1) Portfolio update May-end -

$ADYEY $AFTPY $AGC $CPNG $CRWD $DKNG $DOCU $GHVI $GLBE $LSPD $MELI $OZON $PATH $PINS $PLTR $ROKU $RTP $SE $SHOP $SNAP $SNOW $TWLO $UPST

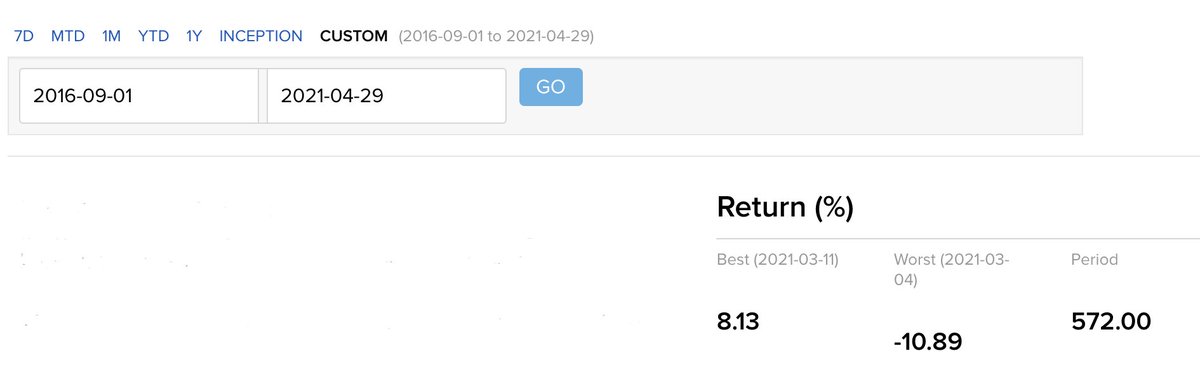

Return since 1 Sept '16 -

Portfolio +624.34% (51.72%pa)

$ACWI +69.86% (11.80%pa)

$SPX +93.66% (14.93%pa)

$ADYEY $AFTPY $AGC $CPNG $CRWD $DKNG $DOCU $GHVI $GLBE $LSPD $MELI $OZON $PATH $PINS $PLTR $ROKU $RTP $SE $SHOP $SNAP $SNOW $TWLO $UPST

Return since 1 Sept '16 -

Portfolio +624.34% (51.72%pa)

$ACWI +69.86% (11.80%pa)

$SPX +93.66% (14.93%pa)

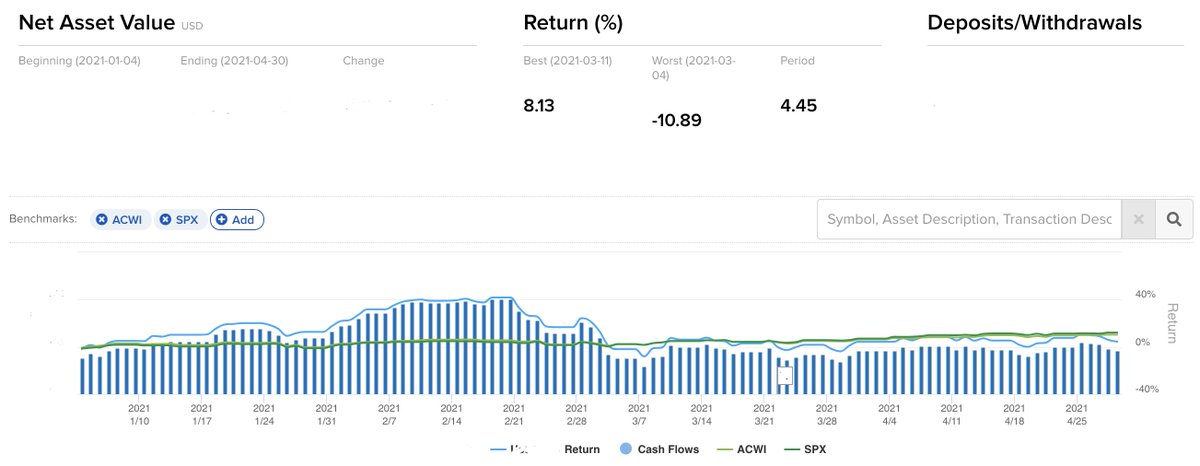

2) YTD return -

Portfolio +11.68%

$ACWI +9.69%

$SPX +11.93%

Biggest positions -

1) $SE 2) $UPST 3) $GLBE 4) $SNOW 5) $MELI

Contd....

Portfolio +11.68%

$ACWI +9.69%

$SPX +11.93%

Biggest positions -

1) $SE 2) $UPST 3) $GLBE 4) $SNOW 5) $MELI

Contd....

3) Commentary -

May was a tough month for growth companies as most related stocks came under the pump before stabilising.

Fortunately, my trend following indicators got me hedged in time and my portfolio remained market-neutral during most of the month which is reflected...

May was a tough month for growth companies as most related stocks came under the pump before stabilising.

Fortunately, my trend following indicators got me hedged in time and my portfolio remained market-neutral during most of the month which is reflected...

4)...in my portfolio's YTD equity curve (see above).

During the month, I became quite disillusioned with the SPAC related media stories (lack of adequate disclosure, colourful accounting, other shenanigans) so I decided to get rid of most of these names from my portfolio....

During the month, I became quite disillusioned with the SPAC related media stories (lack of adequate disclosure, colourful accounting, other shenanigans) so I decided to get rid of most of these names from my portfolio....

5)....Taking losses on these positions (namely $CURI $IPOE $OPEN $SFTW $SKLZ ) was not a pleasant experience but I followed by gut and rule "when in doubt, get out".

So, during the month I sold all these stocks and acquired shares in $GLBE and $LSPD. In terms of futures,

So, during the month I sold all these stocks and acquired shares in $GLBE and $LSPD. In terms of futures,

6)...I sold short 30-Yr US Treasuries #ZB_F and also Bitcoin - the former was covered with a small loss and the latter with a profit. Finally, I also increased my positions in $PLTR $MELI $SE $SNOW .

The above changes seem to have worked as my portfolio rebounded nicely...

The above changes seem to have worked as my portfolio rebounded nicely...

7)...towards month-end and I'm now able to sleep well with my capital invested in my highest conviction companies.

My two new buys $GLBE and $LSPD appear to be promising secular compounders (cross border DTC ecommerce + payments/software) and their recent stock performance...

My two new buys $GLBE and $LSPD appear to be promising secular compounders (cross border DTC ecommerce + payments/software) and their recent stock performance...

8)...has only increased my conviction.

Although my portfolio's YTD return is quite satisfactory (not least of all after last year's incredible gains), I am a bit disappointed with my high portfolio turnover. Unfortunately, I got caught in the new IPO frenzy and took starter...

Although my portfolio's YTD return is quite satisfactory (not least of all after last year's incredible gains), I am a bit disappointed with my high portfolio turnover. Unfortunately, I got caught in the new IPO frenzy and took starter...

9)...positions in too many new stocks (especially in unattractive industries) but have now recognised my folly - going forwards, my portfolio churn will be a lot lower.

In terms of the near-term outlook for growth stocks, it appears as though the worst of the decline is....

In terms of the near-term outlook for growth stocks, it appears as though the worst of the decline is....

10)...perhaps behind us and a base building period has commenced. The only caveat being that if long-dated rates rise rapidly due to inflationary fears, then growth stocks (long duration assets) might face some additional selling pressure.

In any event, should that happen...

In any event, should that happen...

11)...my hedges will kick in again and defend my capital.

The market's short-term zigs and zags notwithstanding, am confident that ecommerce, fintech/payments, software + streaming businesses will continue to grow and prosper over the next 4-5 years.

Hope this is helpful.

The market's short-term zigs and zags notwithstanding, am confident that ecommerce, fintech/payments, software + streaming businesses will continue to grow and prosper over the next 4-5 years.

Hope this is helpful.

• • •

Missing some Tweet in this thread? You can try to

force a refresh