Here is a compilation of all the major threads I have done in the past on "Principles of Investing" & "Fundamental Analysis of Crypto-currencies".

I like to take concentrated long term bets and only invest in the highest quality names.

Fundamentals > Hype

Compilation below 👇

I like to take concentrated long term bets and only invest in the highest quality names.

Fundamentals > Hype

Compilation below 👇

My initial thoughts / thesis on @THORChain, the number 1 cross-chain DEX:

https://twitter.com/HighCoinviction/status/1362942749444628480

My initial thoughts / thesis on @cosmos, a highly undervalued L1 project with an exploding ecosystem:

https://twitter.com/HighCoinviction/status/1382880443188576263

Valuation / fundamental analysis on @iearnfinance, critical infrastructure protocol building the backbone for DeFi:

https://twitter.com/HighCoinviction/status/1386886324779687937

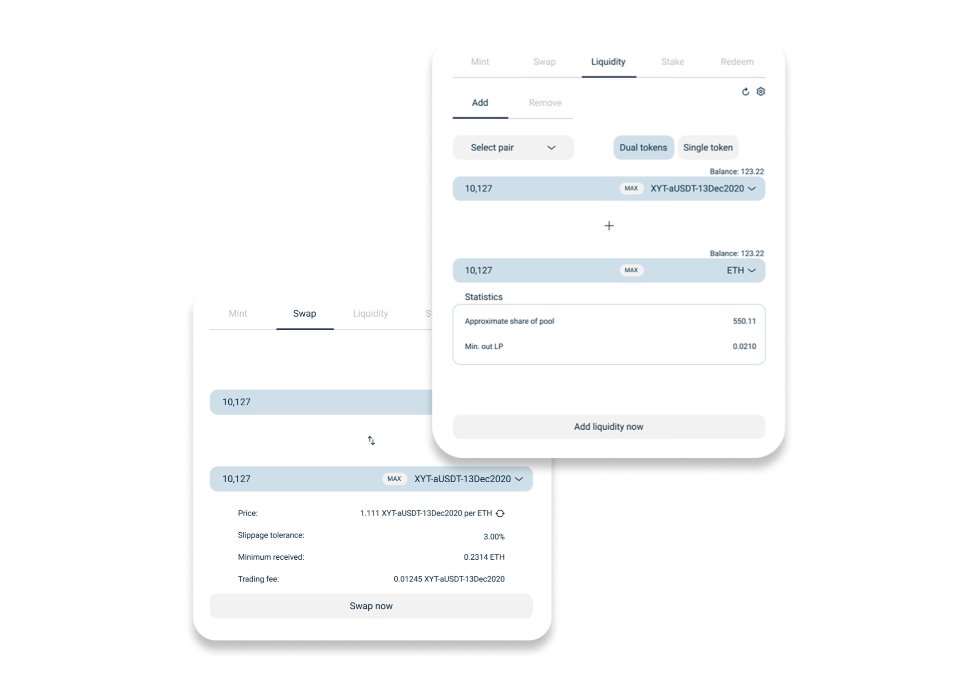

My initial thoughts on @pendle_fi, a leader in the interest rate derivatives space with a massive TAM:

https://twitter.com/HighCoinviction/status/1394795639272353793

My initial thoughts on the best non-pegged stable coin protocol @OlympusDAO v1:

https://twitter.com/HighCoinviction/status/1385072248512471040

My initial thoughts on the @saffronfinance_ and the concept of risk tranches in DeFi:

https://twitter.com/HighCoinviction/status/1359669115074580482

Investing thread regarding basing investment decisions on valuation alone:

https://twitter.com/HighCoinviction/status/1367151115310141441

Discussing ETH Fundamentals on 6/9/2021:

https://twitter.com/HighCoinviction/status/1402779873001738241

Compound Finance launching Compound Chain and Compound Treasury:

https://twitter.com/HighCoinviction/status/1414583112030371841

Thoughts on Solana valuation as of 8/18/21:

https://twitter.com/HighCoinviction/status/1428006105486135303

Thoughts on Pendle SLP & (Pe,P) update:

https://twitter.com/HighCoinviction/status/1428064851922980869

Thesis on $RUNE deserving to be treated as L1 asset:

https://twitter.com/HighCoinviction/status/1428547514492391426

• • •

Missing some Tweet in this thread? You can try to

force a refresh