In this discussion about the latest trends in the housing market, @greg_bonnell asked if I expect to see a pullback in the market this year...

At this point it's looking unlikely because the market is still very competitive....but 1/

At this point it's looking unlikely because the market is still very competitive....but 1/

I also mentioned that when thinking about how the housing market might start to cool, it's important to consider whether the trigger will be a fundamental shift in the market vs a behavioural shift in the market...2/

A fundamental shift would be something like a traditional recession where job losses actually lead to lower income and an inability for home owners to service their mortgage payments - leading some to sell.

That is unlikely to happen any time soon 3/

That is unlikely to happen any time soon 3/

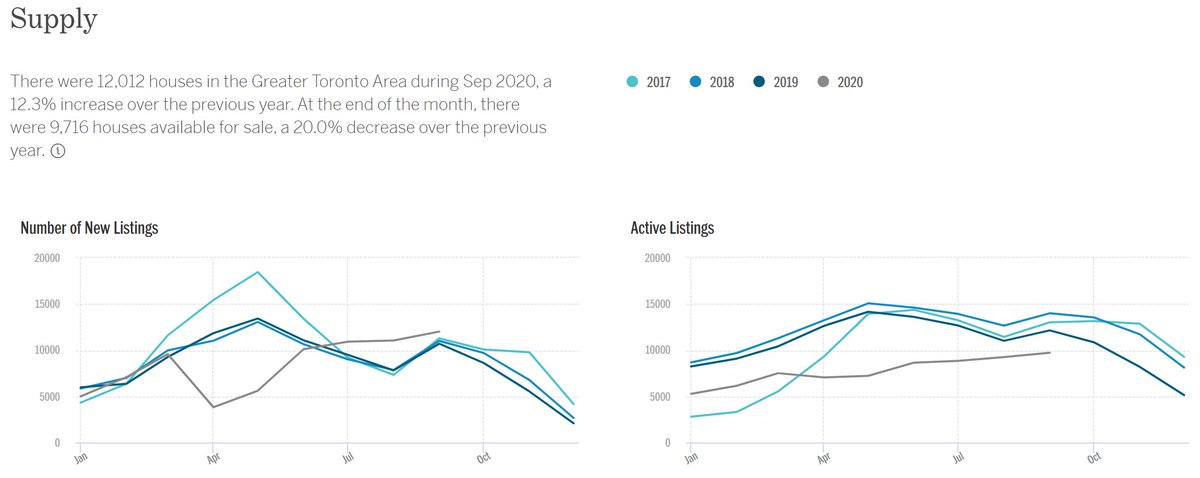

A behavioural shift would look a lot like what happened in April 2017 in the GTA when buyers suddenly hit pause on their home search (and sellers rushed in) out of a fear that the provincial foreign buyer tax would lead to lower home prices 4/

Many people incorrectly assume that the roughly 20% decline in home prices in 2017 was because of the foreign buyer tax.

That's not the case, there were not enough foreign buyers to justify the shift in the market we saw.

The decline was effectively a reverse bubble..5/

That's not the case, there were not enough foreign buyers to justify the shift in the market we saw.

The decline was effectively a reverse bubble..5/

On the way up bubbles are driven by behavioural factors, beliefs like a fear of missing out, prices can only go up etc.

Well, beliefs can also have a negative effect on the market when the belief is fear that home prices will be lower tomorrow (as an example)....6/

Well, beliefs can also have a negative effect on the market when the belief is fear that home prices will be lower tomorrow (as an example)....6/

It's this fear that caused buyers to rush out of the market and sellers to rush in in early 2017.

Behavioural shifts like this are impossible to predict because they are not based on quantitative trends.

They are based on the collective beliefs of buyers/sellers...7/

Behavioural shifts like this are impossible to predict because they are not based on quantitative trends.

They are based on the collective beliefs of buyers/sellers...7/

All that to say, when thinking about the future direction of the housing market we want to be mindful of behavioural shifts in the market as well as fundamental factors /

• • •

Missing some Tweet in this thread? You can try to

force a refresh