1/9 Today #Bitcoin saw its first $10k daily candle

The problem: it was to the downside 📉😅

A 🧵 using some on-chain data to have a look at what happened, assess the damage & a possible outlook 🤕

The problem: it was to the downside 📉😅

A 🧵 using some on-chain data to have a look at what happened, assess the damage & a possible outlook 🤕

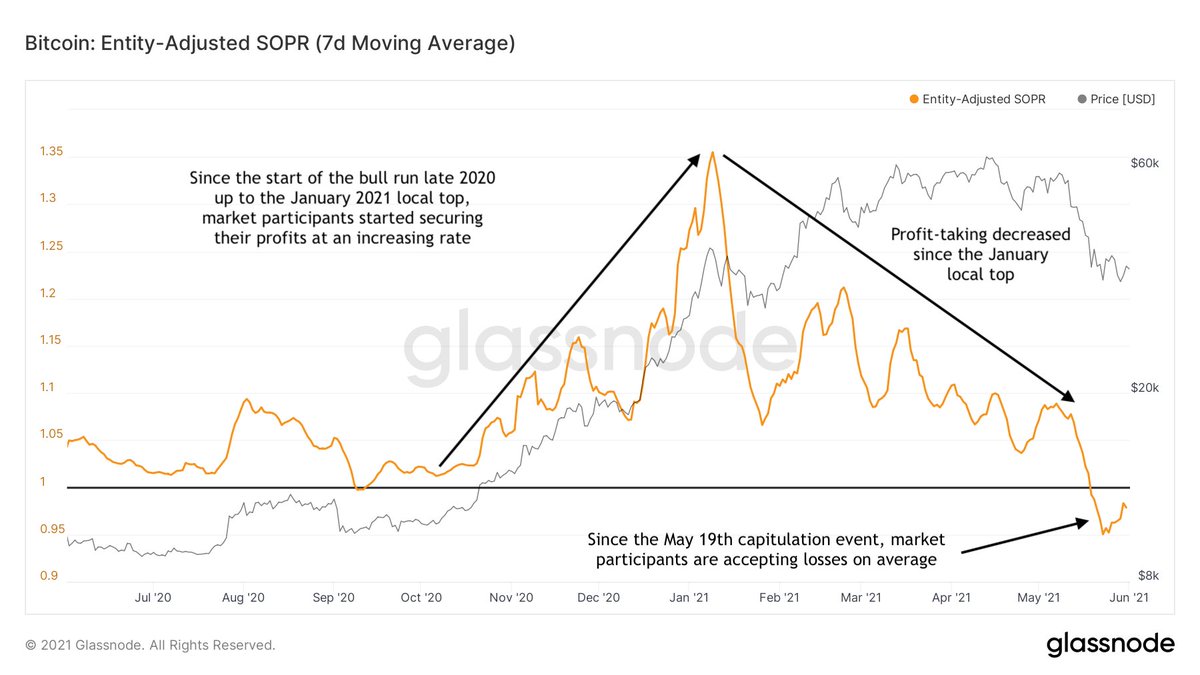

2/9 Today's on-chain movements were similar to those of last week:

1) Most of the coins moving were relatively young 👶

2) Short-term holders are now at net unrealized loss levels not seen since the March 2020 market crash 😱

3) ..and appear to be capitulating those losses 🪦

1) Most of the coins moving were relatively young 👶

2) Short-term holders are now at net unrealized loss levels not seen since the March 2020 market crash 😱

3) ..and appear to be capitulating those losses 🪦

3/9 The young coins that were likely capitulating were a possible sign of inexperienced market participants (e.g. retail) capitulating

Today we also saw a huge uptick in #Bitcoin dominance: altcoins were bleeding (much) harder

Another possible sign of retail capitulation..? 👀

Today we also saw a huge uptick in #Bitcoin dominance: altcoins were bleeding (much) harder

Another possible sign of retail capitulation..? 👀

4/9 If we zoom in on the last 2 weeks (on a 10-min resolution), we see that over the last week, there were some huge net exchange inflows 🐳

During today's dip, there also were a few huge net outflows - a possible sign that a big entity is shopping at a discount 💸

During today's dip, there also were a few huge net outflows - a possible sign that a big entity is shopping at a discount 💸

5/9 Today's $10k daily candle was breathtaking to experience 😨

Price bounced back +30% from its low & appears to be forming a beautiful capitulation wick 🌹

Can today's candle even close above its 200-day moving average? ...and who is doing that heavy buying on Coinbase? 👀

Price bounced back +30% from its low & appears to be forming a beautiful capitulation wick 🌹

Can today's candle even close above its 200-day moving average? ...and who is doing that heavy buying on Coinbase? 👀

6/9 As you would expect on such a bloody Tuesday, a lot of longs were liquidated 🪦

