🧵 on startup 'valuations'.

Why are loss-making startups run by 20-somethings 'valued' as unicorns while similar profit-making companies are valued at half that?

Thread below has the dope, but the longer read is 👇🏽

sajithpai.medium.com/exhaust-fumes-…

1/23

Why are loss-making startups run by 20-somethings 'valued' as unicorns while similar profit-making companies are valued at half that?

Thread below has the dope, but the longer read is 👇🏽

sajithpai.medium.com/exhaust-fumes-…

1/23

First, the title 'Exhaust Fumes'

Comes from a great quote by @fredwilson

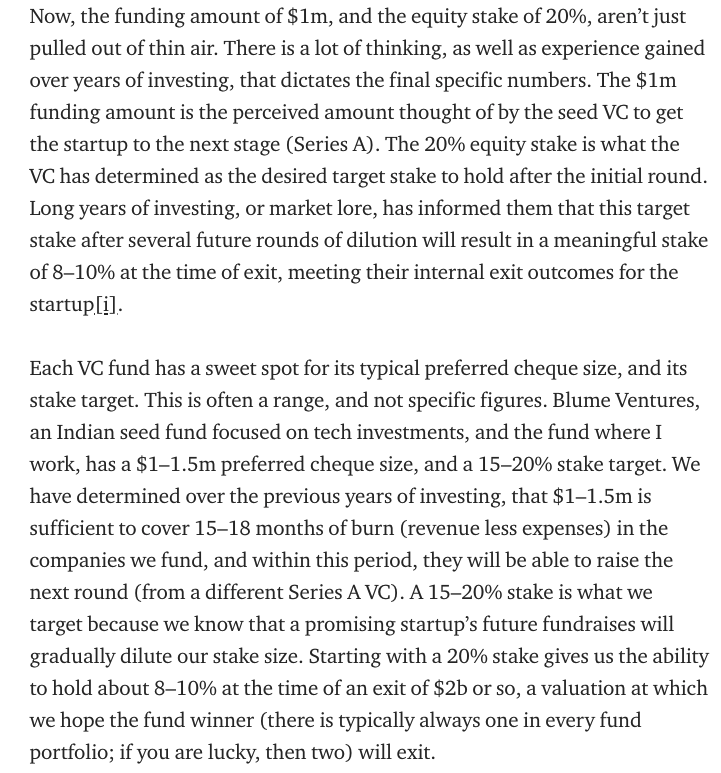

“Early stage valuations aren’t really valuations. They are the exhaust fumes of a negotiation about two things — the amount raised and the amount of dilution.”

Let us understand this.

2/23

Comes from a great quote by @fredwilson

“Early stage valuations aren’t really valuations. They are the exhaust fumes of a negotiation about two things — the amount raised and the amount of dilution.”

Let us understand this.

2/23

They say that chess is a game that can be learnt in an hour, but it takes a lifetime to master. Venture valuations are similar.

Here is the simple part of startup valuations. Take capital invested, and divide by stake diluted.

3/23

Here is the simple part of startup valuations. Take capital invested, and divide by stake diluted.

