COMP will likely vastly outperform ETH & DeFi over the next 6 months given:

1) Compound Treasury - more liquidity, better borrowing rates, more adoption

2) Compound Chain - more chains, more collateral, larger TAM

Institutional adoption is here & COMP is at the center of it 🧵

1) Compound Treasury - more liquidity, better borrowing rates, more adoption

2) Compound Chain - more chains, more collateral, larger TAM

Institutional adoption is here & COMP is at the center of it 🧵

' @compoundfinance is an ETH-based project that is focused on establishing various money markets on Ethereum.

The protocol aggregates a bunch of assets into a single pool so that suppliers & borrowers can interact directly with the protocol as opposed to with a third party.

The protocol aggregates a bunch of assets into a single pool so that suppliers & borrowers can interact directly with the protocol as opposed to with a third party.

This is a superior model for collateralized lending vs. how it is currently done traditionally by banks given:

1) It eliminates the need for matchmaking

2) Terms are set algorithmically, which removes the need for negotiating terms and increases trust

3) Better transparency

1) It eliminates the need for matchmaking

2) Terms are set algorithmically, which removes the need for negotiating terms and increases trust

3) Better transparency

Another important diff. is that lending on Compound enables lenders to reinvest their underlying asset to earn additional yield given the issuance of a cToken, which can be repurposed in the DeFi ecosystem.

The yield on the underlying asset was traditionally pocketed by banks.

The yield on the underlying asset was traditionally pocketed by banks.

KPI's for $COMP are healthy, with revenue continuing to grow and TVL strong despite the market crash in May.

COMP will gain market share & see revenue greatly accelerate over the next few months due to:

1) Launch of Compound Treasury & Chain

2) Continued growth of $USDC

COMP will gain market share & see revenue greatly accelerate over the next few months due to:

1) Launch of Compound Treasury & Chain

2) Continued growth of $USDC

For starters, Compound Treasury is an extremely bullish event.

Just like how we saw the Fortune 500 hold $BTC on their balance sheets as SOV asset, we will soon see them use Compound to generate yield on idle cash.

This is another way for companies to combat rising inflation.

Just like how we saw the Fortune 500 hold $BTC on their balance sheets as SOV asset, we will soon see them use Compound to generate yield on idle cash.

This is another way for companies to combat rising inflation.

Through the use of @circlepay API, institutions will be able to easily deposit their USD onto Compound.

The process will be seamless.

Institution deposits USD -> Circle Handles conversion /custody & deployment of USDC into Compound.

It really is that simple.

The process will be seamless.

Institution deposits USD -> Circle Handles conversion /custody & deployment of USDC into Compound.

It really is that simple.

They are currently guaranteeing a ~4% yield on stable coins for institutions, which is better than anything close to risk-free they can get in Tradfi.

I would expect Compound to see an explosion in TVL as a result upon launch.

I would expect Compound to see an explosion in TVL as a result upon launch.

As a result, Compound Treasury will propel @compoundfinance to a level of mass adoption that very few protocols in crypto have achieved.

Think big like $BTC, $ETH, $UNI.

Think big like $BTC, $ETH, $UNI.

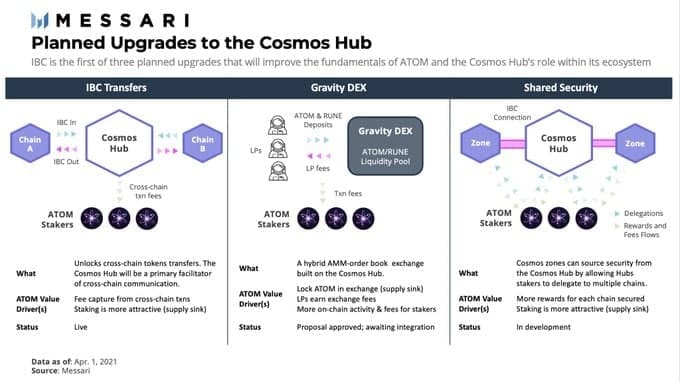

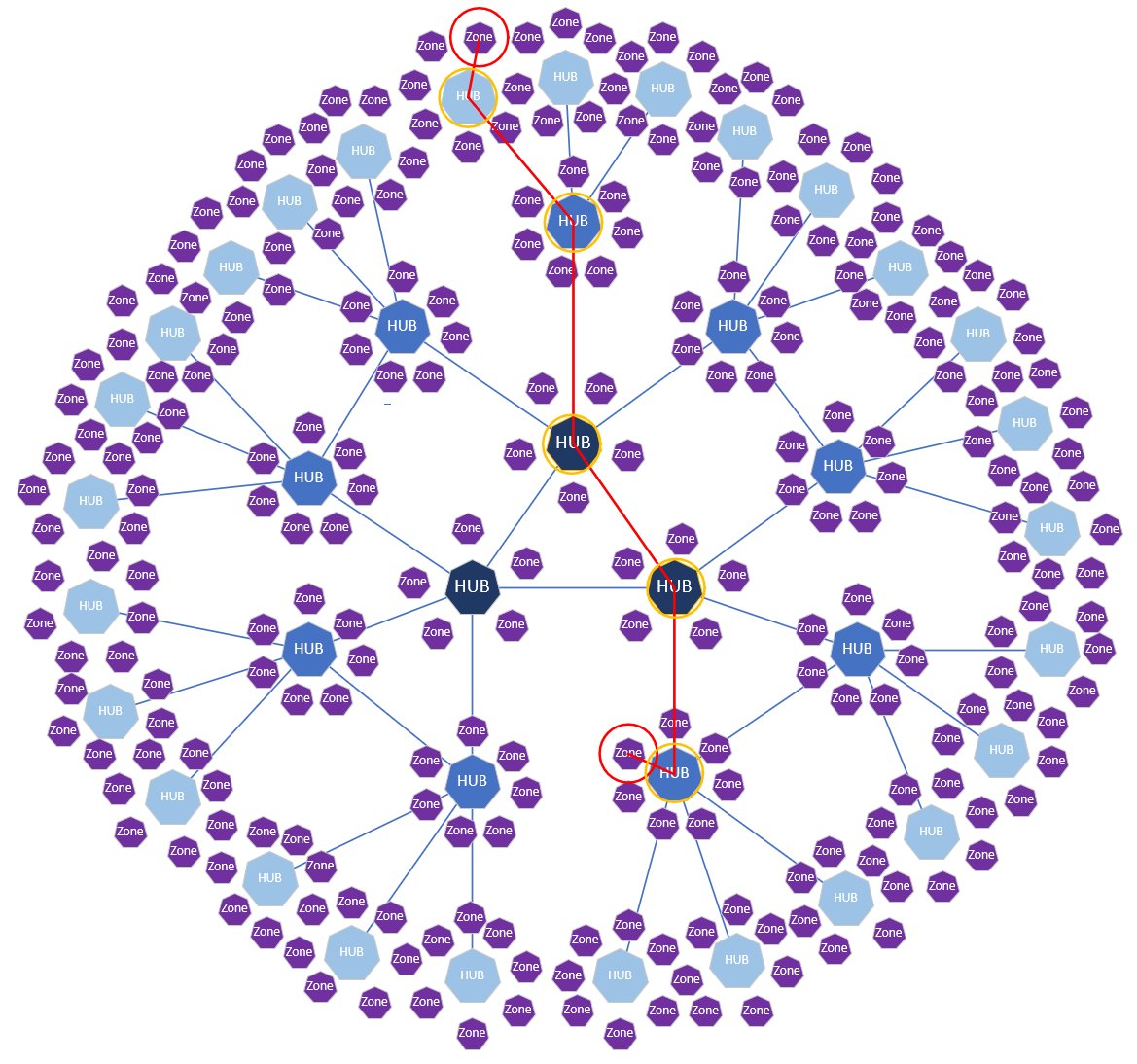

In addition, Compound Chain (COMP-Chain) will also provide massive upside for the $COMP token, as it expands the TAM potential for Compound.

Compound Chain will be its own blockchain built using Substrate and is expected to be coming soon.

Compound Chain will be its own blockchain built using Substrate and is expected to be coming soon.

