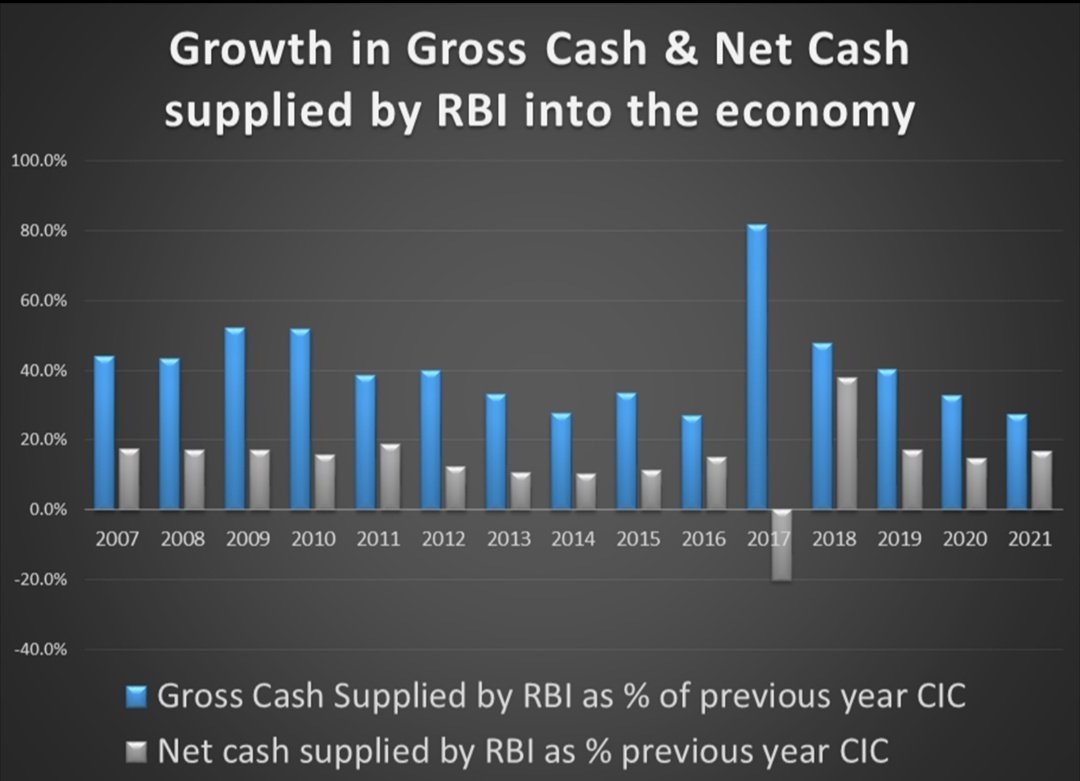

Cash-in-Circulation (CiC) dynamics- thr is a myth that RBI has been printing new money significantly causing CiC to trend up,or people hoarding cash etc. With RBI annual report out,we hv detailed data on both CiC (denomination wise) as well as printing of notes from mint.

As can be seen, growth rates are stable. Of course, this is gross new notes printed by mint. Given we have CiC denomination wise from 2 years, we can also calculate the notes extinguished or withdrawn from circulation as well, and what matters is net supply by RBI to economy

Net supply has been lower like in the past few years,however, if we slice the data on High Value Denomination (HVD) (500/1000/2000), one gets a slightly different picture.

Net supply of HVD Notes have grown at faster clip in FY21, even as gross supply of HVD has slower growth

Net supply of HVD Notes have grown at faster clip in FY21, even as gross supply of HVD has slower growth

So the issue is with extinguishing of notes not necessarily of printing new notes. I suspect, each note has a particular velocity with which it circulates in the economy before reaching the currency chests back when RBI MAY choose to extinguish it

Close to 30% of 2000 Rs notes have been extinguished from circulation over last 2 years, this rate is for sure higher than normal rates, but can it be more higher or lower, only algos in RBI will know

As percent of GDP, plotted the fresh printing, cash withdrawn from circulation and net supply (see the dip in blue line), this is causing the (in) famous CiC to GDP metric to optically trend up

Had written bfr tht RBI extinguishes notes every 2nd qtr in a fiscal & generally,change in CiC as percent of GDP goes negative,whereas in FY21, it was positive. This thread👇also shows cash withdrawals by public hv been flatlining for almost 17 qtrs now

https://twitter.com/hktg13/status/1395771415916253187?s=19

In summary,rather than focusing on CiC as % of GDP,if one focuses on cash withdrawals by public, net cash printed by RBI into economy as well as rising use of digital txns, we get a different narrative rather than "cash hoarded by public ⏫" or "black money increasing⏫⏫" etc..

Was pointed to source data from RBI by Gautam (Spark Capital) & Nikhil (Motilal), many thanks🙏

FIN!

Worded this wrong, it is not that RBI waits for Sep qtr to withdraw notes fro circulation, they do it all the time. The dip in cash is more a function of seasonality of cash withdrawals and cash deposits (lead by farming cycles)

https://twitter.com/hktg13/status/1398474104118804480?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh