#China Credit Tightening?

▪️ Aggregate Financing AFRE or Total Social Financing TSF growth slowed to 11% yoy May v/s 11.7% Apr

▪️ Renminbi RMB Loan growth inched down to 12.2% yoy May v/s 12.3% Apr

▪️ Optically Broad Credit YoY charts look scarier than they actually are

1/9

▪️ Aggregate Financing AFRE or Total Social Financing TSF growth slowed to 11% yoy May v/s 11.7% Apr

▪️ Renminbi RMB Loan growth inched down to 12.2% yoy May v/s 12.3% Apr

▪️ Optically Broad Credit YoY charts look scarier than they actually are

1/9

▪️ To start, target Fiscal Deficit 3.1% in 2021 v/s over 3.6% in 2020 => bound to be fiscal tightening by design

▪️ AFRE outstanding stock indeed points to recent marginal slowdown relative to post-COVID trend

▪️ But AFRE stock still above more longer term (4yr) trend

2/9

▪️ AFRE outstanding stock indeed points to recent marginal slowdown relative to post-COVID trend

▪️ But AFRE stock still above more longer term (4yr) trend

2/9

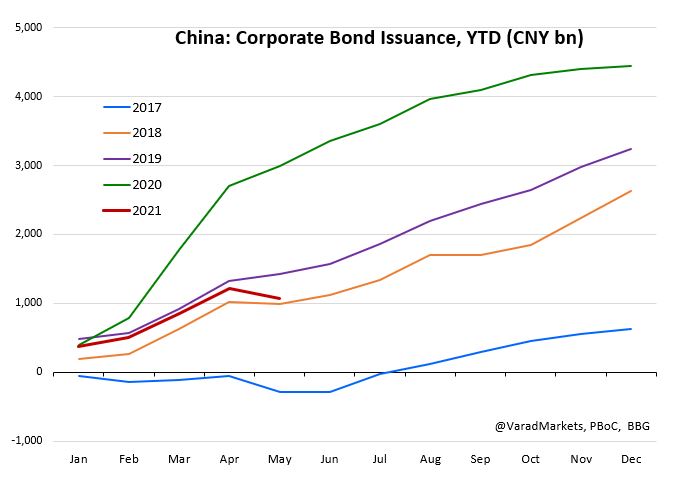

▪️ Credit did tighten in 2021 v/s exceptional surge in 2020 (base effect) but 2021 still ahead of pre-COVID yrs of 2017-19 => better call it credit 'normalization'

▪️ Govt completed only ~25% of 2021 bond issuance in first 5m of yr => backloaded => likely pickup in H2'21

3/9

▪️ Govt completed only ~25% of 2021 bond issuance in first 5m of yr => backloaded => likely pickup in H2'21

3/9

Few key points by @michaelxpettis:

1. Not to focus too much on YoY as discussed above as well

2. Even at just 0.6% mom (4yr avrg +0.93%), AF YoY growth, ~9.3%, will be close to 2021 Nominal GDP growth expectations

3. Credit growth v/s Leverage ratios

4/9

1. Not to focus too much on YoY as discussed above as well

2. Even at just 0.6% mom (4yr avrg +0.93%), AF YoY growth, ~9.3%, will be close to 2021 Nominal GDP growth expectations

3. Credit growth v/s Leverage ratios

4/9

https://twitter.com/michaelxpettis/status/1403276518487384066?s=20

Components of China Aggregate Financing to Real Economy (AFRE, as they call it now)

Total CNY 298tn

🔹 Renminbi RMB Loans CNY 184tn 61.5%

🔹 Govt Bond Issuance CNY 48tn 16%

🔹 Corporate Bond Issuance CNY 28tn 9.5%

🔹 Trust/Entrusted Loans/BA (Shadow) CNY 20tn 6.8%

5/9

Total CNY 298tn

🔹 Renminbi RMB Loans CNY 184tn 61.5%

🔹 Govt Bond Issuance CNY 48tn 16%

🔹 Corporate Bond Issuance CNY 28tn 9.5%

🔹 Trust/Entrusted Loans/BA (Shadow) CNY 20tn 6.8%

5/9

RMB Loans, which form major portion of China broad credit (AFRE), are holding up well even relative to 2020

6/9

6/9

Corporate Bond issuance weaker relative to previous years => one of the key reasons for 2021 credit slow down

7/9

7/9

Deleveraging: tightening of Shadow Banking sector over years - another partial reason for credit tightening, though absolute numbers are small

8/9

8/9

Previous #DiveIn into China Macro around 'basically stable' FX:

https://twitter.com/VaradMarkets/status/1396754427583688704?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh