The #Chainlink and SWIFT partnership and its potential impact on the tokenomics of $LINK. Thread 🧵 ⬇️

1) $LINK and SWIFT have been working together since 2016, largely in secret. SWIFT is the Society for Worldwide Interbank Financial Telecommunications. They’re the leader in financial messaging, with their network responsible for facilitating all international bank transfer info.

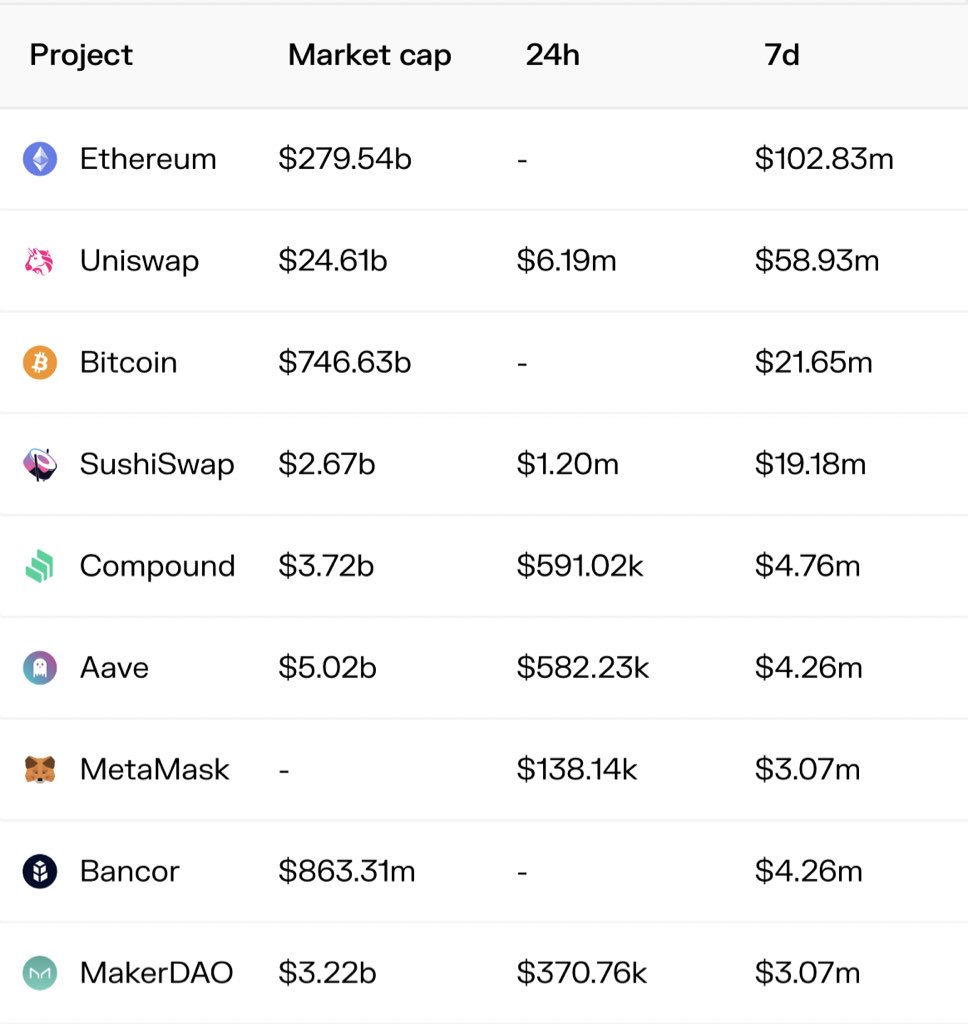

2) SWIFT facilitates close to $4-5 Quadrillion in transactions a year, yes with a Q. The entire TVL of DeFi is currently only ~$58 billion, much of which $LINK secures with its oracle network. If SWIFT integrates LINK into its payments network imagine the volume that LINK secures

3) SWIFT works with over 11,000 institutions, each of which would need to run its own $LINK node to process/verify these transactions. In order to ensure trustworthy data, nodes have to put up LINK tokens as collateral. That means they will have to buy LINK to run their nodes.

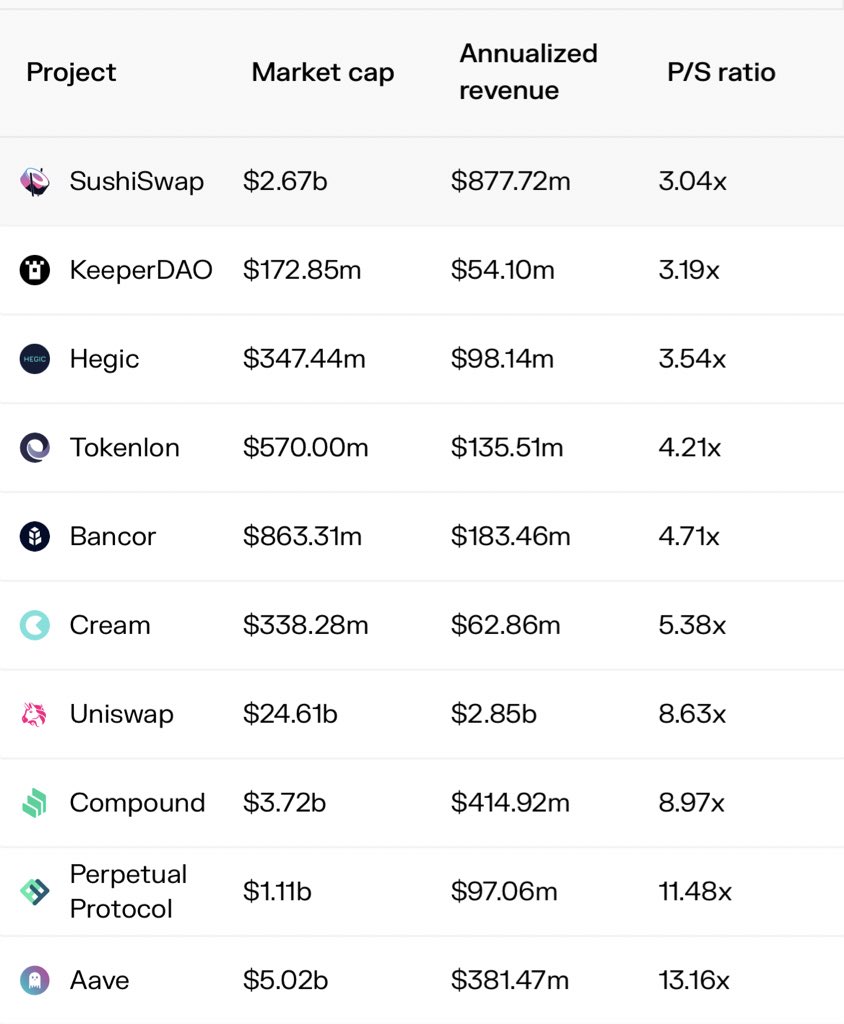

4) Not only will the nodes have to buy and put up $LINK as collateral, users of the network have to pay the nodes with LINK. The genius tokenomics of #Chainlink create immense organic buying pressure on the token which scales exponentially with the size of the network.

5) What does this mean?

Worst case scenario the partnership results in no end product and $LINK walks away with the respect and connections with 11,000 institutions/potential future partners that move trillions every year.

Worst case scenario the partnership results in no end product and $LINK walks away with the respect and connections with 11,000 institutions/potential future partners that move trillions every year.

6) Best case scenario $LINK becomes the standard currency of the world. Sound crazy? Every institution around the world runs a node in order to use the SWIFT/LINK payments network. All buy and put up LINK as collateral. Everyone using the institutions pays them(nodes) in LINK...

7) The tokenomics add up. Working with institutions also minimizes risk of regulation unlike other crypto. The SWIFT partnership if successful would be the catalyst to bring $LINK to the top spot in crypto. The R/R of Chainlink is unlike any asset since #BTC in its infancy imo.

8) Whether the SWIFT partnership is successful or not, $LINK ‘s unique network effects, complimentary tokenomics, and strong institutional relationships ensure a bright future for the project and its stakeholders.

Retweets and likes are appreciated if you enjoyed the thread 🤝

Retweets and likes are appreciated if you enjoyed the thread 🤝

• • •

Missing some Tweet in this thread? You can try to

force a refresh