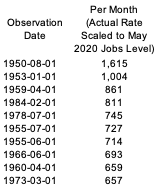

The speed limit view of job creation is greatly overstated. Here are the fastest periods of six-month job growth in the United States since 1950 (scaled to today's job level)

We can and likely will do much better than 500K or 600K per month.

Slightly more nuanced 🧵follows.

We can and likely will do much better than 500K or 600K per month.

Slightly more nuanced 🧵follows.

These examples are a long time ago but I would argue conditions are better for job creation now than ever before:

--Huge stimulus

--Highest opening rate ever recorded

--A large number of unemployed

--People getting vaccinated, COVID coming down, policy restraints ending.

--Huge stimulus

--Highest opening rate ever recorded

--A large number of unemployed

--People getting vaccinated, COVID coming down, policy restraints ending.

Moreover, the rate of people finding jobs is notably low right now as @p_ganong points out. If it was just normal we would be adding an extra 500,000 jobs a month give or take.

https://twitter.com/p_ganong/status/1400644270894239750?s=20

I've gone the opposite way on the "speed limit" view on the pace of job creation than @paulkrugman. All of last year I was emphasizing what I called the "slog": a period when the pact of job creation would be limited by the difficulty matching people to jobs.

I have also emphasized that after the "partial rebound" (a period we're still in) it will get harder to match people to jobs. It is easier to bring people back from temporary layoff than to match them to entirely new jobs.

At *some* point should get harder to add jobs.

At *some* point should get harder to add jobs.

But we're not close to that point. Still lots of COVID and non-vaccinated people in April and May. The only reliable economic data we have is for an eternity ago in COVID time.

And moreover, just read this piece and think about how awful it would have been for the ARP to cut 11 million people off UI in March and April--even if they would have forced more people into jobs more quickly. tcf.org/content/report…

IF the strong version of the speed limits view is right then potential GDP is substantially lower than we thought, inflation risks are substantially higher than we thought, and the American Rescue Plan was way too many dollars per month (but not enough months).

I do think there are some limits. You can't employ 9m people in a single month even if there are 9m job openings. The short-run NAIRU is higher than the long-run NAIRU. The last few million jobs might be particularly hard to get back and take longer than we (or I) would like.

The most important policy to speed up job growth is to wait another month or two or three or four.

I would bet the pace of job creation over the next six months is meaningfully faster (maybe 50% faster) than it has been the past three months.

I would bet the pace of job creation over the next six months is meaningfully faster (maybe 50% faster) than it has been the past three months.

I also think there is a good chance that we get at least one month with 1 million jobs and I just hope it is me and not @Austan_Goolsbee doing @SquawkCNBC that month.

• • •

Missing some Tweet in this thread? You can try to

force a refresh