Another flawed design for a stablecoin has failed and I’d like to explain why. This one is essentially the next iteration of basis/esd/esdv2/nubits so really this isn’t too surprising 🙃

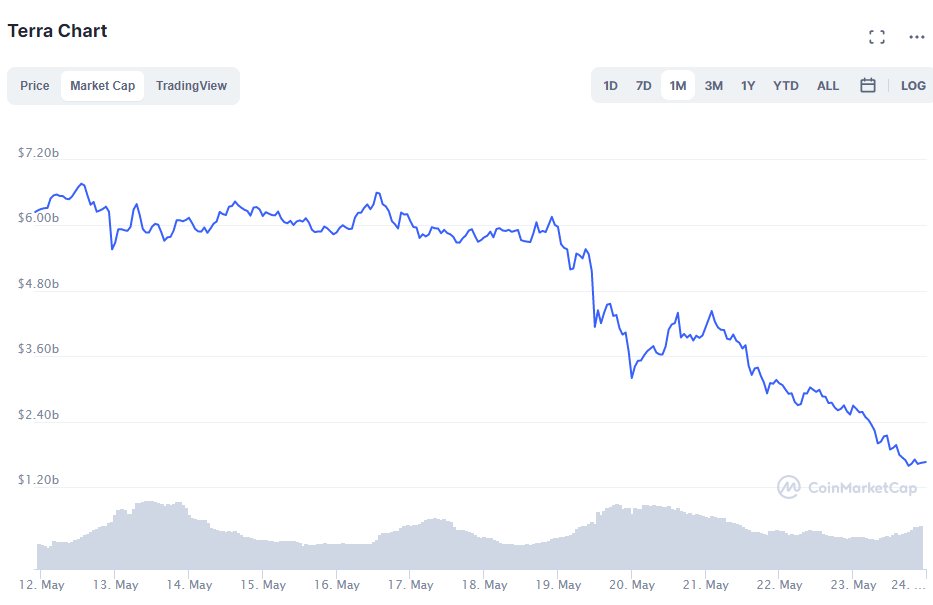

It's not pure basis, which hopefully everyone can now agree doesn't work! They have something that is ~ a reserve. In that respect, essentially like Nubits with different parameters (larger reserve but still too small). Reminder of how that worked out 👇

