Our major new report reveals a critical fault line in global efforts to reach climate goals.

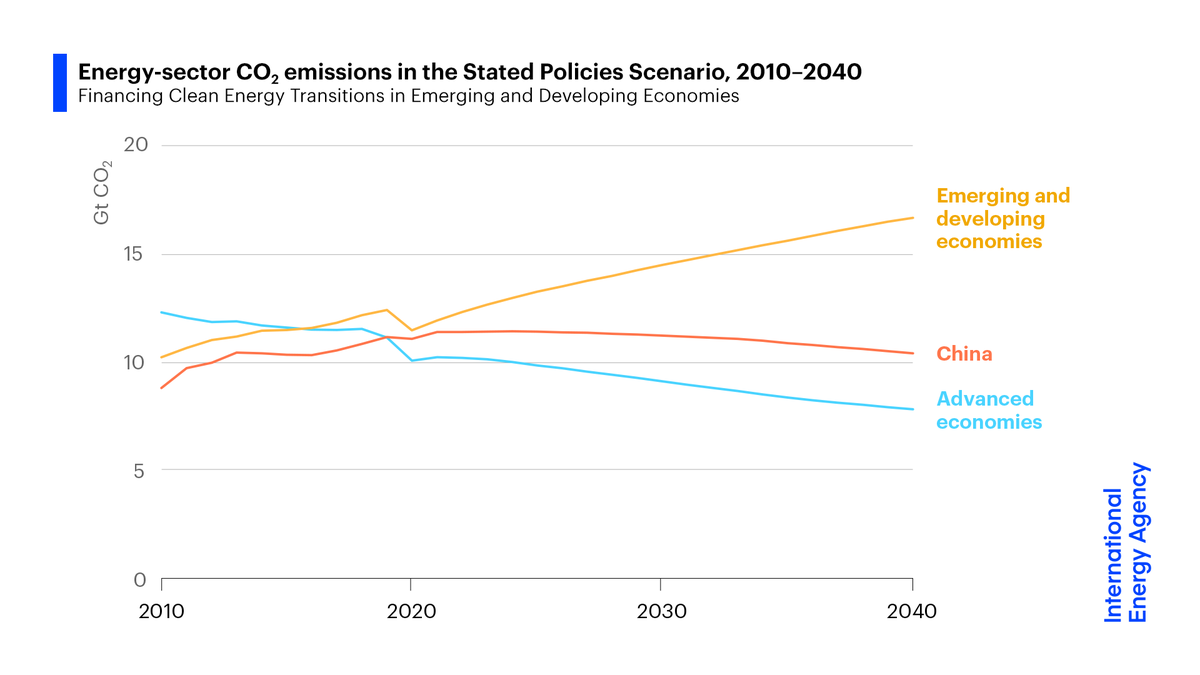

In many emerging & developing economies, emissions are rising while clean energy investments are faltering. Money is not going where it’s most needed.

Read more: iea.li/2TTHPSk

In many emerging & developing economies, emissions are rising while clean energy investments are faltering. Money is not going where it’s most needed.

Read more: iea.li/2TTHPSk

Today, emerging & developing economies account for two-thirds of the world's population, but only one-fifth of global investment in clean energy.

Our new report shows that this investment needs to grow more than 7 times by 2030 to over $1 trillion a year to meet net zero goals.

Our new report shows that this investment needs to grow more than 7 times by 2030 to over $1 trillion a year to meet net zero goals.

One of our key recommendations: Governments need to give international public finance institutions a strong mandate to finance clean energy in the developing world.

There is no shortage of funds globally, but we need huge efforts to channel them where they can make a difference.

There is no shortage of funds globally, but we need huge efforts to channel them where they can make a difference.

A massive obstacle for clean energy in emerging & developing economies is the cost of capital. They face debt & equity costs up to 7 times higher than in the US or Europe.

But avoiding a tonne of CO2 emissions in the developing world costs half as much as in advanced economies.

But avoiding a tonne of CO2 emissions in the developing world costs half as much as in advanced economies.

The new @IEA special report – produced in collaboration with @WorldBank & @wef – is a global call to action, especially for those who have the wealth, resources & expertise to help accelerate clean energy transitions in the developing world.

Read more ➡️ iea.li/353LTl7

Read more ➡️ iea.li/353LTl7

Clean energy transitions must be people‐centred and include sustainable actions to achieve universal access to electricity & clean cooking.

Transitions can create substantial new economic opportunities & jobs. But governments have to help communities navigate the changes.

Transitions can create substantial new economic opportunities & jobs. But governments have to help communities navigate the changes.

Join us at 14:00 CEST for a livestreamed high-level event to discuss the new @IEA report with energy, climate & finance leaders, including @WorldBank Managing Director for Development Policy & Partnerships @Mari_Pangestu and @wef President @borgebrende ⬇️ iea.li/3wadMnB

• • •

Missing some Tweet in this thread? You can try to

force a refresh