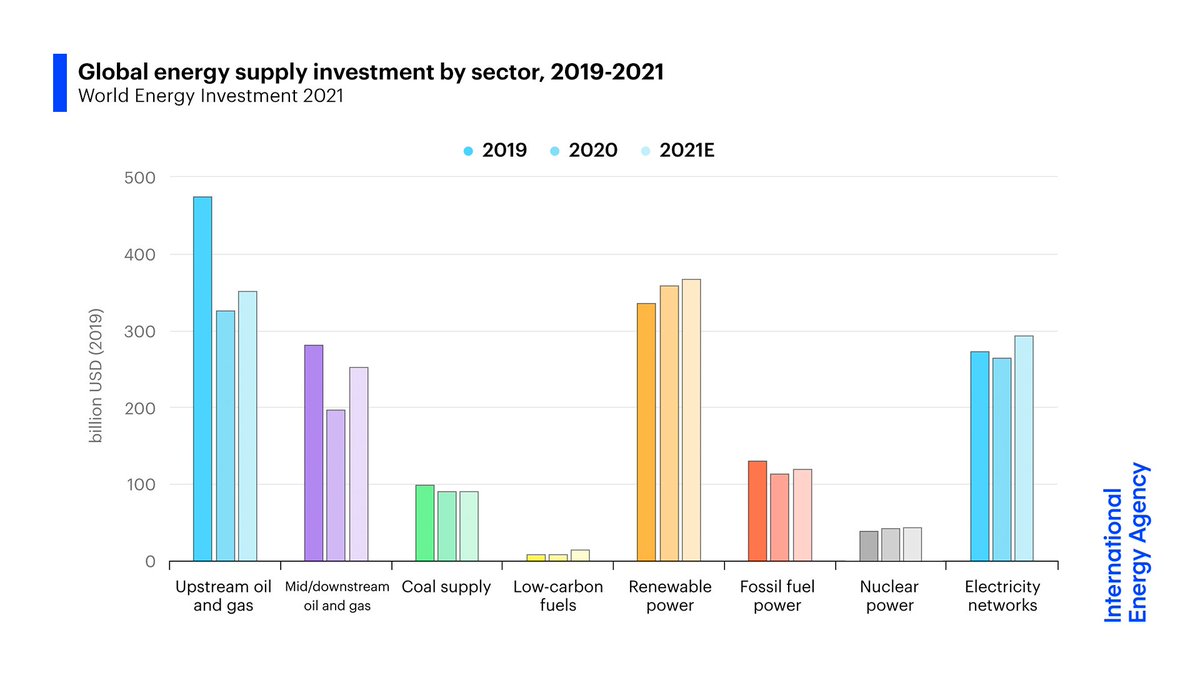

Our new report shows global energy investment is set to rebound nearly 10% in 2021 to $1.9 trillion, reversing most of last year's drop

But the amount going to clean energy technologies is not nearly enough to put us on a path to net zero by 2050

More ➡️ iea.li/3i6Qz1v

But the amount going to clean energy technologies is not nearly enough to put us on a path to net zero by 2050

More ➡️ iea.li/3i6Qz1v

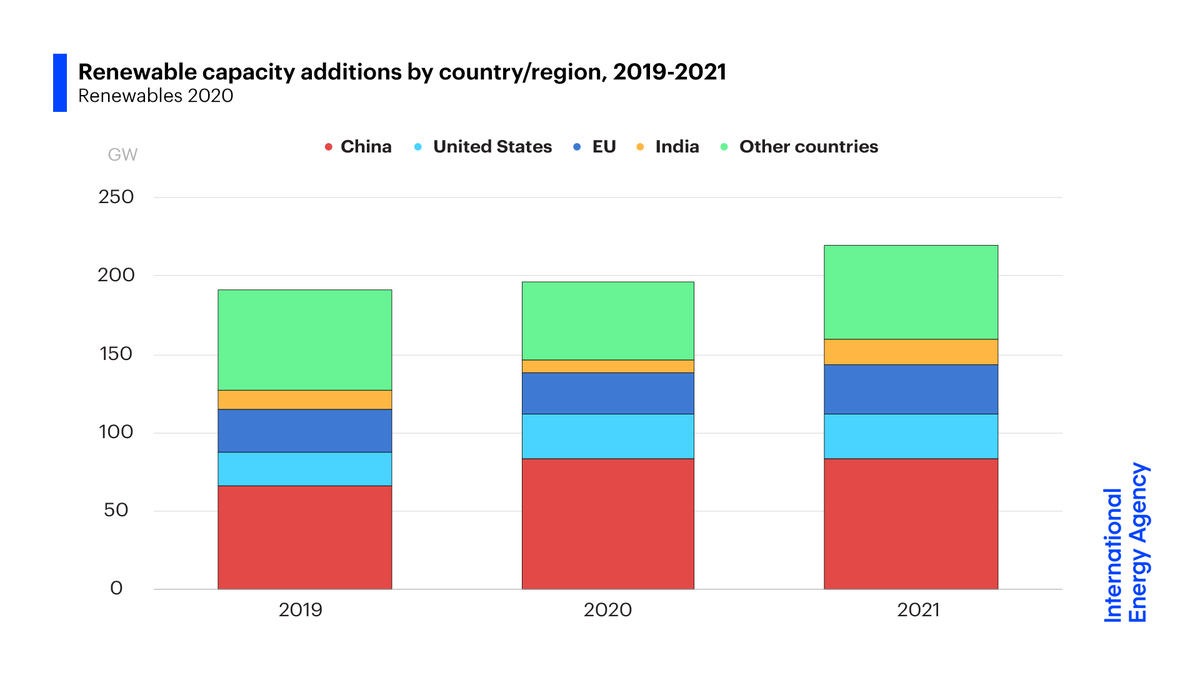

Renewables are dominating investment in new electricity generation & are expected to account for 70% of the global total this year.

However, far more is needed – our #NetZero2050Roadmap calls for investment in clean energy to triple by 2030.

Read more 👉 iea.li/3pcGiCf

However, far more is needed – our #NetZero2050Roadmap calls for investment in clean energy to triple by 2030.

Read more 👉 iea.li/3pcGiCf

Spending by some global oil & gas companies appears to be starting to diversify.

@IEA analysis last year showed only around 1% of the industry's investment went to clean energy. Recent trends suggest this may rise to 4% in 2021 – and well above 10% for some European companies.

@IEA analysis last year showed only around 1% of the industry's investment went to clean energy. Recent trends suggest this may rise to 4% in 2021 – and well above 10% for some European companies.

Much greater spending on energy efficiency is vital to put us on track for net zero

So far, growth in efficiency investments is mainly in areas with clear policies like the buildings sector in Europe. We need far bigger efforts globally & in sectors like transport & industry too

So far, growth in efficiency investments is mainly in areas with clear policies like the buildings sector in Europe. We need far bigger efforts globally & in sectors like transport & industry too

The gap between current investment trends & what’s needed to meet climate goals is particularly large in emerging market & developing economies.

A major new report from @IEA on 9 June – in collaboration with @WorldBank & @wef – will offer solutions to address this challenge.

A major new report from @IEA on 9 June – in collaboration with @WorldBank & @wef – will offer solutions to address this challenge.

• • •

Missing some Tweet in this thread? You can try to

force a refresh