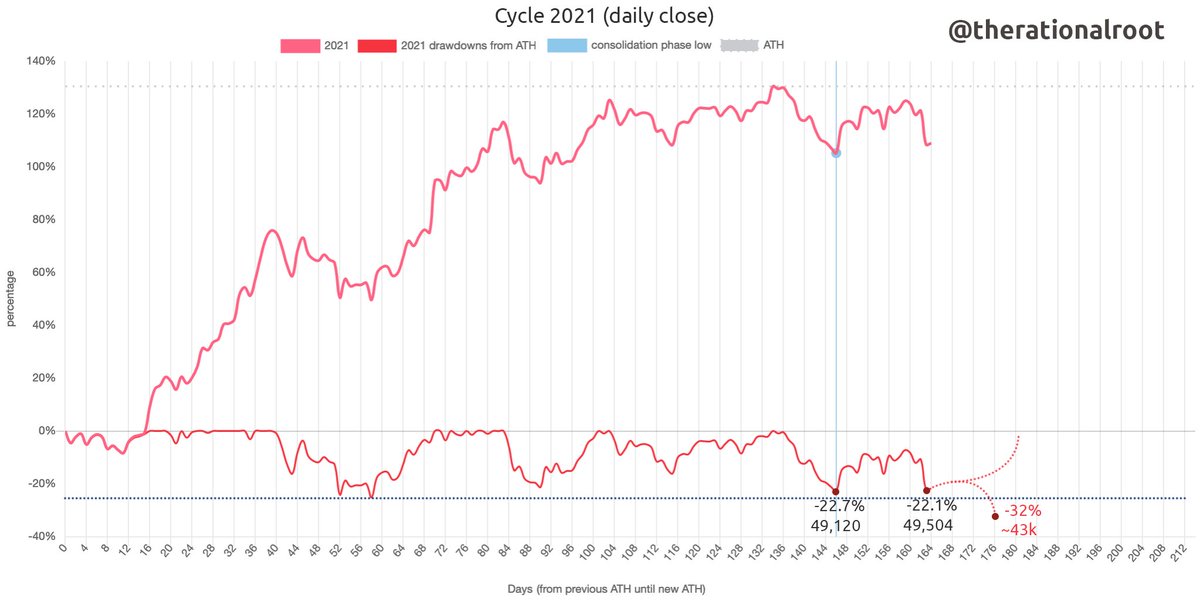

The drop below 90 was expected; however, May’s close was surprisingly low.

It’s good to mention that, if the bottom indeed is in, it fell exactly together with the monthly close bringing the RSI down further than previous cycles where the bottom was at least several days apart.

It’s good to mention that, if the bottom indeed is in, it fell exactly together with the monthly close bringing the RSI down further than previous cycles where the bottom was at least several days apart.

I sure expect June’s close to be an uptrend for otherwise it would be a first time to have 3 consecutive months in a downtrend which we have not seen in previous cycles and would mean uncharted territory.

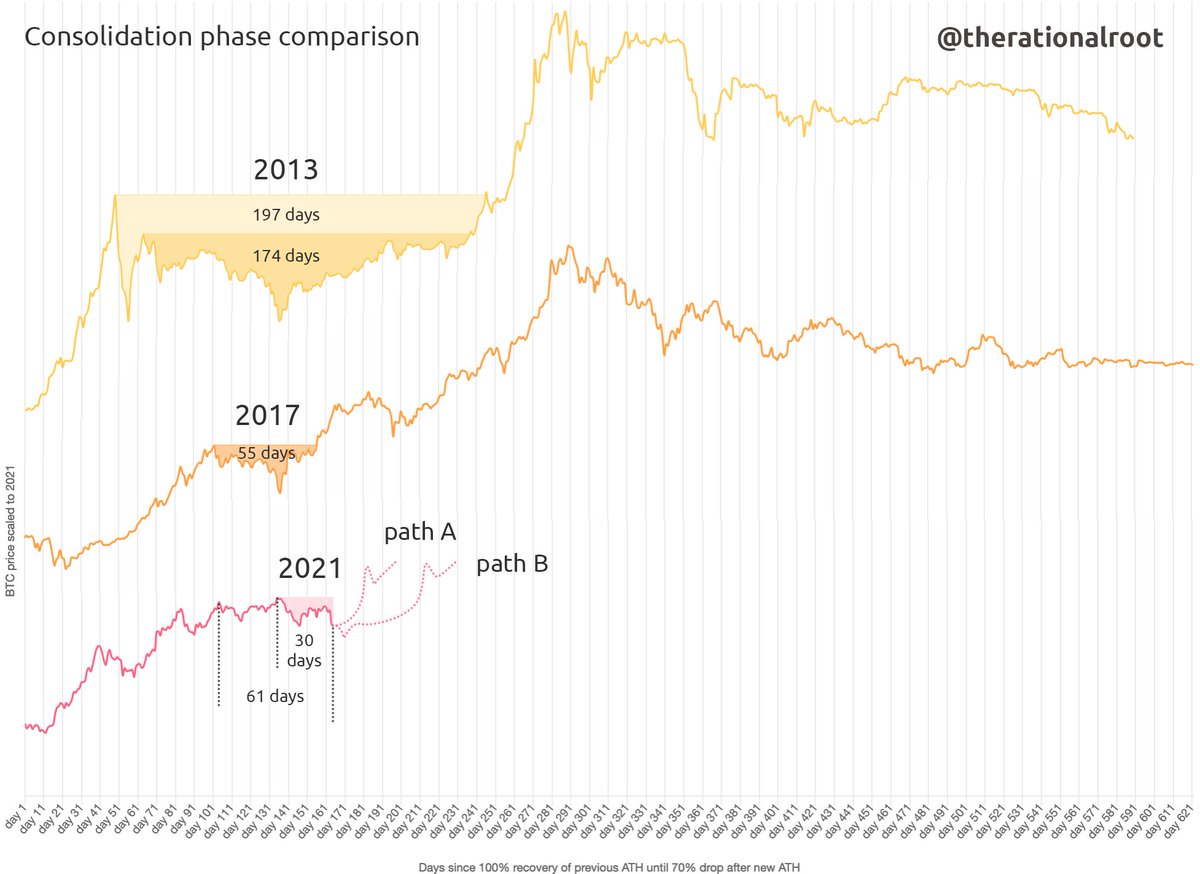

Since we are still consolidating from a tough drop, June’s uptrend might be similar to that of 2013 (black arrows in chart). Closing June above 40K would do.

Another similarity worth mentioning is that we again touched the lower band of the S2F model exactly as we did on the RSI drop below 90 in the 2017 cycle giving further confidence we will see an uptrend from here.

https://twitter.com/100trillionUSD/status/1399723142101323780?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh