1/ “We can have no finer role model. He was a value investor — a member of that eccentric tribe that believes it’s better to underpay than to overpay.”

This thread reveals the story of the greatest value investor you've never heard of.

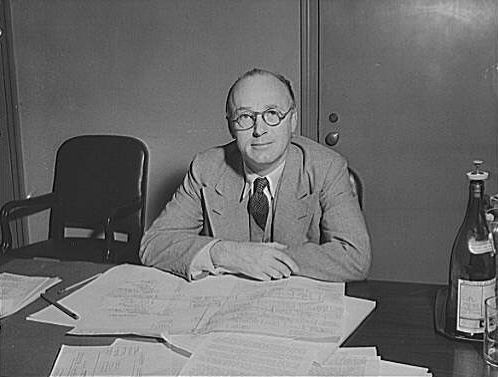

The story of Floyd Odlum.

THREAD

This thread reveals the story of the greatest value investor you've never heard of.

The story of Floyd Odlum.

THREAD

2/ With a decent income from his job as a law clerk, Odlum started trading in the stock market. He initially saw the market as a rich, fertile ground for speculative profits. Far from his cemented legacy as a deep value investor.

3/ Yet like most beginning speculators, Odlum too paid his fair share of market tuition.

After losing all his $40,000 starting capital, Odlum retreated from the markets. One newspaper revealed it, “took [Odlum] a while to pay back that sum”.

After losing all his $40,000 starting capital, Odlum retreated from the markets. One newspaper revealed it, “took [Odlum] a while to pay back that sum”.

4/ Yet It was this early $40K loss that turned Odlum from speculator to investor. From tape reader to business analysis.

Soon enough, Odlum would be back. The starting capital would be the same. The approach, anything but similar.

Soon enough, Odlum would be back. The starting capital would be the same. The approach, anything but similar.

5/ The partnership, formed in 1923, was a couple’s affair. Odlum, George Howard and their wives seeded the partnership with $39,000 ($573K adj. for inflation).

What followed over the next two years was nothing short of incredible.

What followed over the next two years was nothing short of incredible.

6/ According to Odlum’s biography, The United States Company grew 17x from 1923 – 1925. What started as a small partnership amongst friends turned into a $660,000 behemoth ($9.47M adjusted for inflation).

Odlum’s two-year CAGR is mind-numbing.

Odlum’s two-year CAGR is mind-numbing.

7/ If that wasn’t impressive enough, he generated these returns while working full-time as a law clerk!

How did he generate such outsized returns?

Odlum preferred two kinds of investments:

- Utility stocks

- Special situations

How did he generate such outsized returns?

Odlum preferred two kinds of investments:

- Utility stocks

- Special situations

8/ He defined a special situation as “an investment involving not only primary financial sponsorship, but usually also responsibility for the management of the company."

9/ Embedded in Odlum’s strategy was the determination to see a special situation through until success, “[We will] stay with the investment until the essentials of the job have been done, and then move on [to] another special situation”.

10/ Between 1925 – 1928, Odlum steadily grew the partnership. By investing in utilities and special situations, The United States Company AUM grew to $6M (over $88M adjusted for inflation). It was around this time that Odlum began sensing euphoria in the market.

11/ He smelled a top and he decided it was time for him to act.

With $14M in cash, Floyd sat on his hands. Waiting for the next market crash, which shortly followed.

With $14M in cash, Floyd sat on his hands. Waiting for the next market crash, which shortly followed.

12/ Odlum was prepared and took full advantage once fear had fully gripped the market and there was blood in the streets…

13/ “After the crash, Odlum, looking around quietly with more ready money than almost anybody in Wall Street except [a] few of the big banks, noticed that the trend in trusts had reversed.”

Odlum’s 1929 Strategy: Sit. Wait. Attack.

Odlum’s 1929 Strategy: Sit. Wait. Attack.

14/ Along with his traditional investments, Odlum dabbled in a number of other industries, including:

- Mining

- Oil and gas

- Motion picture production and distribution

- Aircraft and airlines

- Department stores

- Mining

- Oil and gas

- Motion picture production and distribution

- Aircraft and airlines

- Department stores

15/ But his bread and butter during the Depression was buying investment trusts. His strategy was simple. He found investment trusts that had fallen so much their stock prices were trading less than the value of their marketable securities.

16/ He discovered he could buy these trusts, liquidate their assets, and reap large profits for his stakeholders. He was buying dollar bills for $0.60 and he milked this strategy for all it’s worth. He ended up buying and merging investment trust twenty-two times.

17/ The newspaper article profiled these dealings:

“He figured out that by buying all the outstanding shares of a particular trust, he was really buying cash or its equivalent at sixty cents on the dollar.”

“He figured out that by buying all the outstanding shares of a particular trust, he was really buying cash or its equivalent at sixty cents on the dollar.”

18/ When he didn’t have the cash to buy the trusts, he sold shares in his own company, Atlas, to fund the purchases. After exchanging his stock for the trust’s stock, Odlum would merge or dissolved the existing trust, keeping the cash and assets within Atlas Corp.

19/ This strategy helped grow his assets to $150M ($2.2B adjusted for inflation).

Between 1929 and 1935, Odlum invested (and controlled) many diverse businesses.

Between 1929 and 1935, Odlum invested (and controlled) many diverse businesses.

20/ He owned Greyhound Bus, a little motion picture studio named Paramount, Hilton Hotels, three women’s apparel companies, uranium mines, a bank, an office building, and an oil company.

Taking It All In

Odlum started with $40,000 and lost it all speculating in the market.

Taking It All In

Odlum started with $40,000 and lost it all speculating in the market.

21/ He then pooled together another $39,000 to form his first partnership. That original $39,000 grew to $150M in controlled assets. All that during a span of just twelve years.

Odlum grew assets 384,515% in a bit over a decade. That’s a 32,042% CAGR for asset growth.

Odlum grew assets 384,515% in a bit over a decade. That’s a 32,042% CAGR for asset growth.

22/ And his early partnership returns are just as impressive. Odlum grew assets from $39,000 to $6M between 1923 – 1929. That’s a cumulative 15,284% return. In other words, Odlum compounded capital at an annual rate of 2,547%.

23/ I want to finish this thread with three takeaways from Floyd Odlum’s investing career:

- You don’t need to be 100% invested 24/7

- Boring is beautiful

- Be a dumpster diver (with standards)

- You don’t need to be 100% invested 24/7

- Boring is beautiful

- Be a dumpster diver (with standards)

24/ /Conclusion

I hope you enjoyed this thread. If you liked what you read, consider subscribing to our new Substack Newsletter "Macro Musings"

macroops.substack.com

I hope you enjoyed this thread. If you liked what you read, consider subscribing to our new Substack Newsletter "Macro Musings"

macroops.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh