference:

https://twitter.com/ExanteData/status/1392540935410618382

We should probably add Nasdaq to this matrix @WBegole . Will be interesting to track...

for example, BTC has a marginal positive correlation to SPX and ETH has a marginal negative correlation to SPX over the last 20 days. Hence, the co-movement is something new, which will only be picked up in backward looking correlations (and risk management) over time.

Here is an expanded matrix with Nasdaq now included (no historical correlation to crypto showing yet)

we will automate an update on @exantedata going forward, as this is interesting to monitor

thanks @WBegole

we will automate an update on @exantedata going forward, as this is interesting to monitor

thanks @WBegole

• • •

Missing some Tweet in this thread? You can try to

force a refresh