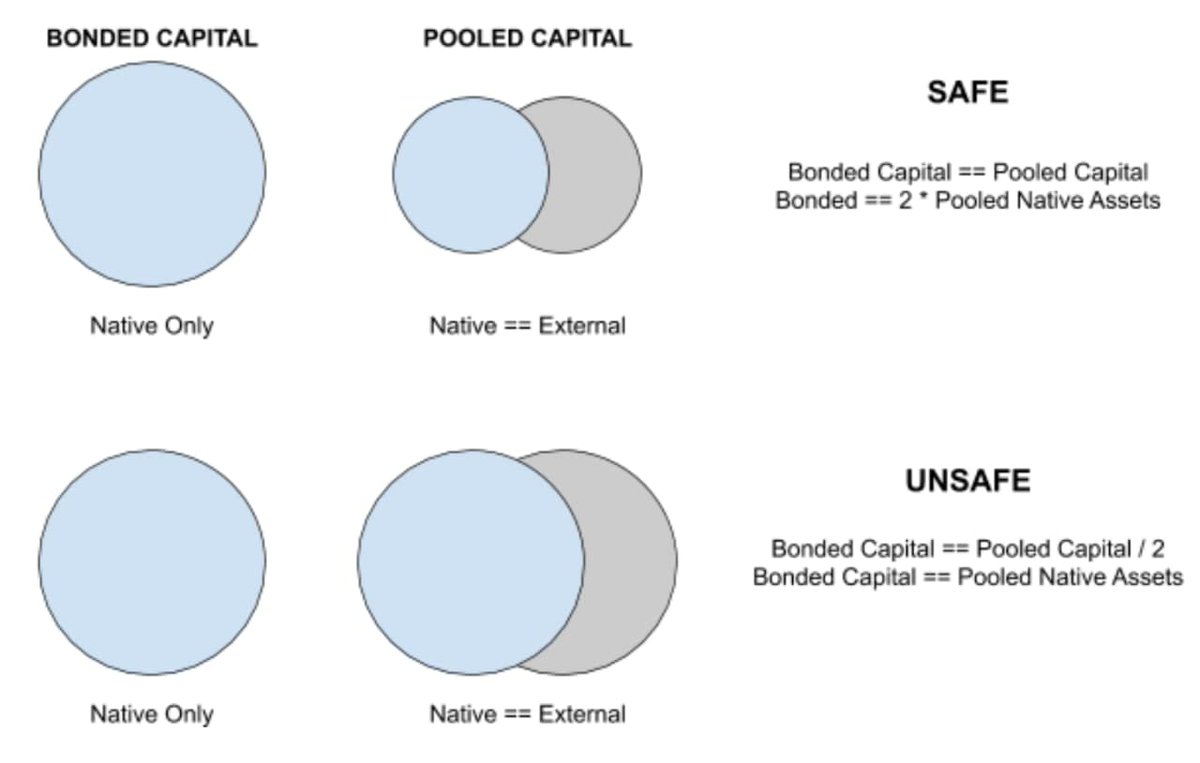

COMP-Chain will enable cross-chain lending, and assets like $DOT, $BTC could be onboarded via Starport and used for collateralized lending without the need for an external custody service.

An interesting point on COMP-Chain is that it will be like Maker where you deposit assets and mint a loan in $CASH.

$CASH will be used to pay for transaction costs on the network.

This makes COMP-Chain structurally more profitable as cost of capital is zero.

$CASH will be used to pay for transaction costs on the network.

This makes COMP-Chain structurally more profitable as cost of capital is zero.

$COMP holders will capture the upside from Compound Chain given the $COMP token will be used for governance and have a claim on the reserves of the protocol as well.

Lastly, secular tailwinds remain strong for lending protocols given the rising dominance of $USDC.

https://twitter.com/ryanwatkins_/status/1410013776636743683?s=21

This benefits lending protocols because users are constantly looking for ways to earn yield on idle deposits;

As of July 2021, lending protocols held ~23% of USDC supply.

The LT trend growing USDC dominance will only be exacerbated as Circle’s API / Compound Treasury ramps.

As of July 2021, lending protocols held ~23% of USDC supply.

The LT trend growing USDC dominance will only be exacerbated as Circle’s API / Compound Treasury ramps.

While this will dilute yields for depositors on assets like USDC, the increased adoption of DeFi lending protocols would lead to unprecedented lending / borrowing volumes that would more than offset the negative impact to profitability from lower APYs.

Compound also currently sits at a reasonable valuation as well, and we will likely see valuation gaps close with $AAVE as a result of these catalysts.

AAVE: 4bn mkt cap

COMP: 2bn mkt cap

This implies ~100% upside over the next few months assuming AAVE val. remains constant.

AAVE: 4bn mkt cap

COMP: 2bn mkt cap

This implies ~100% upside over the next few months assuming AAVE val. remains constant.

Finally, the Compound team are exceptional executioners as well (@rleshner, @cjliu49) and will propel Compound to be the leader in the space.

Coupled with the amount of dry powder from megafunds like a16z etc… I just don’t see how $COMP remains at a $2bn val. much longer.

Coupled with the amount of dry powder from megafunds like a16z etc… I just don’t see how $COMP remains at a $2bn val. much longer.

• • •

Missing some Tweet in this thread? You can try to

force a refresh