Bill Hwang went from $200 million to $30 billion and then lost it all in two days

Here's what you need to know and how to avoid a similar fate

/THREAD/

Here's what you need to know and how to avoid a similar fate

/THREAD/

Sung Kook Hwang immigrated to the U.S. from South Korea in 1982 and took the English name Bill

He attended U.C.L.A and earned an MBA at Carnegie Mellon

After working as a salesman in securities firms he got an analyst job at Tiger Management in 1996

He attended U.C.L.A and earned an MBA at Carnegie Mellon

After working as a salesman in securities firms he got an analyst job at Tiger Management in 1996

Tiger Management was a prestigious fund led by legendary investor Julian Robertson

The key lesson Hwang learned from him was to learn to live with losses

In the 2000s, Hwang had his own fund, Tiger Asia Management, with about $10 billion in assets

The key lesson Hwang learned from him was to learn to live with losses

In the 2000s, Hwang had his own fund, Tiger Asia Management, with about $10 billion in assets

He initially tried to invest only in Asian companies that did business domestically

However, he started sorting Volkswagen AG in 2008

After the short squeeze, he had to close his position at a loss, ending the year down 23%

However, he started sorting Volkswagen AG in 2008

After the short squeeze, he had to close his position at a loss, ending the year down 23%

Many investors pulled out their money, because of his gambling in the European markets despite running an Asia-focused fund

For more on this story, see the thread below

For more on this story, see the thread below

https://twitter.com/itsKostasOnFIRE/status/1354456402920660993?s=20

In 2012, he was accused by the U.S. S.E.C. of insider trading and manipulation in two Chinese bank stocks

He settled that case and pleaded guilty to a U.S. Department of Justice charge of wire fraud

He settled that case and pleaded guilty to a U.S. Department of Justice charge of wire fraud

He paid $60 million in fines and his mother told him to think of it as a tax

He had to close the fund after this incident

In 2013, he started Archegos Capital as a family office

He had to close the fund after this incident

In 2013, he started Archegos Capital as a family office

Despite his investment scandals and huge bets, Hwang was mostly unknown in investing circles

He was familiar to his fellow churchgoers and former hedge fund colleagues, as well as a few bankers

He was familiar to his fellow churchgoers and former hedge fund colleagues, as well as a few bankers

He wasn't the usual billionaire hedge fund manager

• No fancy penthouses

• No hillside mansions

• No private jets

He has said:

"I confess to you, I could not live very poorly

But I live a few notches below where I could live”

• No fancy penthouses

• No hillside mansions

• No private jets

He has said:

"I confess to you, I could not live very poorly

But I live a few notches below where I could live”

He spent his time between his three passions:

• Family

• Business

• Charity via the Grace & Mercy Foundation

"I try to invest according to the word of God and the power of the Holy Spirit

In a way, it’s a fearless way to invest

I am not afraid of death or money"

• Family

• Business

• Charity via the Grace & Mercy Foundation

"I try to invest according to the word of God and the power of the Holy Spirit

In a way, it’s a fearless way to invest

I am not afraid of death or money"

He said that God loved Google because it provided the best information

"God also cares about fair price, because the scripture said God hates wrong scales

My company does a little bit, our part, bringing a fair price to Google stock

Is it important to God? Absolutely"

"God also cares about fair price, because the scripture said God hates wrong scales

My company does a little bit, our part, bringing a fair price to Google stock

Is it important to God? Absolutely"

So how did someone so devoted to God became entangled in a $20 billion mess?

Hwang used swaps, a type of derivative that gives an investor exposure to the gains or losses in an underlying asset without owning it directly

Hwang used swaps, a type of derivative that gives an investor exposure to the gains or losses in an underlying asset without owning it directly

This asset allowed him to hide his identity and the size of his positions

While the client gains or loses from any changes in price, the bank shows up in filings as the registered holder of the shares

That’s how Hwang was able to amass huge positions so quietly

While the client gains or loses from any changes in price, the bank shows up in filings as the registered holder of the shares

That’s how Hwang was able to amass huge positions so quietly

Even the banks that provided loans for his investments were not fully aware

Since the banks had details of his deals with them, they couldn’t know he was using leverage to buy the same stocks via swaps with other banks

Since the banks had details of his deals with them, they couldn’t know he was using leverage to buy the same stocks via swaps with other banks

The banks were eager to provide millions of credit despite his past scandals and failures, due to the hefty fees he was paying

Archegos was paying more than $100 million in fees per year

Archegos was paying more than $100 million in fees per year

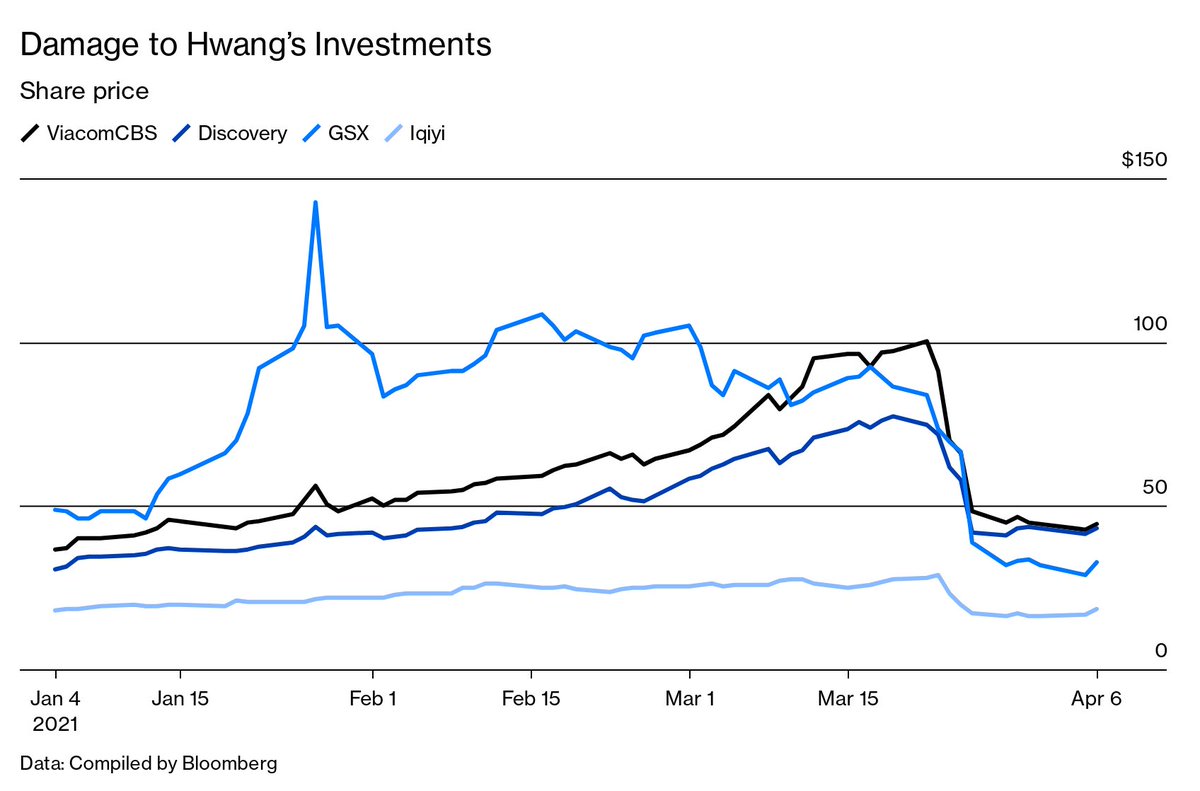

It invested most of the money it borrowed into a few stocks like

• ViacomCBS

• GSX Techedu

• Shopify

By March 2021 the leverage was 5x

On March 22, ViacomCBS announced a $3 billion sale of stock and convertible debt

The stock plummeted by 9% on Tuesday and 23% on Wednesday

• ViacomCBS

• GSX Techedu

• Shopify

By March 2021 the leverage was 5x

On March 22, ViacomCBS announced a $3 billion sale of stock and convertible debt

The stock plummeted by 9% on Tuesday and 23% on Wednesday

Some bankers asked Hwang to sell shares, take some losses, and avoid a default

He refused, forgetting the lesson his mentor Julian Robertson taught him

The banks that provided the loans faced a difficult dilemma

He refused, forgetting the lesson his mentor Julian Robertson taught him

The banks that provided the loans faced a difficult dilemma

1. Wait for the stocks in his swap accounts to rebound

2. Sell his positions before other banks do it, further plummeting the stock prices

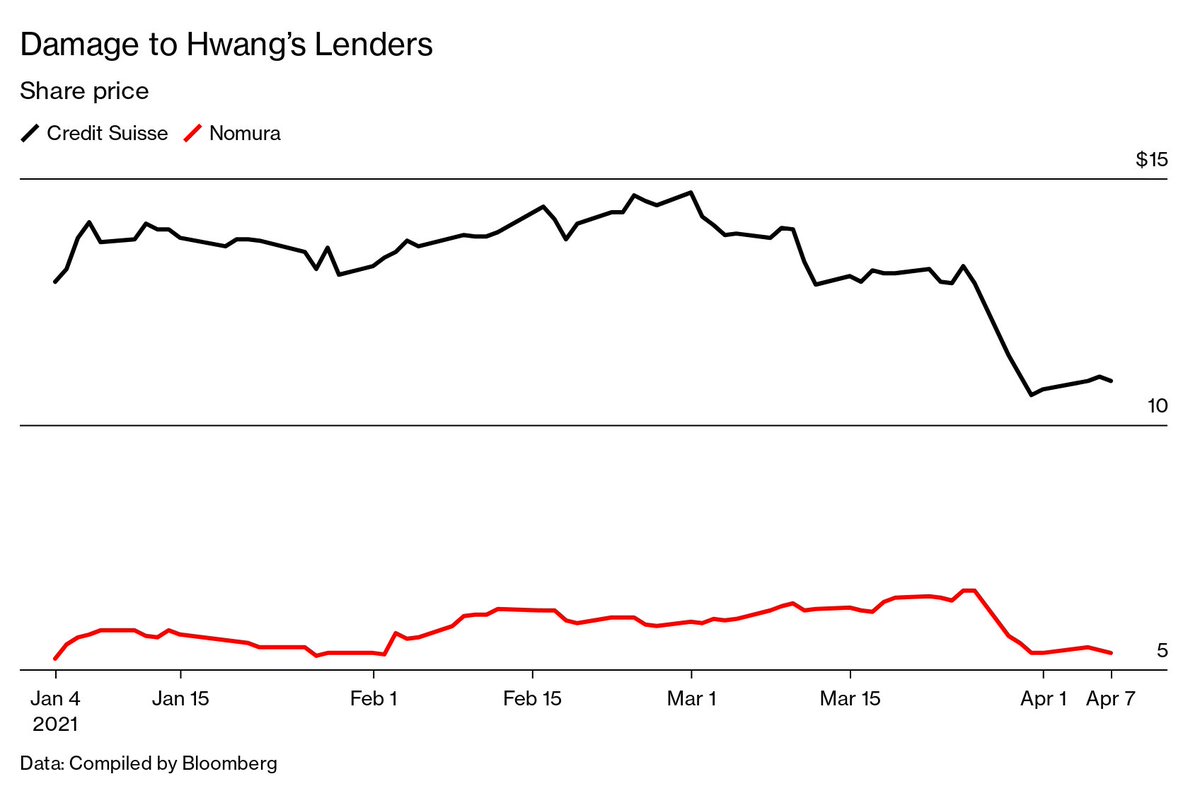

Credit Suisse wanted to wait

But Morgan Stanley didn't

They quietly unloaded $5 billion of their Archegos holdings

2. Sell his positions before other banks do it, further plummeting the stock prices

Credit Suisse wanted to wait

But Morgan Stanley didn't

They quietly unloaded $5 billion of their Archegos holdings

On Friday morning, before the market open, Goldman started liquidating more than $10 billion in Archegos holdings

Goldman, Deutsche Bank AG, Morgan Stanley, and Wells Fargo managed to avoid losses

Goldman, Deutsche Bank AG, Morgan Stanley, and Wells Fargo managed to avoid losses

Credit Suisse lost $4.7 billion with several top executives, including the head of investment banking, being forced out

Nomura Holdings Inc. faced a loss of about $2 billion

Nomura Holdings Inc. faced a loss of about $2 billion

Luckily, these losses didn't spark a domino-like sell-off in the markets similar to the collapse caused by mortgage swaps in 2007

However, this story is a useful lesson on what happens when excessive risk meets unlimited leverage

However, this story is a useful lesson on what happens when excessive risk meets unlimited leverage

Everyday investors may not be able to get billions in loans to invest in stocks

But there are still valuable lessons to be learned from this story

But there are still valuable lessons to be learned from this story

1. Never become greedy

2. Never chase your losses

3. Never take excessive risks

4. Never overestimate investing skills

5. Never chase last year's stock winners

6. Never use leverage or margin to invest

7. Never overconcentrate your investment portfolio

2. Never chase your losses

3. Never take excessive risks

4. Never overestimate investing skills

5. Never chase last year's stock winners

6. Never use leverage or margin to invest

7. Never overconcentrate your investment portfolio

History may not repeat itself, but it rhymes

Learn from the mistakes of others to avoid a similar fate

/END/

Learn from the mistakes of others to avoid a similar fate

/END/

If you liked this thread

• Click below and retweet the first tweet

• Follow me @itskostasonfire to stay updated

• Click below and retweet the first tweet

• Follow me @itskostasonfire to stay updated

https://twitter.com/itsKostasOnFIRE/status/1398990833467068421?s=20

Check below my master thread with all my threads on

• Finance

• Investing

• Stock market history

• Finance

• Investing

• Stock market history

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh