Tesla recently published some patent applications where we can learn some super interesting details about the Cybertruck, Cybertruck camping mode…. and most importantly, the Cybertrailer.

Here’s a thread…

Here’s a thread…

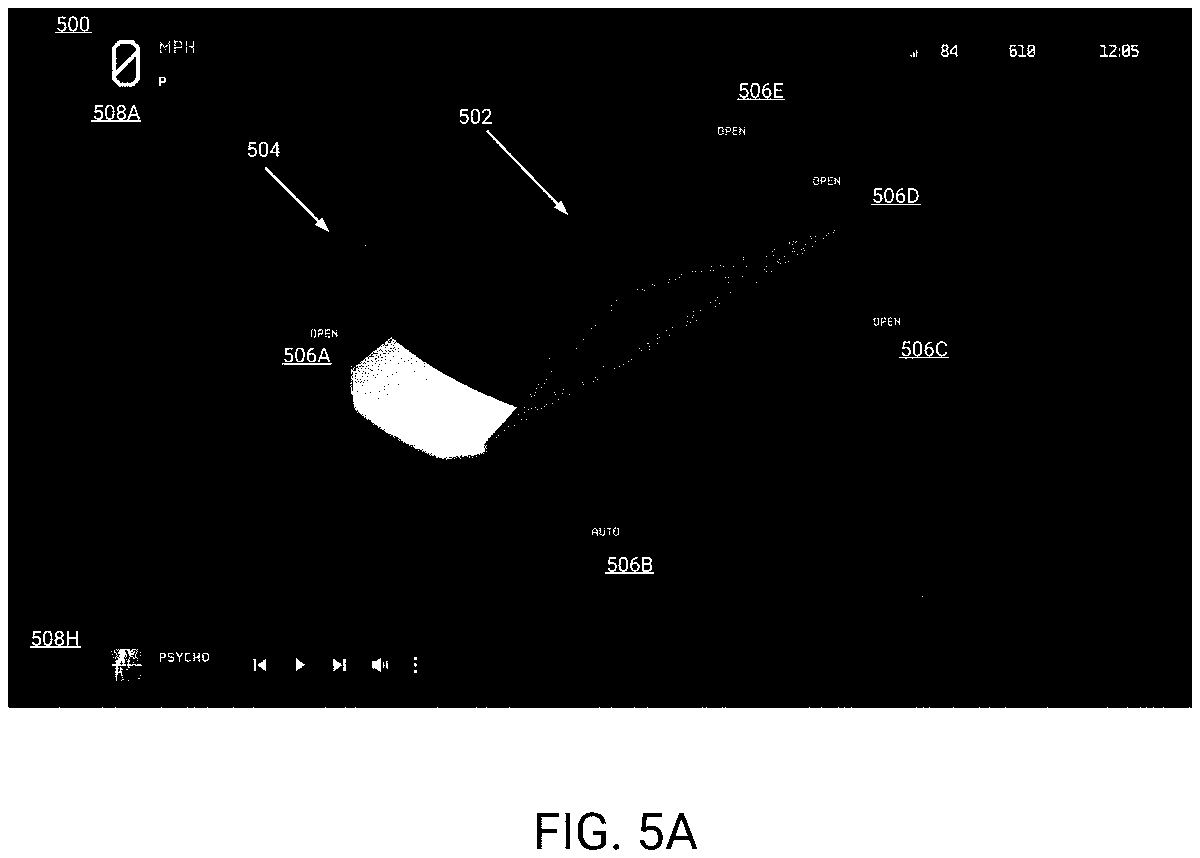

The Cybertruck tonneau cover and tail gate can be opened with press of a button. Also, the tonneau cover will likely have solar panels. These solar panels would likely give 15 miles of range per day (according to @elonmusk on 11/22/19).

https://twitter.com/elonmusk/status/1197889310550216704?s=20

Patent application drawings show Cybertruck with 610 mile range. Obviously this is no guarantee, but nevertheless interesting. (Tri-motor Cybertruck is advertised with 500+ mile range on Tesla's website)

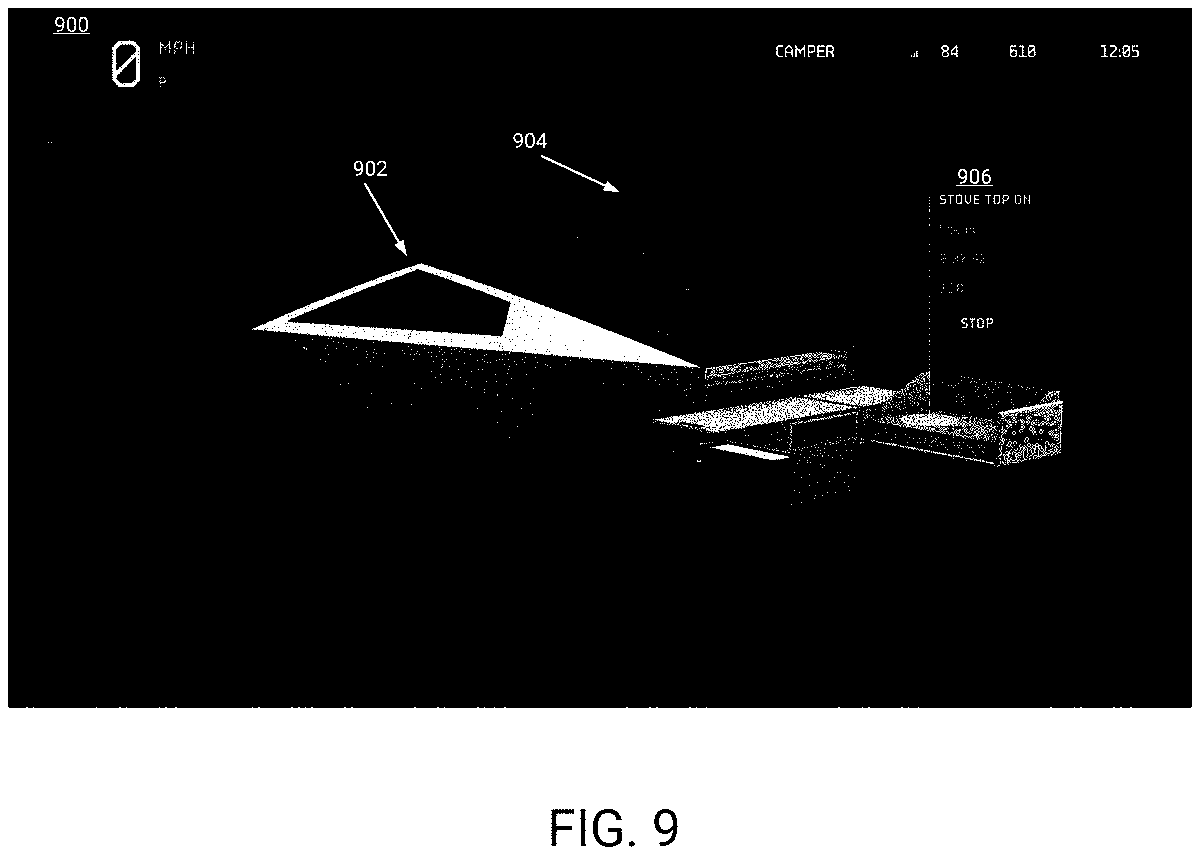

Cybertruck camping mode will allow camping stove to be controlled via app (or vehicle), and patent photo looks identical to photo released earlier. Stove and storage fold under a bed in the Cybertruck cab.

