Thread - How to Think to be a Successful Trader

"If 90% of all people engaged in trading are

losing maybe it's a time we have a real

long hard look at what it is that we're

actually doing when we are trading"

- Tom Hougaard

"If 90% of all people engaged in trading are

losing maybe it's a time we have a real

long hard look at what it is that we're

actually doing when we are trading"

- Tom Hougaard

1/ Notes and reflections about the Tom Hougaard presentation:

From trading psychology series, "Normal doesn't make money"

Tom Hougaard watched 50,000 people trade over a decade.

From trading psychology series, "Normal doesn't make money"

Tom Hougaard watched 50,000 people trade over a decade.

2/ "I realized that actually

trading had absolutely nothing to do

with technical analysis and fundamental

analysis."

"People tend to make the same

mistakes over and over and over and

actually very few people are capable of

making money consistently"

trading had absolutely nothing to do

with technical analysis and fundamental

analysis."

"People tend to make the same

mistakes over and over and over and

actually very few people are capable of

making money consistently"

3/ "What's stopping people from making money in the markets?

Sure people are good at making money at

times but the tendency is to make it,

lose it, make it ,lose it."

"I believe that the only reason why I am good at what I do is because of my relationship with fear"

Sure people are good at making money at

times but the tendency is to make it,

lose it, make it ,lose it."

"I believe that the only reason why I am good at what I do is because of my relationship with fear"

4/ "You need to have a rather special

relationship with losing and you need to

have a rather special relationship with

winning as well"

"No matter how good a grasp

you get on technical analysis, there are

still those days where you simply refuse

relationship with losing and you need to

have a rather special relationship with

winning as well"

"No matter how good a grasp

you get on technical analysis, there are

still those days where you simply refuse

5/ to take your loss, where, despite your

best intentions, you simply cannot get

yourself to do the right thing"

"The narrative here is not that I am a

fearless trader, I'm not even a fearless person.

I can't block out fear in in many other

aspects of my life."

best intentions, you simply cannot get

yourself to do the right thing"

"The narrative here is not that I am a

fearless trader, I'm not even a fearless person.

I can't block out fear in in many other

aspects of my life."

6/ "In trading, I seem to have developed an

immunity to fear which enables me to

make the right decisions when they need

to be made."

immunity to fear which enables me to

make the right decisions when they need

to be made."

7/ "Practice does not make perfect practice makes permanent and if you carry on practicing the wrong way you will merely establish a behaviour pattern that doesn't serve you"

👆👆👆👆👆👆👆

👆👆👆👆👆👆👆

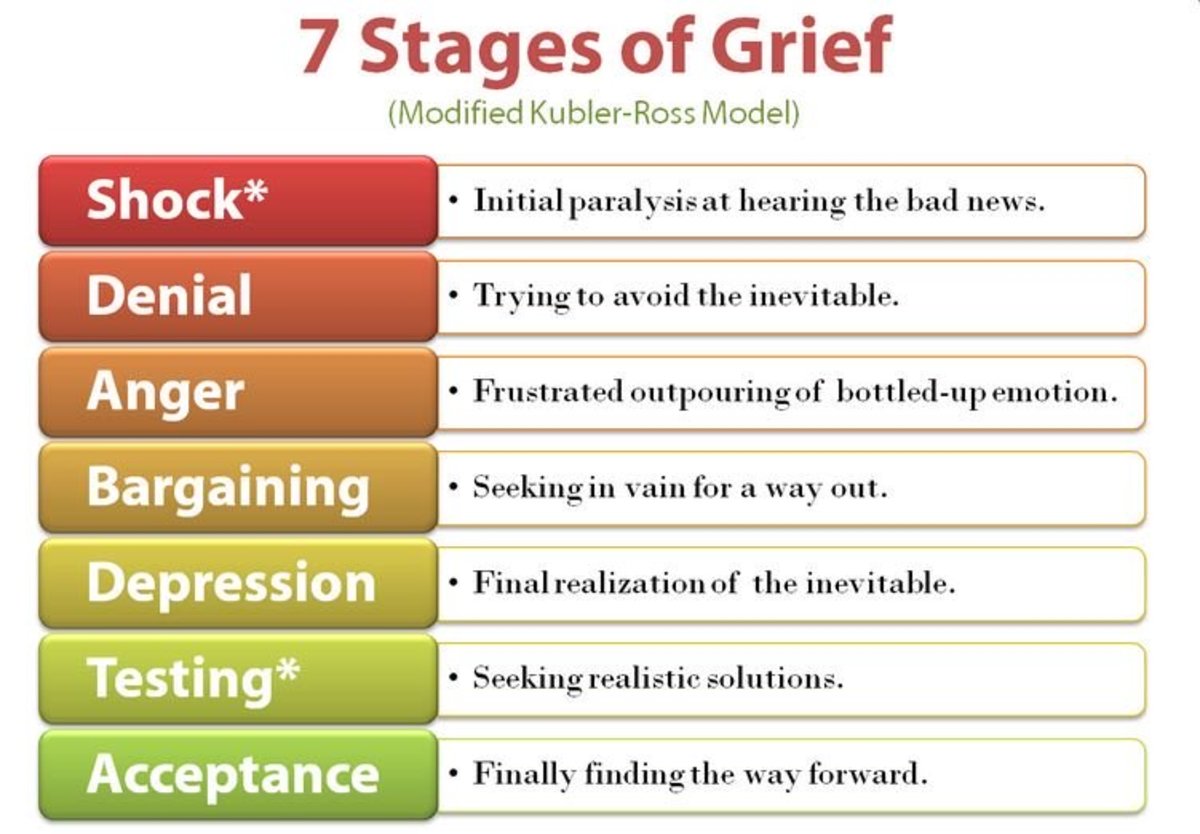

8/ [ Hammie note > Much of the problems in our lives are really ingrained habits / beliefs that are working against us. They can be rooted in our childhood and last for a lifetime.

9/ One of the worst things that can happen in trading is to meet a larper when you're a newbie; learning bad habits and models of thinking can slow you down for years (my case) or directly put you out of the game forever.

10/ Most of the time we don't have the necessary neuro-plasticity to complete revert a damaging belief we became familiar with. Every information that goes against it becomes an actual biological threat.

We all tend to entropy.

We all tend to entropy.

11/ Opposing information can fragment our ego and cause real physical and mental pain. Avoiding pain is a natural self-defensive mechanism, at a cellular level.

Taking a (small) loss causes pain. We know very well it's the logical right thing to do.

Taking a (small) loss causes pain. We know very well it's the logical right thing to do.

12/ Every cell in our body tells us otherwise.

That's why Mark Douglas refers to some traders as "Elliott Wave casualties". After you spent, say, 5 years learning such a complex larping system, you will identify with it.

That's why Mark Douglas refers to some traders as "Elliott Wave casualties". After you spent, say, 5 years learning such a complex larping system, you will identify with it.

13/ What are you gonna do, admit that you made a 5 year mistake and just move on? Very few people are able to do that.

14/ To be continued. Hammie has to go buy some back pain meds because he tried to impose the force of his mind but the back replied with "miss me with that shit".

15/ "You see, if there's a hundred people in here, and 75 of them are losing as it shows here on the CMC market website, well this is no longer a technical analysis issue."

16/ "You're not a losing trader because you are deficient in MACD and you don't understand stochastic or moving averages, this is not a technical analysis problem, this is a human problem."

17/ "And the sooner you accept that this

is a human problem, the sooner you can

actually do something about it."

[ Hammie note > If you think about it, it can't be a problem of technical analysis.

is a human problem, the sooner you can

actually do something about it."

[ Hammie note > If you think about it, it can't be a problem of technical analysis.

18/ Yes you may have a more or less complex system but at the end of the day, the general complexity of TA doesn't justify the fact that 90% of people never make it. And a much higher percentage makes it in physics, rocket science, medicine and the like.

19/ "I have no knowledge of the future. Whenever people ask me "where do you think the price is going", I say "You know what, come back to me next week, my crystal ball is out for repair"

20/ "It's a facetious way of telling people to stop bugging me about where I think the market is going because I am NOT Nostradamus, I have absolutely no idea".

"Anyone who says otherwise has a vested interest or a bias towards a direction or another."

"Anyone who says otherwise has a vested interest or a bias towards a direction or another."

21/ "If you're long #Bitcoin of course you're

going to say that Bitcoin is gonna

go up, and you think it's going to go up.

You wouldn't say *I think bitcoin is going

down* and then go long $BTC."

going to say that Bitcoin is gonna

go up, and you think it's going to go up.

You wouldn't say *I think bitcoin is going

down* and then go long $BTC."

22/ [ Hammie note > Some people don't understand the complex nature of the larping game here on crypto twitter. It's a full on ecosystem that we may call "CT Pyramid of Larpers".

23/ LEVEL 1: SCAMMERS / HUSTLERS

Some are just full outright scammers / hustlers, they will either dump microcap pre-sales on your face, get paid to promote something or sell you their magic paid group.

But that is Larpers level 1.

Some are just full outright scammers / hustlers, they will either dump microcap pre-sales on your face, get paid to promote something or sell you their magic paid group.

But that is Larpers level 1.

24/ There are many, more sneaky levels: including, for example, people that have to keep the klout dopamine rolling.

LEVEL 2: DOPAMINE JUNKIES

Most of the time the market is simply ranging.

LEVEL 2: DOPAMINE JUNKIES

Most of the time the market is simply ranging.

25/ You can easily recognize that non-larpers: either they tell you that we're in a range or they start posting random non-market content during those times.

Larpers of the level 2 will keep posting bullish charts no matter what, just to keep feeding their egos and get likes.

Larpers of the level 2 will keep posting bullish charts no matter what, just to keep feeding their egos and get likes.

26/ Making bullish calls 24/7/365 is EV+ in the twitter game (not the trading one) because the market mostly goes up and people don't want to hear bearish (or neutral) calls anyway.

You have to realize these are not traders, they are social media marketers.

You have to realize these are not traders, they are social media marketers.

27/ LEVEL 3, 4 etc

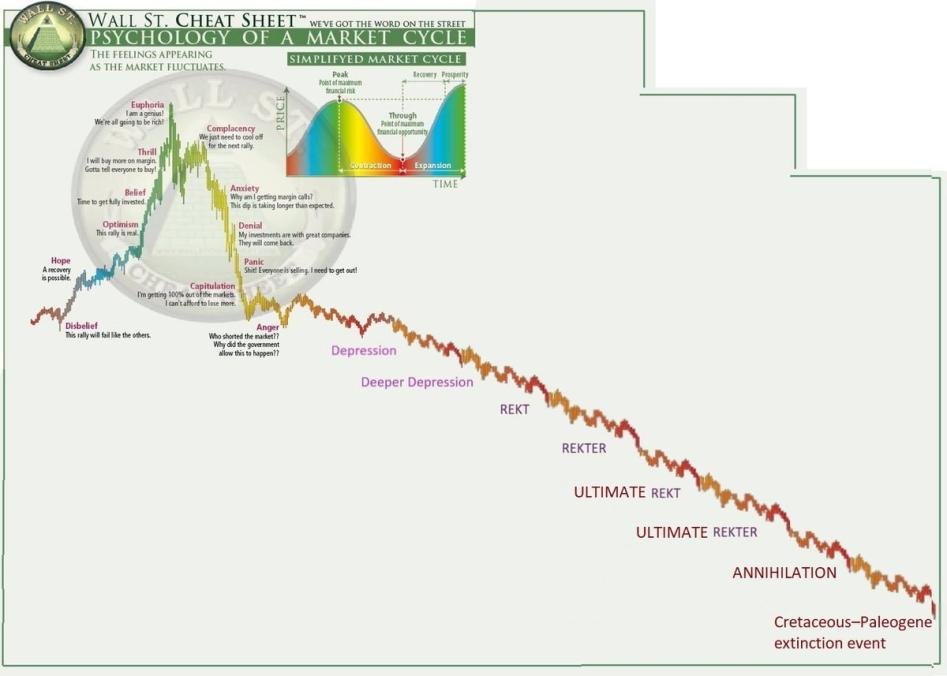

Of course we can add several other levels. Larpers level 3 that simply don't have any idea what they're doing: the Green Candle Buy gang. Larpers level 4 that are just in pain and want someone to buy their heavy bags etc.

Of course we can add several other levels. Larpers level 3 that simply don't have any idea what they're doing: the Green Candle Buy gang. Larpers level 4 that are just in pain and want someone to buy their heavy bags etc.

28/ The main point is simple

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

NOBODY KNOWS WHERE PRICE IS GOING

29/ You may think "of course" but do you truly understand this deep in your bones? Or there's a part of you that thinks that "somebody knows something" that you don't?

If you're just starting, you should stay as far away from twitter as possible. Too much larping > useful info.

If you're just starting, you should stay as far away from twitter as possible. Too much larping > useful info.

30/ "So if my entries

are purely random and I'm a professional

trader, and you may think *oh as a

professional trader you may have a hit

rate around the 80% and 90%*"

"Oh no I most certainly do not have a hit

rate in the 80s or in the 90s. In fact

are purely random and I'm a professional

trader, and you may think *oh as a

professional trader you may have a hit

rate around the 80% and 90%*"

"Oh no I most certainly do not have a hit

rate in the 80s or in the 90s. In fact

31/ you could even argue that I would have a

better hit rate if I simply flip the

coin and then I applied money management".

"So, either way, the sooner I accept that

the nature of what I am doing is

basically random the sooner I can begin

to trade as trading should be done."

better hit rate if I simply flip the

coin and then I applied money management".

"So, either way, the sooner I accept that

the nature of what I am doing is

basically random the sooner I can begin

to trade as trading should be done."

• • •

Missing some Tweet in this thread? You can try to

force a refresh