Today's liquidations weren't more extreme than those in Feb-Apr. However, these didn't come after reaching a new all-time high - but during what appeared to be a capitulation event! 😯

Today's liquidations weren't more extreme than those in Feb-Apr. However, these didn't come after reaching a new all-time high - but during what appeared to be a capitulation event! 😯

7/9 Earlier today I tweeted that I was worried about the positive funding rate (

This is no longer the case. Not only did leveraged longs get flushed out - the market is now net short 👀

There is now a 🐳 incentive to pump the price & liquidate shorts

https://twitter.com/dilutionproof/status/1394907478329110528?s=20)

This is no longer the case. Not only did leveraged longs get flushed out - the market is now net short 👀

There is now a 🐳 incentive to pump the price & liquidate shorts

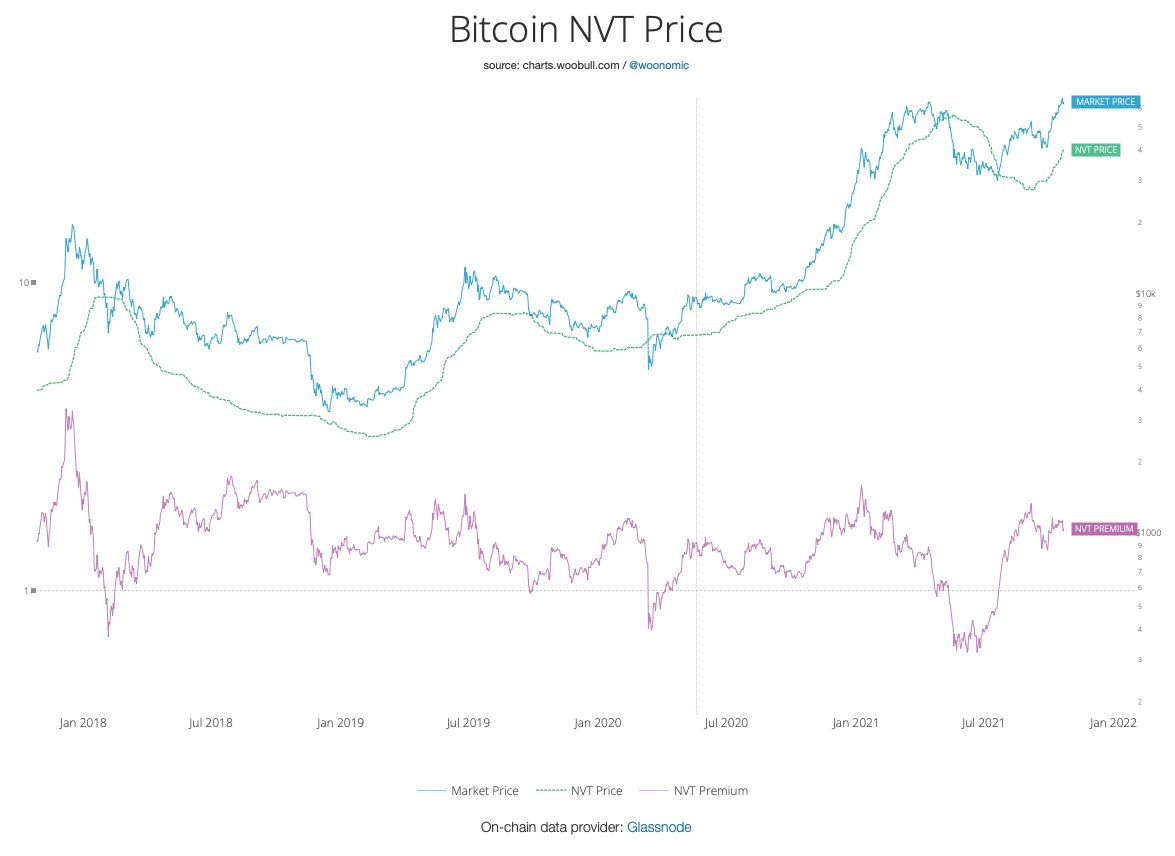

8/9 The big question: is this the end of the bull market..? 🤔

We have a @glassnode, but not a crystal ball 🤷♂️

I don't think this was it. Like I tweeted earlier today (

We have a @glassnode, but not a crystal ball 🤷♂️

I don't think this was it. Like I tweeted earlier today (

https://twitter.com/dilutionproof/status/1394905108455084039?s=20), I would expect more HODLers selling, e.g. moving RHODL & Reserve Risk into the red

9/9 If this indeed was not end of the bull market, it would mean that we have just experienced the largest bull market drawdown since 2013 💪

These are extremely volatile times - stay safe out there (e.g., don't use leverage but just buy dips via spot or DCA)! ✌️

These are extremely volatile times - stay safe out there (e.g., don't use leverage but just buy dips via spot or DCA)! ✌️

• • •

Missing some Tweet in this thread? You can try to

force a refresh