Thread 🧵 on Marksans Pharma 💊

- 3,000 Cr market cap is an Indian Pharmaceutical Company having a global footprint.

Disc: Invested & not a recommendation to buy.

#investing

- 3,000 Cr market cap is an Indian Pharmaceutical Company having a global footprint.

Disc: Invested & not a recommendation to buy.

#investing

2/ Incorporated in 1992, was a wholly–owned subsidiary of Glenmark.

It became a separate entity in March 2003 &the name was changed to Marksans Pharma in 2005.

They have presence in

1️⃣Active Pharmaceuticals Ingredients (APIs) 2️⃣Formulations &

3️⃣Biopharmaceuticals

It became a separate entity in March 2003 &the name was changed to Marksans Pharma in 2005.

They have presence in

1️⃣Active Pharmaceuticals Ingredients (APIs) 2️⃣Formulations &

3️⃣Biopharmaceuticals

3/ Lets understand bit of Indian Pharma Industry👇

① Largest provider of generic drugs globally

② Supplies 50% of the global demand of vaccines

③ Supplies 40% of generic demand in the US

④ Supplies 25% of all medicines in the UK

⑤ Expected to grow to $100 billion by 2025

① Largest provider of generic drugs globally

② Supplies 50% of the global demand of vaccines

③ Supplies 40% of generic demand in the US

④ Supplies 25% of all medicines in the UK

⑤ Expected to grow to $100 billion by 2025

4/ As per IBEF ~

Domestic pharmaceutical market is estimated at $ 41 b in 2021 and likely to reach $ 65 b by 2024 and further expand to reach $ 130 b by 2030

(ibef.org/industry/pharm…)

Despite all the challenges, the Indian Pharma industry has also registered a growth of 18%.

Domestic pharmaceutical market is estimated at $ 41 b in 2021 and likely to reach $ 65 b by 2024 and further expand to reach $ 130 b by 2030

(ibef.org/industry/pharm…)

Despite all the challenges, the Indian Pharma industry has also registered a growth of 18%.

5/ Indian Govt Support ~

❶The Production Linked Incentive (PLI) Scheme for promotion of domestic manufacturing of critical Key Starting Materials (KSMs)/Drug Intermediates (DIs) & API.

⏬

⏬

❶The Production Linked Incentive (PLI) Scheme for promotion of domestic manufacturing of critical Key Starting Materials (KSMs)/Drug Intermediates (DIs) & API.

⏬

⏬

6/

❷Financial incentive will be given to eligible manufacturers of identified 41 eligible pdts which covers 53 APIs, for 6 yrs, committed investment & sales made by selected applicant for the eligible pdts.

Details👇

investindia.gov.in/schemes-for-ph…

❷Financial incentive will be given to eligible manufacturers of identified 41 eligible pdts which covers 53 APIs, for 6 yrs, committed investment & sales made by selected applicant for the eligible pdts.

Details👇

investindia.gov.in/schemes-for-ph…

7/

Indian pharmaceutical industry is the 3rd largest in the world by volume and is $ 41 billion in terms of value

India should become one of the top 10 countries in terms of medicine spending in the next 5 years.

Mckinsey on Indian Pharma👇

mckinsey.com/~/media/mckins….

Indian pharmaceutical industry is the 3rd largest in the world by volume and is $ 41 billion in terms of value

India should become one of the top 10 countries in terms of medicine spending in the next 5 years.

Mckinsey on Indian Pharma👇

mckinsey.com/~/media/mckins….

8/ **Pharmacy of World**

During interaction with leaders of Indian Pharma Industry PM .@narendramodi quoted "It is because of the efforts of the Pharma Industry that today India is identified as "Pharmacy of world"

During interaction with leaders of Indian Pharma Industry PM .@narendramodi quoted "It is because of the efforts of the Pharma Industry that today India is identified as "Pharmacy of world"

10/ Business Overview

Major Product Portfolio

1. Pain Mgmt

2. Anti-Daibetic

3. CVS

4. Cough & Cold

5. Gastrointestinal

6. CNS

Rev Mix

1. OTC - 55%

2. Rx - 45%

Geo Mix

America - 43%

Europe - 42%

Aus - 10%

95% rev comes from regulated mkt & presence in niche softgel segment

Major Product Portfolio

1. Pain Mgmt

2. Anti-Daibetic

3. CVS

4. Cough & Cold

5. Gastrointestinal

6. CNS

Rev Mix

1. OTC - 55%

2. Rx - 45%

Geo Mix

America - 43%

Europe - 42%

Aus - 10%

95% rev comes from regulated mkt & presence in niche softgel segment

12/ Long Term Strategy

⏬

A. Strategic Focus on Regulated Mkts

1. Global Footprint

2. Higher Margins

3. 25+ Countries

4. Regulatory Approvals

5. Expansion in Regulated Markets

⏬

A. Strategic Focus on Regulated Mkts

1. Global Footprint

2. Higher Margins

3. 25+ Countries

4. Regulatory Approvals

5. Expansion in Regulated Markets

13/ ⏬

B. Niche Formulations with few Competitors

1. Differentiated Offerings

2. Limited Competition

3. High Barriers to Entry

4. Selectively Targets Larger Mkts

5. New Approvals

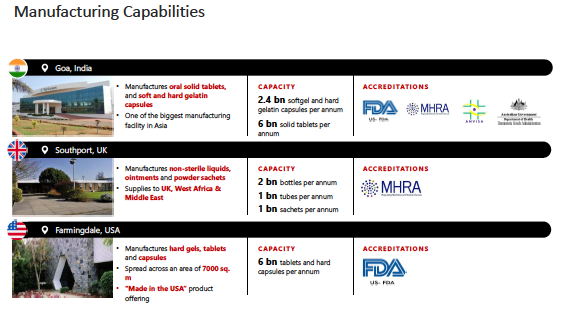

6. Manufacturing Capabilities with Regulatory Approvals

B. Niche Formulations with few Competitors

1. Differentiated Offerings

2. Limited Competition

3. High Barriers to Entry

4. Selectively Targets Larger Mkts

5. New Approvals

6. Manufacturing Capabilities with Regulatory Approvals

14/ Marksans is all set to grab Business opportunities in UK/Europe, US & EMs:

1. 50+ products in the pipeline in different stages to cater to UK Mkt

2. Company is awaiting approval for 20 MAs in the UK mkt

3. Strengthen US operations & add 4-5 new products to it portfolio.

1. 50+ products in the pipeline in different stages to cater to UK Mkt

2. Company is awaiting approval for 20 MAs in the UK mkt

3. Strengthen US operations & add 4-5 new products to it portfolio.

15/⏬

4. For emerging markets, Marksans is in the process of launching new products & obtaining product registration for 175 developed products

Marksans manufacturing Capabilities👇

4. For emerging markets, Marksans is in the process of launching new products & obtaining product registration for 175 developed products

Marksans manufacturing Capabilities👇

17/ Key Focus Areas👇

1. Expansion

2. Product Launch

3. Inorganic Expansion

4. Backward Integration

1. Expansion

2. Product Launch

3. Inorganic Expansion

4. Backward Integration

18/ Marksans Financial Ratios & Highlights

👉Not bad, pretty impressive

👉Q4'21 Result is a trigger for stock price movement

👉Not bad, pretty impressive

👉Q4'21 Result is a trigger for stock price movement

20/ Few key points (Investment Rationale):

1. Widening Product Portfolio

2. Key Markets

3. Amongst largest Pharma market

4. Engaging R&D Team

5. New R&D Center in Navi Mumbai

6. Repaid LT loans, surplus reinvested in R&D and Expansion

1. Widening Product Portfolio

2. Key Markets

3. Amongst largest Pharma market

4. Engaging R&D Team

5. New R&D Center in Navi Mumbai

6. Repaid LT loans, surplus reinvested in R&D and Expansion

Here is a detail blog on Marksans by @drvijaymalik , he does highlighted few red 🚩🚩

Please read before investing 👇👇

drvijaymalik.com/analysis-marks…

Please read before investing 👇👇

drvijaymalik.com/analysis-marks…

Technical info on Marksans Pharma: OP in 9 months exceeding previous year & huge foreign holdings added👇

Time to tag - the god of Pharma @unseenvalue though I have DM'ed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh