1) Would you take a loan with negative interest rate (you are paid for borrowing) with zero risk of liquidation? I would and I did. It's (temporarily) possible on @RulerProtocol on a few collateral types: $BDI, $ibBTC and $NEAR. How does it work? 👇

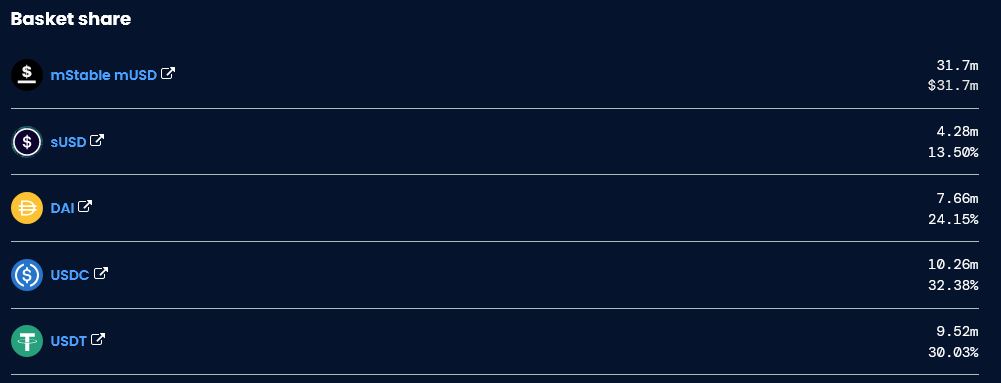

2) Let's say you have $BDI and want to borrow DAI (you can also choose USDC and USDT). For each BDI deposited as collateral, you are currently able to borrow 150.39 DAI. At the same time, you will only have to repay 150 DAI. You are paid 0.39 DAI which corresponds to -3.34% APR.

3) The more you borrow, the higher your borrowing APR becomes. For 100 BDI of collateral, you can borrow 15024 DAI and you will need to repay 15000 only. It's still negative borrowing APR of -2.06%. It becomes positive when you borrow more than 40.5k DAI.

4) The best part about loans on @RulerProtocol is that they are never liquidated before expiry date. Sudden market crash can't harm you at all. Temporary price movements of collateral are irrelevant. You only need to repay the loan before expiry. However, not necessarily...

5) Sometimes it makes sense not to repay the loan at all. Look: for 1 $BDI of deposited collateral, you need to repay 150$ (Mint Ratio for BDI = 150). So if at expiry BDI is worth less than 150$, it makes sense to leave it there and keep your borrowed stablecoins.

6) To sum up, you are paid to take a loan which can't be liquidated if you repay before expiry and in case of market crash it may be more profitable for you to not repay it at all. Sounds like magic? Yes, magic Internet money lego called DeFi. Enjoy!

• • •

Missing some Tweet in this thread? You can try to

force a refresh