Ok all my #AMCAPES out there. I want to give my thoughts on what I have been seeing with our current price action. This will be in multiple parts so please follow in the comments. I have a dual major in business and psychology and many years experience in the business world. Cont

(1/8) There are many Battle hardened apes out there who understand the mind games but there are also at least a million new apes out there. I have seen these tactics employed on very intelligent people because $$$ causes lots of emotions.

Like Sun Tzu said "Know your enemy"

Like Sun Tzu said "Know your enemy"

(2/8) My time with many large-scale business dealings one of the biggest lessons learned: Fear of loss is the single most driving force in human decision-making. Research states: A loss stings twice as much as an equivalent gain, i.e., losing $5 actually feels like losing $10+

(3/8) This can be leveraged in buy/sell transactions simply by pointing out what is going to be lost if a deal isn’t made, or something isn’t done.

The party who feels they have more to lose has less leverage, and vice versa.

The party who feels they have more to lose has less leverage, and vice versa.

(4/8) A practice used in difficult negotiations, especially if they are drawn out, is to make the other party see these losses real time. So if you are trying to get someone to sell, you offer an amount that seems like a lot but is only a fraction of the real worth.

(5/8) When they decline you go out of your way to devalue what the other party is selling (e.g. negative news articles, negative media attention, FUD, etc.). You then come back at them with a lower offer, and repeat, repeat, repeat.

(6/8) After multple cycles you then offer your original offer. Psychologically they will feel like they are losing money with each offer. Once you offer an amount close to the original amount they will feel like they gained back money they lost (even though they lost nothing)

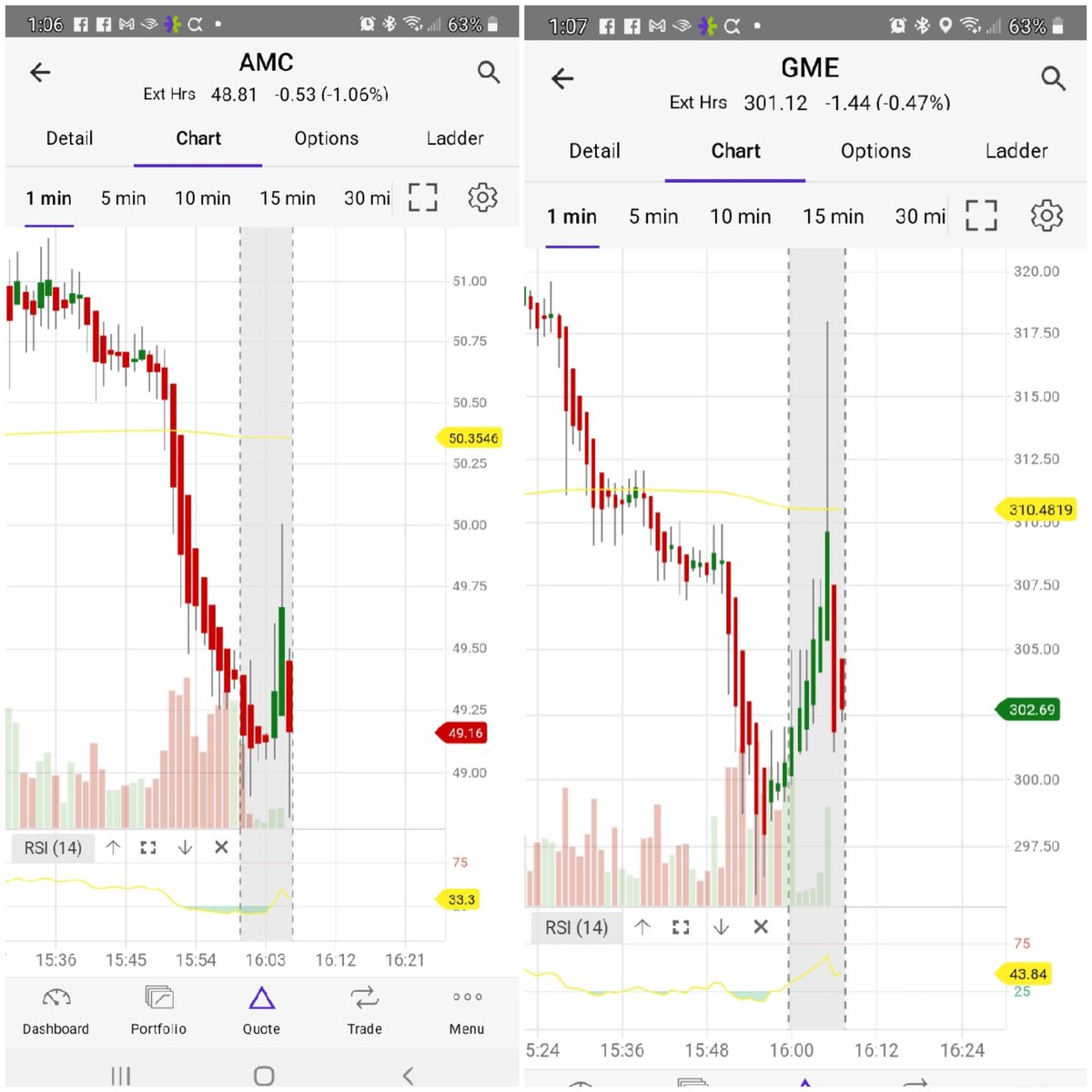

(7/8) Say a stock we all love is trying to be bought by a Hedge Fund. On 6/1 High of $72.62, 6/3 they drop it to a low of $37.66 and only let us see a high of $68.80, on 6/8 they let us see a high of $60.62, on 6/9 they let us see a high of $54.00, on 6/10 the high was $52.38.

(8/8) Now if they let it run back up to the $70 range a lot of people will feel like they made back $(even though we didn’t lose it unless we sold). This will tempt people, but REMEMBER we rejected that offer the first time because it was a fraction of what it is really worth!

Sorry if they show out of order, I am not a spring chicken, just an older ape working hard to get a wrinkle or two😁

LOVE YOU ALL

#AMCSTRONG

LOVE YOU ALL

#AMCSTRONG

Here is the consolidation

Thanks @bbymae

Thanks @bbymae

https://twitter.com/threadreaderapp/status/1403335973543481347?s=09

• • •

Missing some Tweet in this thread? You can try to

force a refresh