(1) #silversqueeze is draining the physical silver market, & past several months have seen a relentless upward trend reflected in paper #silver prices, as the system begins deleveraging. Here is a thread on the monthly cycles observed since this began & what it may mean for June.

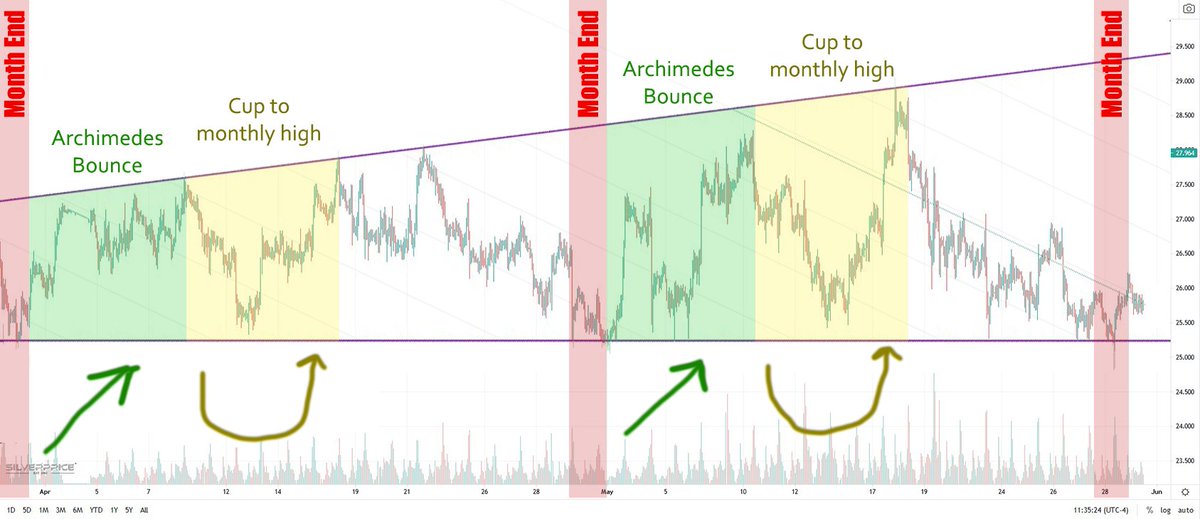

(2) We begin w/the hourly chart, starting from end of MAR, after banks cleaned up all the crazy WSB YOLO bets and took their money. The systemic silver shortages from #silversqueeze had now started seeping into every corner of the physical market, the paper deleveraging had begun

(3) We correct for the overall #silversqueeze effect by skewing the chart, negating the upward pressure from the system deleveraging, as physical metal enters private hands and 50+ paper copies of each ounce vaporizes for each ounce exiting the system.

(4) First obvious observation of the "corrected for #silversqueeze" chart is that paper price craters at the end of every month. EOM slams are also the only times the bottom boundary of the channel gets breached, helped by large dumps of paper off-hours resulting in violent drops

(5) End of month slams likely a concerted effort, even if not outright coordinated, cleaning up free premiums on expiring options (written mid month) & to 'nudge' long OI positions to roll over contracts into future months rather than standing for delivery.. among others

(6) First 10d of new mo. experience an "Archimedes bounce" - a silver beach ball forcibly submerged then released, paper price rises to the top/near-top of the channel. I will cover the 'Hemke london bridge' surprises in a bit (short term manipulation) but generally 📈 to the top

(7) This is where the first batch of options get written (later to expire worthless via end-of-month slams) and the short-term bulls get hooked up to the milking machines (hopefully it's the nipples). #silversqueeze apes rejoice but they're long-term holders so all good.

(8) Following the Archimedes bounce, a cup formation is followed to hit the monthly high, hitting the high roughly on the 18th of each month. A second peak hit in APR due to external macro events (USD breaking down, bitcoin flash crash) but as you'll see it got overridden anyway

(9) Once the cup to monthly high has been completed, a long descent begins to usher in the end-of-month superslam, and the cycle begins anew.

(10) A similar pattern can be found during relatively strong channels (bullish and bearish) when external macro events aren't pushing the price violently causing breakouts or breakdowns from the channel. Deskew for the upward/downward trajectory and the pattern repeats.

(11) So what does June 2021 look like, if the pattern is followed? Barring any external macro events creating a breakout/breakdown from the channel, and ignoring smaller 1-2 day manipulations like the Hemke London Bridge events, here's a breakdown

(12) #silversqueeze forecast has the Archimedes bounce ending June 10 at around $30.75. The cup to monthly high ends June 18th with price hitting almost $31.50, launching the long descent to close out the month just below $30.00 making all the $30 options expire worthless.

(13) Lots can (and does) happen in June. Maybe the #silversqueeze breakout will happen, or external macro events cause a breakout. Basel III may accelerate the deleveraging & the long descent never happens, silver just flies right past $31.50 mid-month never looking back.

(14) But I'm suggesting a floor of just under $30 (~$29.75) for end of June silver paper prices. Looking good regardless for #silversqueeze, even the 'worst case' scenario is a nice little bump up from today. Good chance silver may launch in June, none of this will matter.

(15) Lastly, ignore the short-term manipulation events I like to call "Hemke London Bridges". They look like a sharp drop (or spike) followed by a complete reversal. These are quick little cons metals trading desks run to extract a bit of cash from the plebs.

@TFMetals had a great tweet thread explaining these, I just can't seem to find it now.

But it's safe to ignore them in regards to the forecast, these are little glitches in the matrix as the crooked bankers play their games.

But it's safe to ignore them in regards to the forecast, these are little glitches in the matrix as the crooked bankers play their games.

• • •

Missing some Tweet in this thread? You can try to

force a refresh