PER ORDER Vs PER LOT brokerage

Which one is better?

Read the thread to know why one is clearly better than the other.

A THREAD ...

Which one is better?

Read the thread to know why one is clearly better than the other.

A THREAD ...

Too many people are getting scammed into per lot broking. There are offers anywhere between 6 rs per lot to 25 rs per lot. It's financial suicide to opt for this kind of broker compared to the per order ones.

Let's have a look at why PER ORDER is OBVIOUSLY the better choice.

Let's have a look at why PER ORDER is OBVIOUSLY the better choice.

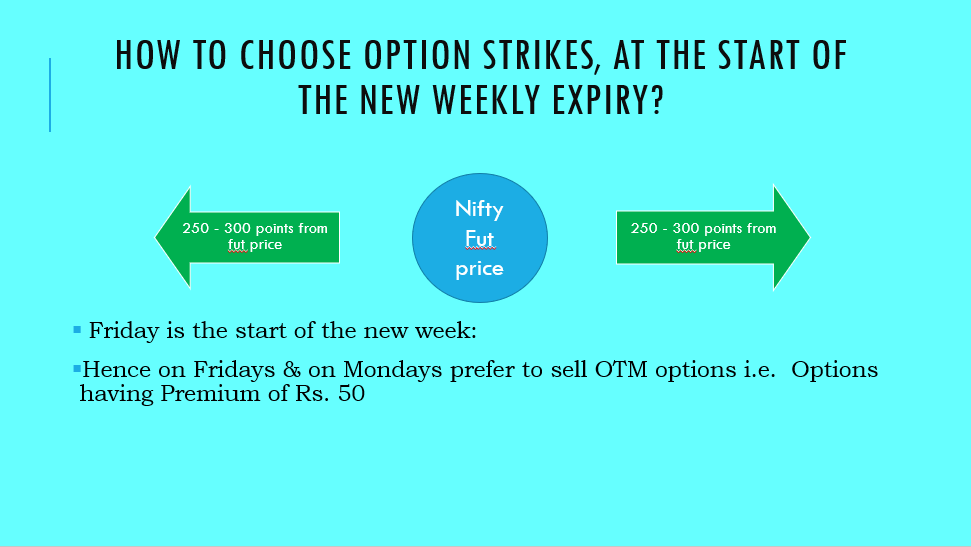

1. How many lots do you sell at a time?

The majority of the people must be at least selling 2-3 lots in one go. (Assumption)

Per lot brokerage (10 rs per lot) you'll be charged 30 rs buy-side and 30 rs sell-side (as we sold 3 lots), overall 60 rs plus other charges.

The majority of the people must be at least selling 2-3 lots in one go. (Assumption)

Per lot brokerage (10 rs per lot) you'll be charged 30 rs buy-side and 30 rs sell-side (as we sold 3 lots), overall 60 rs plus other charges.

Under per order, you'll only be charged 20 +20 = 40 rs overall. (This can be further reduced to 20 rs, check the 5th point to know how)

2. What's your capital?

If your capital is 10 lakh and above it mathematically makes no sense to opt for per lot unless you are selling 1 lot at a time or punching many orders a day.

(Constantly adjusting)

If your capital is 10 lakh and above it mathematically makes no sense to opt for per lot unless you are selling 1 lot at a time or punching many orders a day.

(Constantly adjusting)

3. Do you know the math behind it?

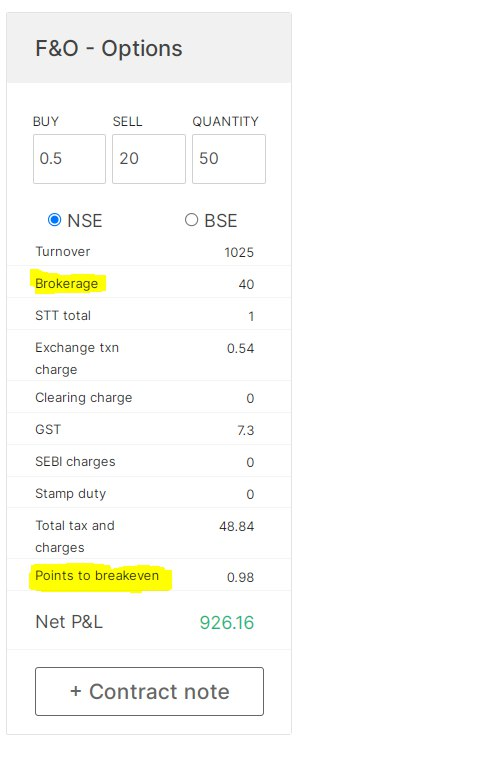

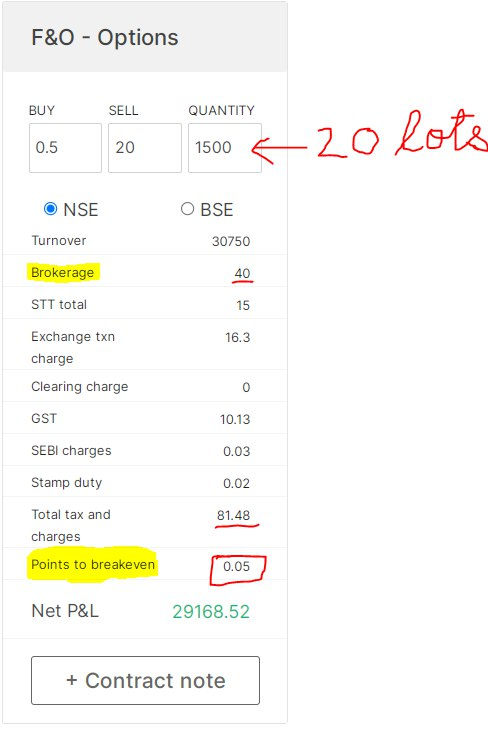

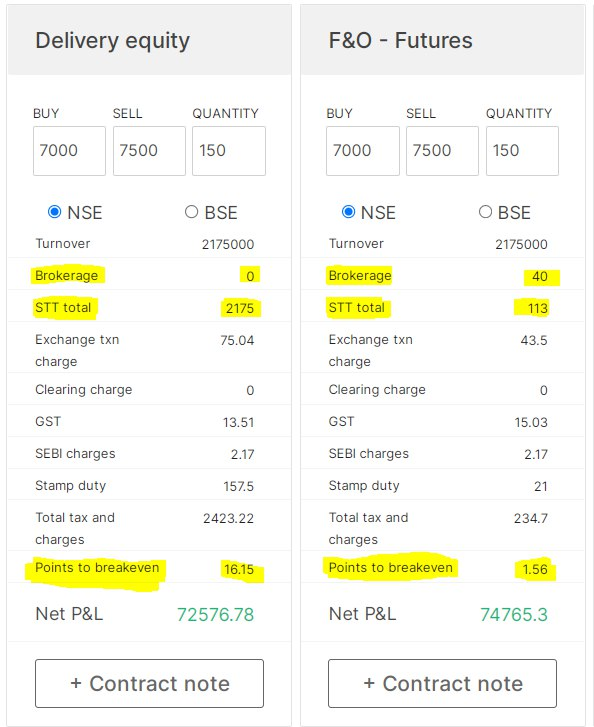

I majorly sell 20 lots in one go when I trade Nifty/BankNifty. See the charges which I face and also the breakeven pointwise for me.

My charges are almost negligible with per order.

I majorly sell 20 lots in one go when I trade Nifty/BankNifty. See the charges which I face and also the breakeven pointwise for me.

My charges are almost negligible with per order.

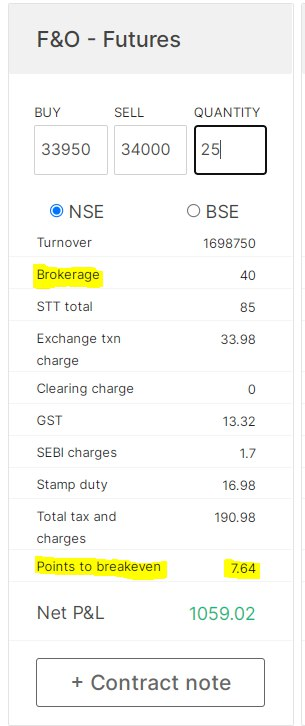

4. Significant cost reduction in Delivery/Future trades

One of the biggest disadvantages of per lot or percentage schemes is that you are charged in percentage when you deal with big capital.

For eg, you take a futures trade of 1 lot. Buy at 34000 sell at 34050.

cont...

One of the biggest disadvantages of per lot or percentage schemes is that you are charged in percentage when you deal with big capital.

For eg, you take a futures trade of 1 lot. Buy at 34000 sell at 34050.

cont...

You'll be charged roughly a percentage, for eg 0.002% to 0.005% of contract value or say 500 rs per crore kinda offers.

Again this isn't wise, if you deal in per order, you buy/sell even 1000 lots max brokerage is only 20rs.

This is a huge cost reduction.

Again this isn't wise, if you deal in per order, you buy/sell even 1000 lots max brokerage is only 20rs.

This is a huge cost reduction.

5. Subbroking benefits

If you become a sub-broker you get back 50% of your brokerage amount generated. So if you opt for per order you can further reduce your brokerage even more thereby making it negligible.

If you become a sub-broker you get back 50% of your brokerage amount generated. So if you opt for per order you can further reduce your brokerage even more thereby making it negligible.

6. Any additional benefits for per lot?

There are NO BENEFITS for per lot customers compared to per order. Whoever tells you there are benefits is purely lying to you and is wanting to make huge money sub broking through people like you.

There are NO BENEFITS for per lot customers compared to per order. Whoever tells you there are benefits is purely lying to you and is wanting to make huge money sub broking through people like you.

7. Never open an account under someone unless many benefits are offered.

You shouldn't be opening accounts under anyone unless they are helping you bec a bttr trader by gvg calls/explaining trades for your benefit. Simply opening via their link shld stop if they offer no benefits

You shouldn't be opening accounts under anyone unless they are helping you bec a bttr trader by gvg calls/explaining trades for your benefit. Simply opening via their link shld stop if they offer no benefits

8. NEST software available for per lot customers only?

This is totally false, I have been approached by brokers who agreed to the NEST platform and per order brokerage. All facilities like collateral/opening all strikes to sell etc was offered.

This is totally false, I have been approached by brokers who agreed to the NEST platform and per order brokerage. All facilities like collateral/opening all strikes to sell etc was offered.

Many people argue they want only NEST platform for trading. Just for their information, I put this point in to make them aware, that even with per order you'll get NEST with few brokers.

9. When should you opt for per lot brokerage?

- Your capital is very low (1 to 5 lakh) in that case per lot 10 rs will make more financial sense to you rather than 20 rs per order as you'll be selling only 1 lot at a time and doubling charges with per order.

- Your capital is very low (1 to 5 lakh) in that case per lot 10 rs will make more financial sense to you rather than 20 rs per order as you'll be selling only 1 lot at a time and doubling charges with per order.

- The guys with bigger capital who take too many trades/punches in a day should also opt for per lot, but not higher than 5 rs per lot.

Why were full-service brokers famous earlier?

10. Earlier full service brokers made sense as they used to give additional benefits like 10 to..

Why were full-service brokers famous earlier?

10. Earlier full service brokers made sense as they used to give additional benefits like 10 to..

.... 20 times leverage and hence per lot brokerage made sense as you could make higher profits with the leverage and also why they were so famous earlier. But now as leverage will be gone it makes zero sense for per lot.

------------------------------------------------------

END

------------------------------------------------------

END

• • •

Missing some Tweet in this thread? You can try to

force a refresh