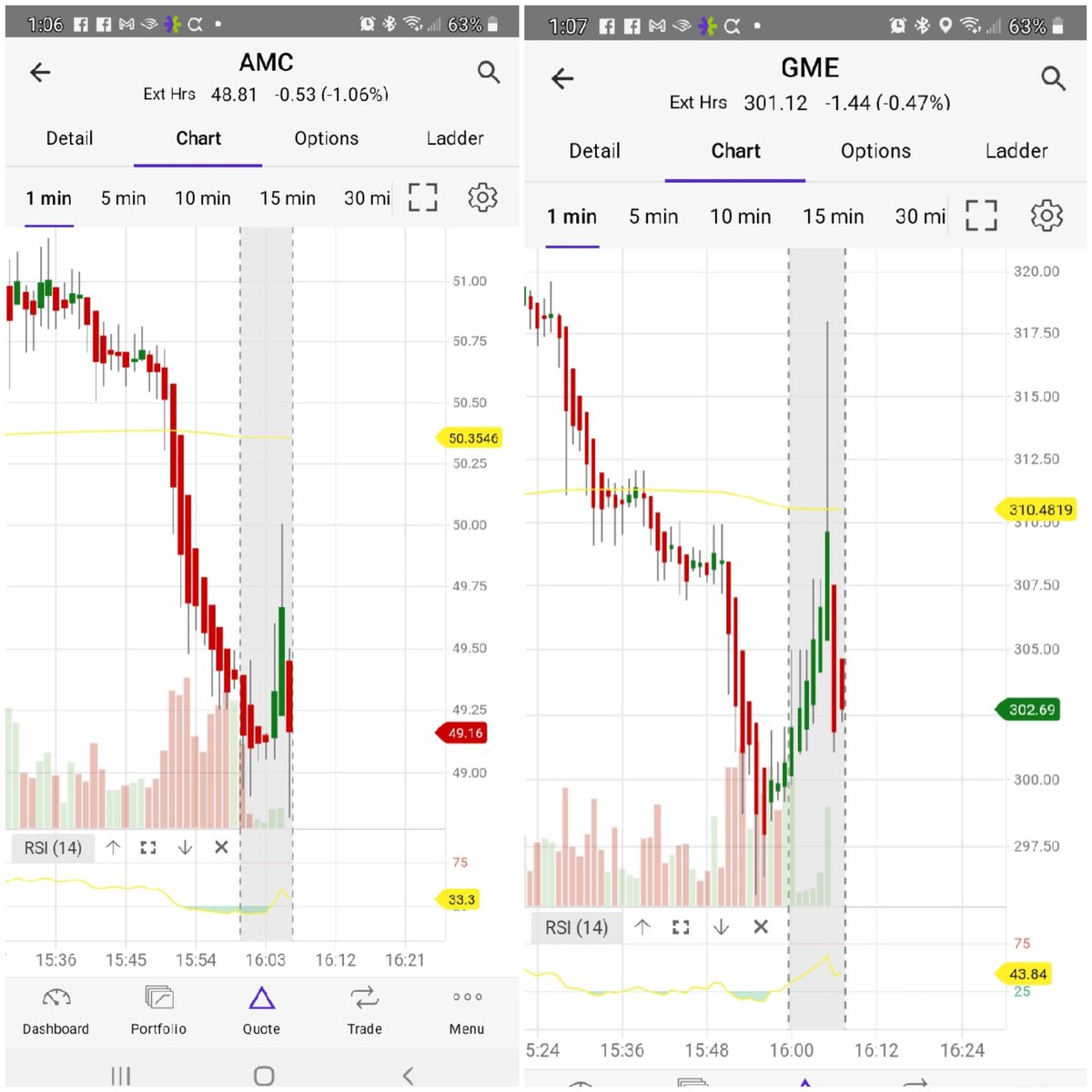

#AMC #GME

Both jump up in AH and then spike down at the exact same time, coincidence.... I think not😠😠😠

@matt_kohrs @TradesTrey @WilliamAston @Joshuajammes

Both jump up in AH and then spike down at the exact same time, coincidence.... I think not😠😠😠

@matt_kohrs @TradesTrey @WilliamAston @Joshuajammes

You have to be kidding me. I refuse to believe the #AMC shareholders decided to all sell after hours at the same time after we were told there were 4.1m shareholders

And #GME selling after they beat earnings by $.38?????

And #GME selling after they beat earnings by $.38?????

I mean really almost identical price action, but it is not coordinated #MarketManipulation

Ok...... did anyone else see this today??????

Same broker, picture taken 3 minutes apart.

If it only happened once I could buy this as a glitch but I have a bunch of examples like this (it is usually going the other way).

Same broker, picture taken 3 minutes apart.

If it only happened once I could buy this as a glitch but I have a bunch of examples like this (it is usually going the other way).

• • •

Missing some Tweet in this thread? You can try to

force a refresh