3/23

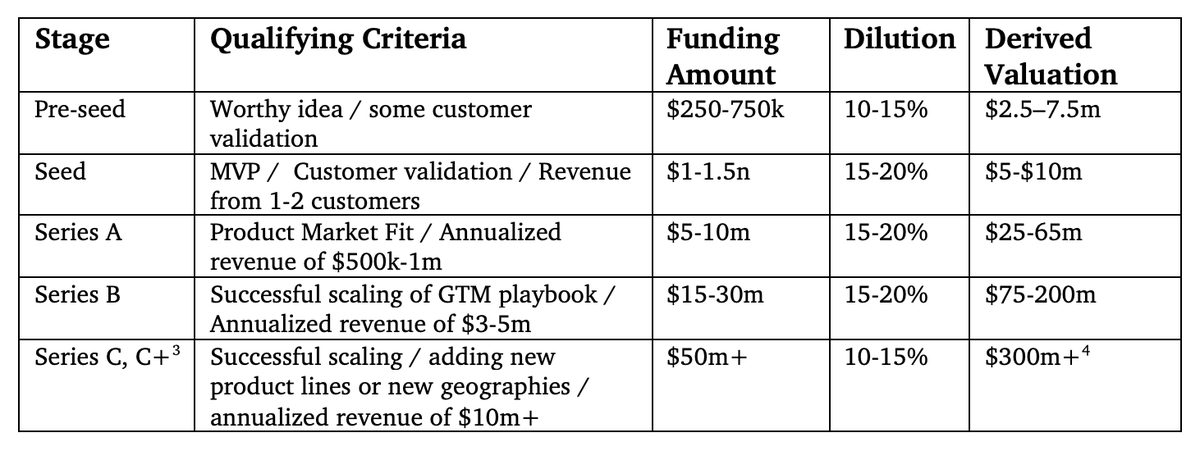

These individual 'valuations' are staged across different rounds by different VCs.

Multi-party Staging is one of the great financial innovations of the 20th century, like microfinance.

5/23

Multi-party Staging is one of the great financial innovations of the 20th century, like microfinance.

5/23

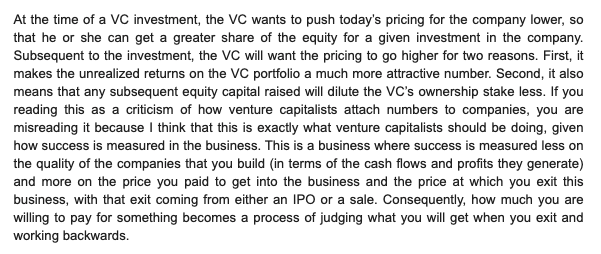

VCs dont use a financial technique like DCF or anything similar to 'value' a startup (or really price the shares). Instead, they jointly collaborate in 'long-term multiparty staging games' to take the startup from idea to IPO.

7/23

7/23

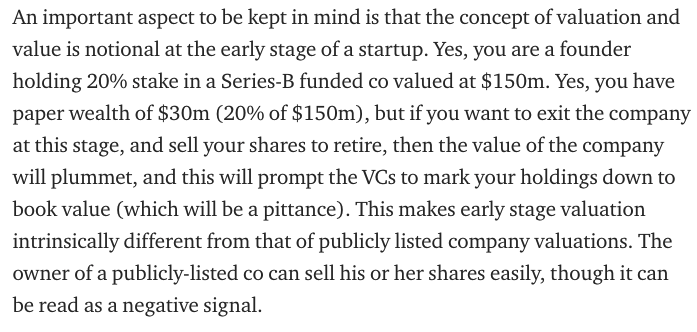

'Valuations' in the inbetween stages, especially early-on are not exactly 'valuations'; at least not in the sense of public market valuations. They are notional at best.

8/23

8/23

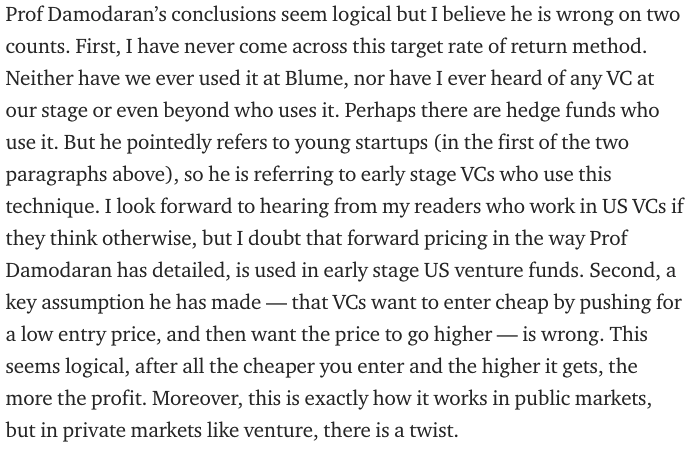

Journalists & academics have struggled to grasp much of this. Here is Prof Aswath Damodaran from his 2016 piece - aswathdamodaran.blogspot.com/2016/10/ventur…

9/23

9/23

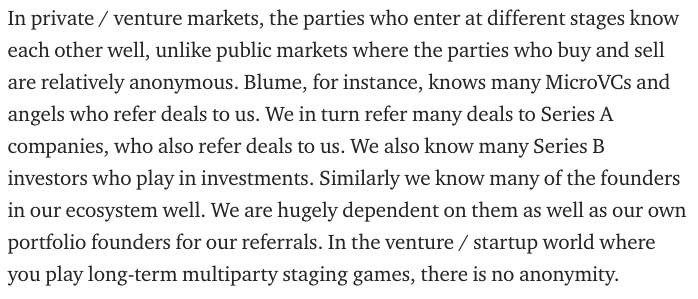

Unlike in public markets where you dont know who you are selling to, and you dont care about what the CEOs / operators think of you as investor, we VCs do.