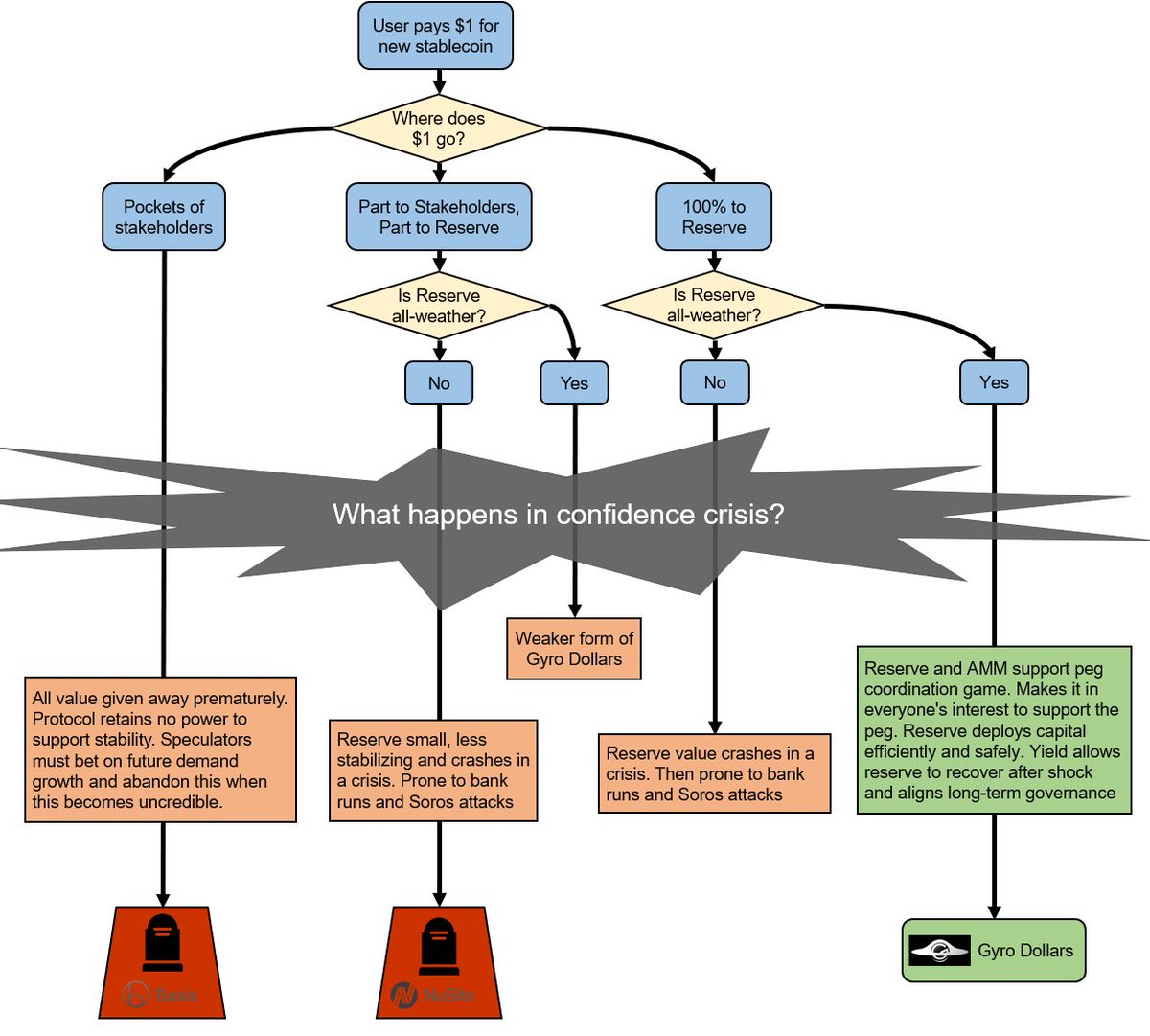

At the root of Malt’s failure lies a misguided aim of "capital efficiency" as trying to create the most stablecoins for the least underlying value. This places us in the middle of this spectrum for algo stablecoins, which is still very prone to failure!

One common mistake is to conflate this misguided notion of “capital efficiency” with scalability. Actually, scalability is different and should just mean that the stablecoin can sustainably meet excess demand, e.g., by expanding the supply. 100% reserved systems can do that also.

Worth also drawing a parallel with frax (which is better reserved in USDC fwiw). Conceptually, Frax is two separable parts: (1) ~$0.85 of deployed USDC, (2) remaining amount of an endogenous collateral/seigniorage shares stablecoin essentially like UST.

The second part could break, and you're left with $0.85 in USDC. Though if USDC breaks, then probably both parts break by extension. Malt is a mix of basis (w/ coupons) and a reserve, and the reserve could be depleted and anyone left gets 0. More like Nubits.

To read on, we’ve discussed this in more detail previously 👇

medium.com/gyroscope-prot…

And even more details in our Stablecoins 2.0 paper

👉 arxiv.org/abs/2006.12388

medium.com/gyroscope-prot…

And even more details in our Stablecoins 2.0 paper

👉 arxiv.org/abs/2006.12388

fwiw a good addition in malt: coupons (although flawed) have automatic redemption. (Potentially) resolves the problem where the miner of a block with a weak demand resurgence can be the sole coupon redeemer and earn riskfree MEV by buying coupons at a discount in that block.

• • •

Missing some Tweet in this thread? You can try to

force a refresh