You’d have heard of these names - Walmart or Costco.

In the US, they sell everything you could need on a daily basis.

They’re masters at what they do.

They have massive warehouse-sized centers where people go shopping.

In the US, they sell everything you could need on a daily basis.

They’re masters at what they do.

They have massive warehouse-sized centers where people go shopping.

Even their shopping carts are much bigger than the ones we see in India.

Their true strength lies in their supply chain management.

Orders are placed in advance by predicting how much their customers will buy.

Their true strength lies in their supply chain management.

Orders are placed in advance by predicting how much their customers will buy.

Some things are seasonal (Christmas trees).

Some things are evergreen (milk).

Some things are durable (cutlery).

Some things are perishable (spinach).

Some things are evergreen (milk).

Some things are durable (cutlery).

Some things are perishable (spinach).

They can store a pack of plastic spoons for years even if nobody buys it.

They can only store fresh apples for a few days. And fresh milk for an even shorter period of time.

In January 2020, most of these stores had cleared out Christmas-related items.

They can only store fresh apples for a few days. And fresh milk for an even shorter period of time.

In January 2020, most of these stores had cleared out Christmas-related items.

Most items had been sold. A few that were left behind were either thrown away or kept for the next year depending on how perishable the item was.

The US shot a missile targeting an Iranian military person. Tensions were high. Some feared this could be the start of World War 3.

The US shot a missile targeting an Iranian military person. Tensions were high. Some feared this could be the start of World War 3.

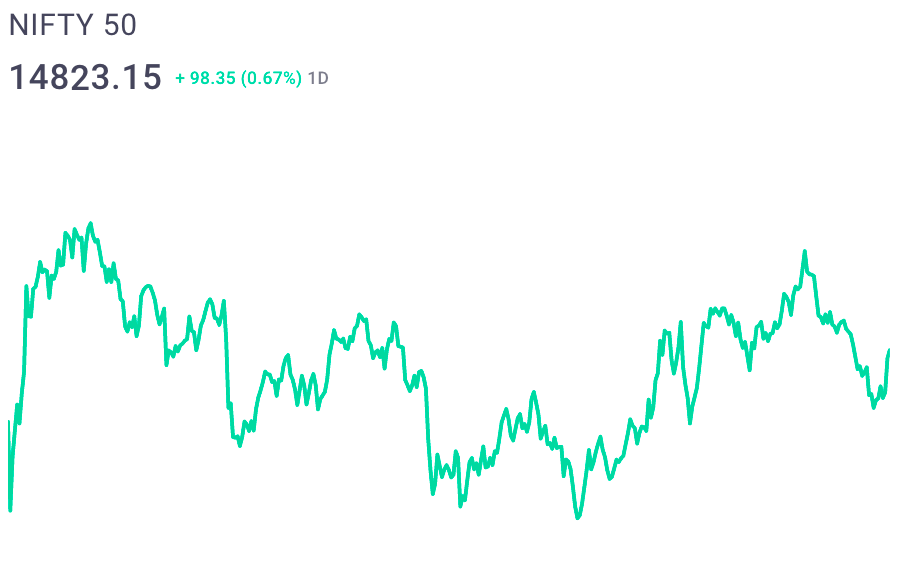

In India, the markets had touched a new high - a relief to investors after the nervous year 2019 with ups and downs.

And in China (you know where this is going), everybody was talking about a mysterious new virus spreading on the streets of Wuhan.

And in China (you know where this is going), everybody was talking about a mysterious new virus spreading on the streets of Wuhan.

China started imposing strict lockdowns. Production of goods and items in the country - also known as the factory of the world - slowed down and even stopped.

Some auto parts started facing a crunch. Gadgets factories too started faltering.

Still, the world chugged on.

Some auto parts started facing a crunch. Gadgets factories too started faltering.

Still, the world chugged on.

February came. Not much changed. Most of the world was functioning as it already did.

Parts of China started emerging out of lockdowns.

Many around the world were now talking about what was happening in China.

Parts of China started emerging out of lockdowns.

Many around the world were now talking about what was happening in China.

But by and large, everyone was still treating this virus as someone else’s problem.

There were a few sparse cases of the virus appearing in different parts of the world but that was that and not much else.

It wasn’t really anything.

There were a few sparse cases of the virus appearing in different parts of the world but that was that and not much else.

It wasn’t really anything.

Until that is, Italy and Iran, rang the bells in desperation.

Suddenly, a greater number of people around the world sat up and stared at their screens.

This was proof that this virus wasn’t going to be only China’s problem.

Suddenly, a greater number of people around the world sat up and stared at their screens.

This was proof that this virus wasn’t going to be only China’s problem.

As soon as March arrived, flights started to get shut down.

Governments all over the world started carrying out tests.

Some asked the unthinkable - is this going to be a global pandemic?

The public started showing initial signs of panic all around the world.

Governments all over the world started carrying out tests.

Some asked the unthinkable - is this going to be a global pandemic?

The public started showing initial signs of panic all around the world.

Experts warned of an economic crisis.

They warned of many other things too - power grid failure, food shortages, mass illnesses, and more.

They warned of many other things too - power grid failure, food shortages, mass illnesses, and more.

The supply chain experts at Walmart, Costco, and other major stores were listening. They were smart and they always kept an eye out for what could be in demand.

More people with the power to act were now sure something big was coming. They were sure they'd have to prepare for it

More people with the power to act were now sure something big was coming. They were sure they'd have to prepare for it

Whatever the guys at stores thought would be most in-demand was ordered extra. Milk. Vegetables. Meat.

Then, they thought of the next layer of items. Snacks. Long-lasting edible products.

Next? Sanitizers. Detergents. Soaps.

Then, they thought of the next layer of items. Snacks. Long-lasting edible products.

Next? Sanitizers. Detergents. Soaps.

Orders were placed. Store shelves were stacked with additional items.

And then, the lockdowns struck.

People rushed to stores to fill up their carts with what they thought they’d need at least for the next 3 months. Who knows when the next batch of items comes to stores again.

And then, the lockdowns struck.

People rushed to stores to fill up their carts with what they thought they’d need at least for the next 3 months. Who knows when the next batch of items comes to stores again.

And the first thing to run out of stock was… toilet paper?

Yes.

Who’d have thought?

You’d imagine people would prioritize buying food more over paper to deal with whatever happens to food after it is digested.

But no. Toilet paper ran out.

Yes.

Who’d have thought?

You’d imagine people would prioritize buying food more over paper to deal with whatever happens to food after it is digested.

But no. Toilet paper ran out.

There were pictures online of stores with shelves filled with food and milk beside empty shelves where toilet paper was supposed to be stacked.

Nobody had thought this would happen. There were no additional stocks.

The toilet paper shelves in stores remained empty for weeks.

Nobody had thought this would happen. There were no additional stocks.

The toilet paper shelves in stores remained empty for weeks.

Why did this happen though?

Search for it on the internet. You’ll know the reasons.

But nobody would have thought of those reasons beforehand.

This was an unexpected consequence of the pandemic.

Search for it on the internet. You’ll know the reasons.

But nobody would have thought of those reasons beforehand.

This was an unexpected consequence of the pandemic.

The obvious ones, we all tried to prepare for. The not-so-obvious ones we find very hard to prepare for

When you’re investing, remember, you’re dealing with this exact world.

The same world that bought more toilet paper than food.

There are going to be unexpected consequences.

When you’re investing, remember, you’re dealing with this exact world.

The same world that bought more toilet paper than food.

There are going to be unexpected consequences.

When you take a quick bet, remember, no matter how easy and obvious a bet seems, this world can surprise you.

News just announced monsoon is going to be great. So fertilizer stocks will go up? They usually do.

News just announced monsoon is going to be great. So fertilizer stocks will go up? They usually do.

Yes, chances are they might. And if some random incident plays out, the opposite might happen too.

How that would happen, we don’t know. (But you’ll find enough people to explain how that would happen after it has happened).

We love a simple cause-and-effect story.

How that would happen, we don’t know. (But you’ll find enough people to explain how that would happen after it has happened).

We love a simple cause-and-effect story.

What this example aims to tell you is that even a system of cause and effect, if complex enough, can surprise you in nasty or pleasant ways.

To top that, the world doesn’t work with simple cause and effect relations.

There’s this thing called probability in between too.

To top that, the world doesn’t work with simple cause and effect relations.

There’s this thing called probability in between too.

Same cause and effect, different results each time 🙂

Scary? It can also be very rewarding.

Just plan in a manner such that no matter what the outcome, you don’t lose all you have.

And also, plan for if the outcome is good, you gain the most.

<end>

Scary? It can also be very rewarding.

Just plan in a manner such that no matter what the outcome, you don’t lose all you have.

And also, plan for if the outcome is good, you gain the most.

<end>

This is what we sent out in our Weekly Groww Digest today. Check your email if you're signed up on Groww.

• • •

Missing some Tweet in this thread? You can try to

force a refresh