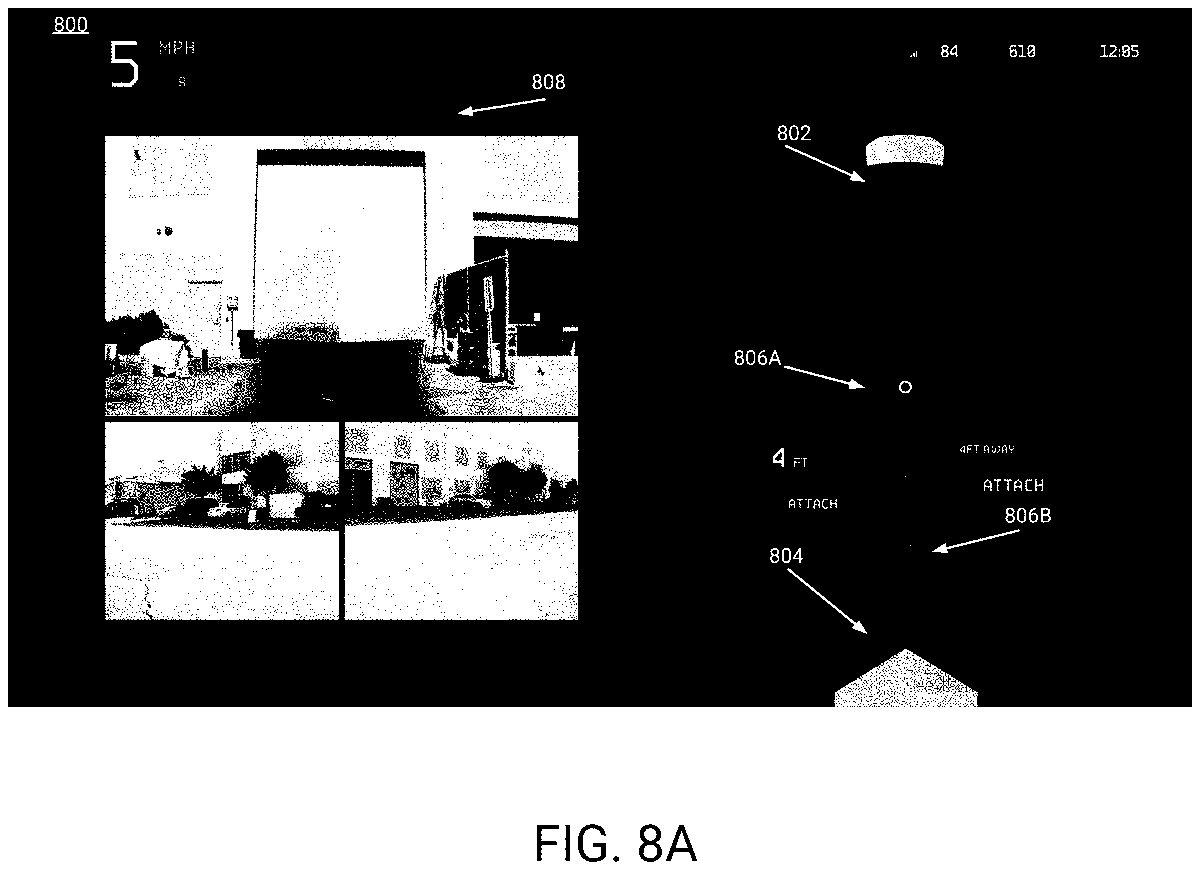

Patent applications shows a Tesla Cybertrailer! Similar to the one shown on Tesla’s website. Trailer can auto-attach to the Cybertruck with a press of a button. Complete game-changer for the RV trailers!

I share more details in this video…

Also here are the patent applications.

uspto.report/patent/app/202…

uspto.report/patent/app/202…

uspto.report/patent/app/202…

uspto.report/patent/app/202…

Also here are the patent applications.

uspto.report/patent/app/202…

uspto.report/patent/app/202…

uspto.report/patent/app/202…

uspto.report/patent/app/202…

• • •

Missing some Tweet in this thread? You can try to

force a refresh