11/23

11/23

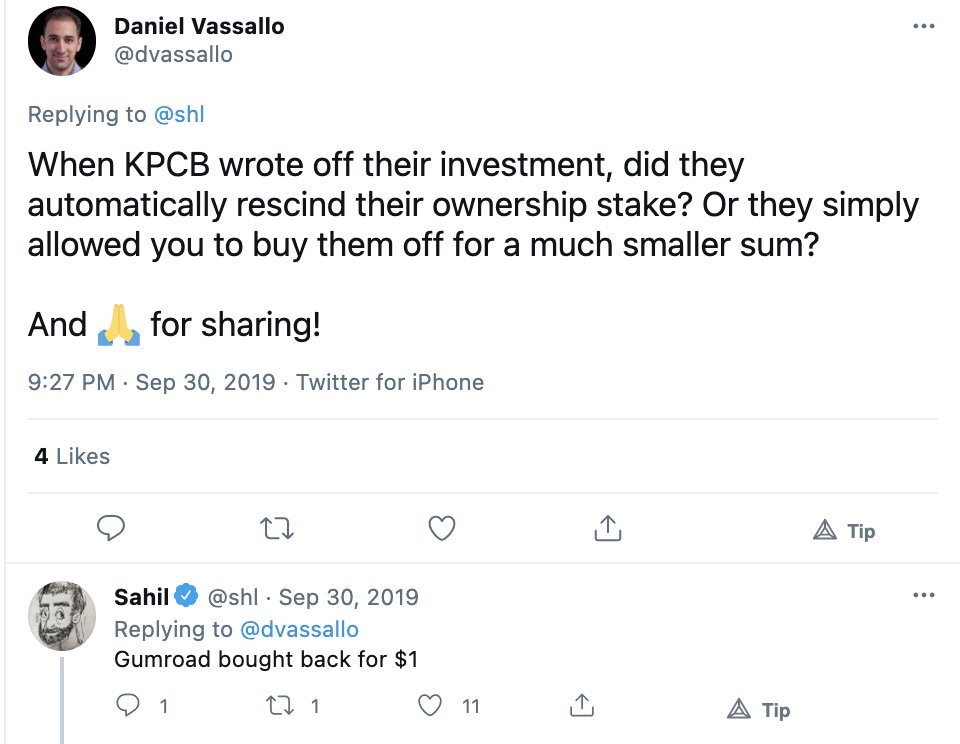

This explains why VCs indulge in actions like writing off the value of their investments and / or selling the shares back for a nominal price to the startup, If you were to go by Prof Damodaran’s logic you would not be able to explain the below.

12/23

12/23

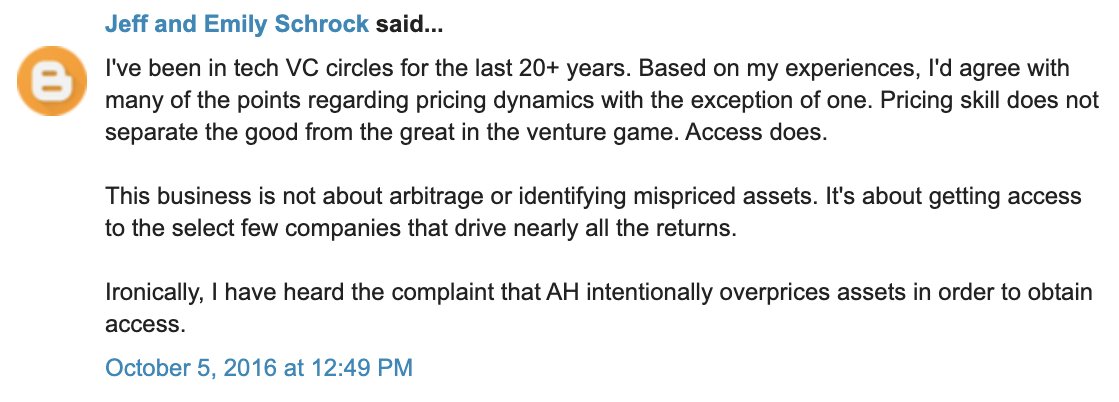

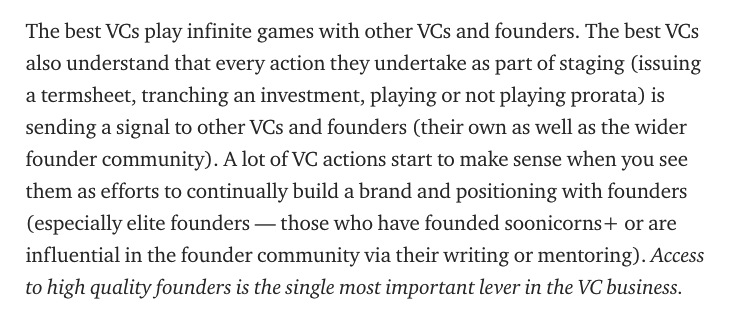

The best VCs play infinite games with other VCs and founders.

Because, access to high quality founders is the single most important lever in the venture business.

13/23

Because, access to high quality founders is the single most important lever in the venture business.

13/23

Let us unpack this. Why does access to high quality founders matter?

2 learnings from history.

14/23

2 learnings from history.

14/23

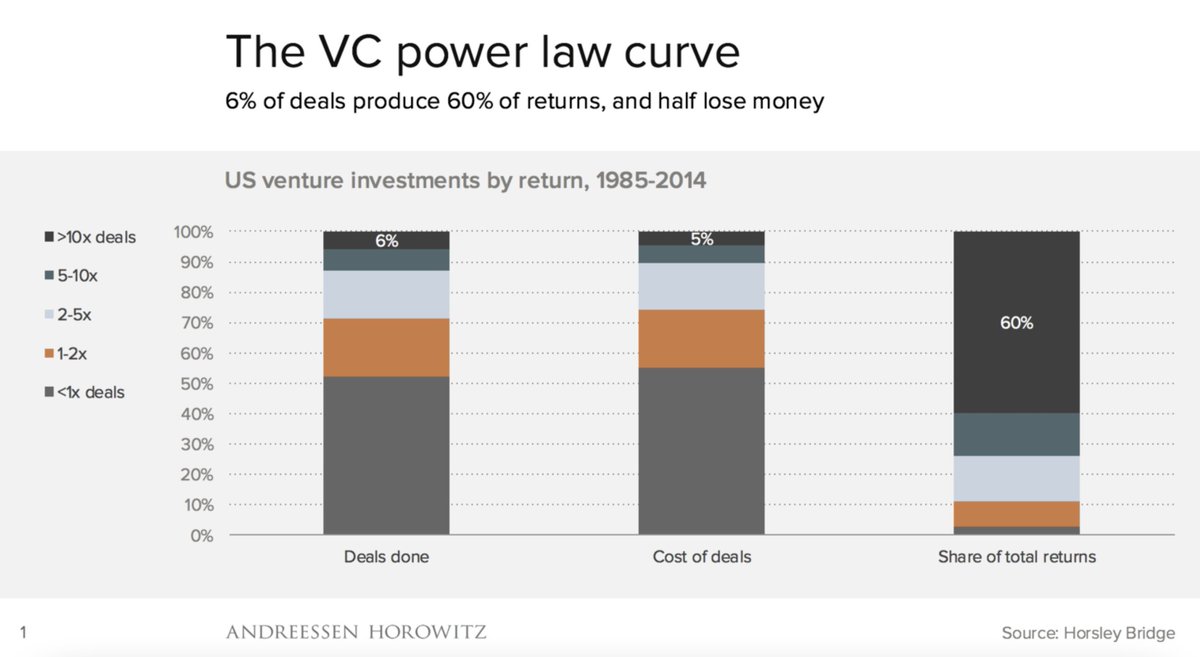

Via @benedictevans

6% of deals produce 60% of returns. There is a brutal power law that operates in every fund. A minority of our investments make all the money, and more.

15/23

6% of deals produce 60% of returns. There is a brutal power law that operates in every fund. A minority of our investments make all the money, and more.

15/23

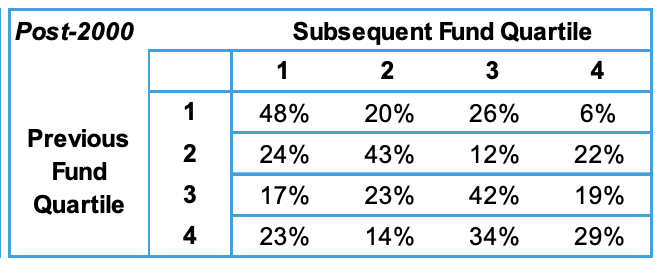

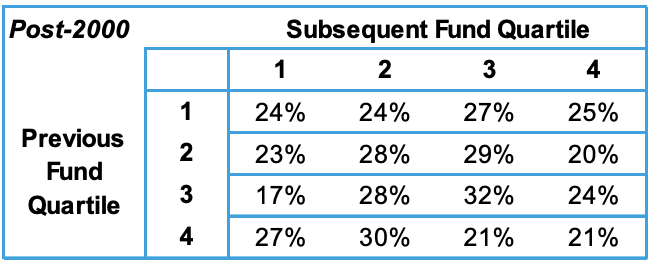

Great VC funds have persistence. Because great founders want to work with great VCs, to increase chances of success. This reinforces the position of the top funds.

Sequoia, Benchmark are virtually impregnable.

Because founders hate PE investors, PE funds have no persistence.

Sequoia, Benchmark are virtually impregnable.

Because founders hate PE investors, PE funds have no persistence.

Yup, let us now wind down.

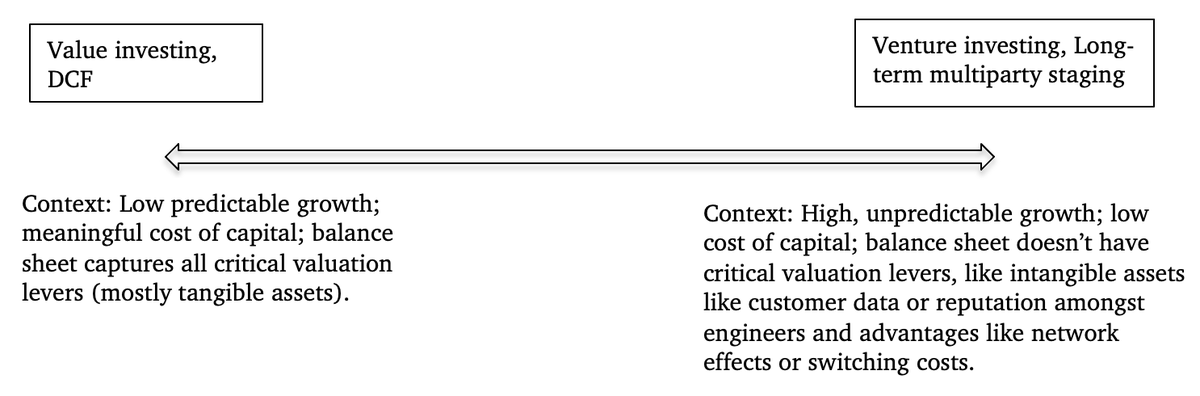

It is important to DCF as a technique relevant only to low growth predictable revenue, high cost of capital contexts.

18/23

It is important to DCF as a technique relevant only to low growth predictable revenue, high cost of capital contexts.

18/23

And hence a framework for understanding how DCF has its space, and the long-term multiparty staging plays that we use in venture has its space.

20/23

20/23

Phew.

I want to thank @mjmauboussin @refsrc @maikeya and Anand Vyas for their reviews of the draft. Their inputs were hugely helpful in shaping the piece.

21/23

I want to thank @mjmauboussin @refsrc @maikeya and Anand Vyas for their reviews of the draft. Their inputs were hugely helpful in shaping the piece.

21/23

For those of who you are venture nerds and want to learn more, I also have a sample portfolio construction sheet, to give you a sense of how VCs build out and think through a portfolio, enjoy.

22/23

docs.google.com/spreadsheets/d…

22/23

docs.google.com/spreadsheets/d…

Here is the piece again.

If you have ever wanted a piece that explains startup valuations to share with your friends, families or colleagues, well, here it is now.

23/23. Fin.👋🏽

sajithpai.medium.com/exhaust-fumes-…

If you have ever wanted a piece that explains startup valuations to share with your friends, families or colleagues, well, here it is now.

23/23. Fin.👋🏽

sajithpai.medium.com/exhaust-fumes-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh