Investing in SA or US equities.

• How do I decide?

• Where does the market go from here?

Let’s look at historical data, to aid us in making better decisions.

(Thread)👇🏽

• How do I decide?

• Where does the market go from here?

Let’s look at historical data, to aid us in making better decisions.

(Thread)👇🏽

For my case study, I’m going to use the SA TOP 40 (SA40) index Chart.

These are the top 40 companies in SA by market capitalization. 👇🏽

sashares.co.za/jse-top-40/#gs…

*picture for visualization purposes only.

These are the top 40 companies in SA by market capitalization. 👇🏽

sashares.co.za/jse-top-40/#gs…

*picture for visualization purposes only.

My starting data is completely arbitrary, the purpose of the thread is educational and not to give investment advice.

Start: 10 June 2002

End : 10 June 2019

Period 19 years.

Start: 10 June 2002

End : 10 June 2019

Period 19 years.

• SA40 chart

R100 invested in June 2002 would equate to R600 by June 2021.

500% return over the period.

(Not bad, right?) but that isn’t truly reflective of the real return.

R100 invested in June 2002 would equate to R600 by June 2021.

500% return over the period.

(Not bad, right?) but that isn’t truly reflective of the real return.

•Reading the graph

-Staying Invested

In 08/09 the GFC caused massive havoc, but you can see that if you stayed invested, you would’ve broke even 2-3 years later, then gone on to earn 200% by 2014 had you bought the dip.

Trying to time the market is futile.

Stay invested.

-Staying Invested

In 08/09 the GFC caused massive havoc, but you can see that if you stayed invested, you would’ve broke even 2-3 years later, then gone on to earn 200% by 2014 had you bought the dip.

Trying to time the market is futile.

Stay invested.

Again, what’s evident here is that after the Covid-19 crash, the market recovered +85%. Had you bought the dip, you’d seen MASSIVE growth, not only in equity price, but in ZAR strength too.

Key takeaway.

#buythedip

#stayinvested

Cost averaging works.

Key takeaway.

#buythedip

#stayinvested

Cost averaging works.

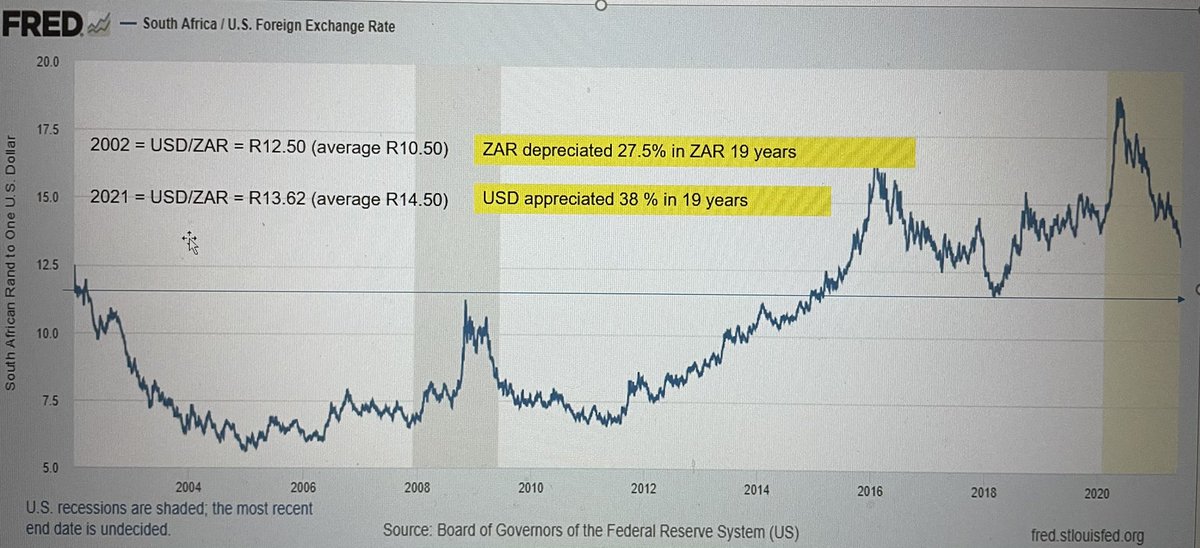

•ZAR Depreciation

June 2002 (USD/ZAR)= R12.50, I worked with an average of R10.50 for that year.

June 2021 (USD/ZAR)= R13.62, I worked on an average of R14.50 for this year so far.

*remember, numbers are for educational purposes.

Check the chart out below. 👇🏽

USD/ZAR

June 2002 (USD/ZAR)= R12.50, I worked with an average of R10.50 for that year.

June 2021 (USD/ZAR)= R13.62, I worked on an average of R14.50 for this year so far.

*remember, numbers are for educational purposes.

Check the chart out below. 👇🏽

USD/ZAR

In that time the ZAR depreciated 27.5% against the Dollar, while the Dollar appreciated 38% against the ZAR.

Imagine not buying the dip in 2009 and sitting in ZAR cash, only to miss the bull run, you’d have missed all those gains and experienced a real loss because of currency devaluation.

Key takeaway

Put idle money to work and don’t try to time the market.

Key takeaway

Put idle money to work and don’t try to time the market.

What’s evident is that the USD/ZAR goes through weakening and strengthening cycles, but the long term trend has been ⬇️

You could cross reference this with the Gold price and work out if miners could potentially outperform or underperform.

That’s a thread for another day

You could cross reference this with the Gold price and work out if miners could potentially outperform or underperform.

That’s a thread for another day

•Local returns

So you deal with local returns growing, but currency depreciation-which brings the real return down.

So, it’s key to have offshore exposure to mitigate these cycles.

Many miss ZAR bull runs trying to time the market, then ask why

Thoughts @MagnusHeystek ?

So you deal with local returns growing, but currency depreciation-which brings the real return down.

So, it’s key to have offshore exposure to mitigate these cycles.

Many miss ZAR bull runs trying to time the market, then ask why

Thoughts @MagnusHeystek ?

•Currency devaluation

In local terms the SA40 has risen 500%, but in real returns, it equates to only 135% in 19 years. (Rand devaluation)

I used the formula:

((1+y)x (1+z)) - 1

Y = equity return

Z= currency devaluation return

Maybe @iamkoshiek can confirm this?

In local terms the SA40 has risen 500%, but in real returns, it equates to only 135% in 19 years. (Rand devaluation)

I used the formula:

((1+y)x (1+z)) - 1

Y = equity return

Z= currency devaluation return

Maybe @iamkoshiek can confirm this?

•Real return.

Now, the question an investor would ask, is the risk worth the reward?

If I had simply invested in the

Dow J over that time, I would have earned a better average of 7%, but also gained from $ ⬆️/ R ⬇️ pushing my real returns higher,in Rand,compared to SA40

Now, the question an investor would ask, is the risk worth the reward?

If I had simply invested in the

Dow J over that time, I would have earned a better average of 7%, but also gained from $ ⬆️/ R ⬇️ pushing my real returns higher,in Rand,compared to SA40

Remember, friends.

Past performance is no guarantee for future results.

Don’t assume that an investment will do well in the future because it has done well in the past.

But.. a key thing to remember here, the trend is your friend.

What do I mean?

Past performance is no guarantee for future results.

Don’t assume that an investment will do well in the future because it has done well in the past.

But.. a key thing to remember here, the trend is your friend.

What do I mean?

If you are South African, it would probably be wise to be buying Dollars in periods of Rand strength, there is least resistance following the trend than going against it.

And in the long run things tend to gravitate to the mean - mean reversion.

And in the long run things tend to gravitate to the mean - mean reversion.

Key Takeaway

Trying to time the market is silly, and your best decision would be to diversify into local equities and have offshore exposure by buying equities on other bourses in other countries.

Stay invested for the long term and ignore the noise, but manage risk.

Why?

Trying to time the market is silly, and your best decision would be to diversify into local equities and have offshore exposure by buying equities on other bourses in other countries.

Stay invested for the long term and ignore the noise, but manage risk.

Why?

•Managing risk

Know when to cut ties.

Screaming buy the F**king dip for every thing is going to get you hurt.

Not every stock keeps going up.

It’s safer, long term, investing and tracking indexes.

Look at the gains you’ll need to recover if you hold a loser👇🏽

Know when to cut ties.

Screaming buy the F**king dip for every thing is going to get you hurt.

Not every stock keeps going up.

It’s safer, long term, investing and tracking indexes.

Look at the gains you’ll need to recover if you hold a loser👇🏽

Shoutout for making it to the end

If you think what I’m putting out is valuable, then consider getting me a coffee. It takes long hours putting this together, and I need to stay awake. 👇🏽

buymeacoffee.com/davidketh

If you think what I’m putting out is valuable, then consider getting me a coffee. It takes long hours putting this together, and I need to stay awake. 👇🏽

buymeacoffee.com/davidketh

YouTube

Subscribe to my YouTube to learn how I go about gathering information and making investment decisions 👇🏽

youtube.com/channel/UCrI_7…

Subscribe to my YouTube to learn how I go about gathering information and making investment decisions 👇🏽

youtube.com/channel/UCrI_7…

I’ll be having a seminar where I’ll be talking about some of these points I brought up in this thread, and much more. If you’d be interested to join, please reserve a spot by completing the form below. 👇🏽

forms.gle/AQqWE8v5ToYPp8…

forms.gle/AQqWE8v5ToYPp8…

• • •

Missing some Tweet in this thread? You can try to

force a refresh