This ratio can be used to identify major Bitcoin bull run tops.

The idea to compare DP and RP was conceptualized in David Puell's article: medium.com/@kenoshaking/b…

The idea to compare DP and RP was conceptualized in David Puell's article: medium.com/@kenoshaking/b…

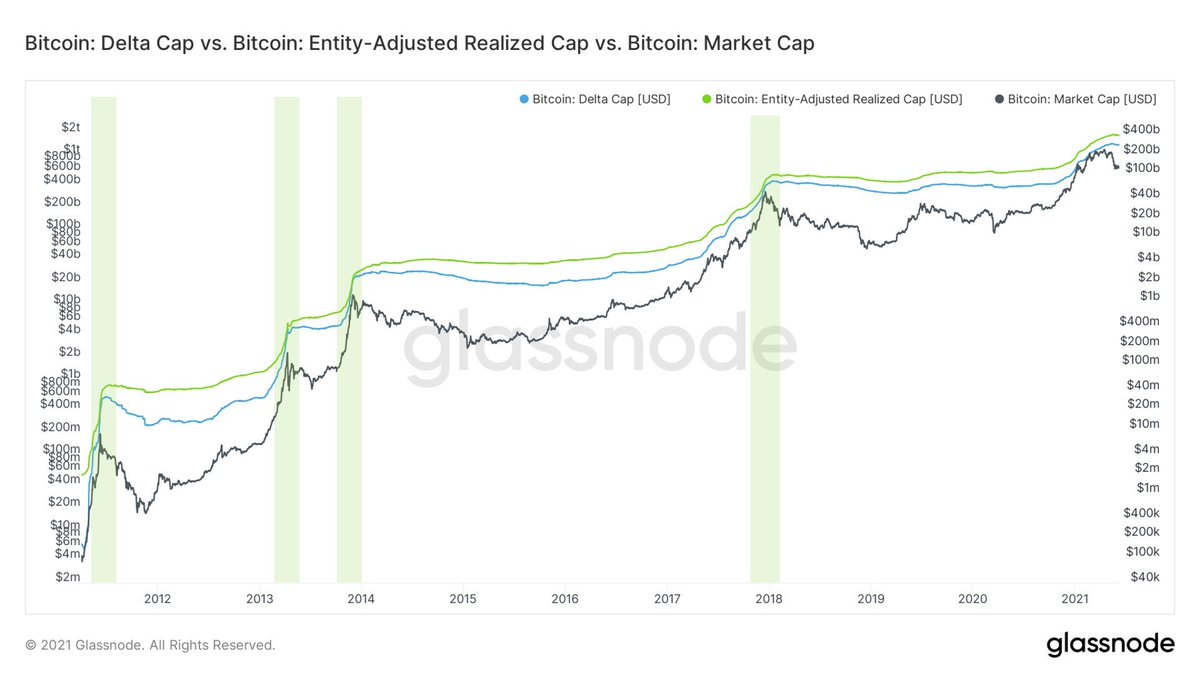

This ratio shows when Delta cap (difference between realized capitalization and the all-time moving average capitalization of Bitcoin) converges with Realized capitalization (cap based on when coins were last moved)

Without taking a ratio of the two, here are the convergences:

Without taking a ratio of the two, here are the convergences:

An interesting thing to note: Each peak is higher.

If this pattern continues, this bull run still has a ways to go.

If this pattern continues, this bull run still has a ways to go.

This arc of higher tops resembles @woonomic's top cap model as well.

Over the long term, Bitcoin tends to move very mechanically.

Over the long term, Bitcoin tends to move very mechanically.

Special thanks to the following:

@kenoshaking: Conceptualizing delta cap and the idea to compare delta to realized. (go check out his article)

@glassnode: Data

@SethSteiman: Coding

@kenoshaking: Conceptualizing delta cap and the idea to compare delta to realized. (go check out his article)

@glassnode: Data

@SethSteiman: Coding

• • •

Missing some Tweet in this thread? You can try to

force a refresh