Fund Manager/Trader; Global Macro/Technical/Market Analysis; Cash/Deriv/Vols; No gossip, No investment advice. Just markets & learning together. VARAD: Blessing

3 subscribers

How to get URL link on X (Twitter) App

▪️ China reported 3,300 cases on Saturday - worst outbreak since early days

▪️ China reported 3,300 cases on Saturday - worst outbreak since early days

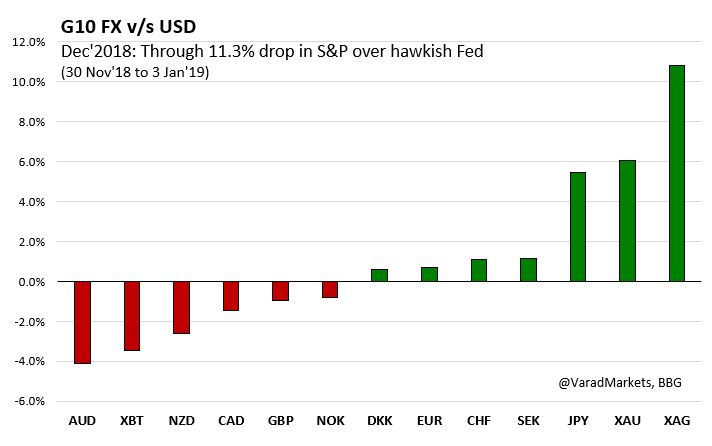

▪️ Recent S&P drawdown -12.5% since 3 Jan'22 on hawkish Fed & Russian invasion but $JPY +1.0% with drawdown of only 1.4%

▪️ Recent S&P drawdown -12.5% since 3 Jan'22 on hawkish Fed & Russian invasion but $JPY +1.0% with drawdown of only 1.4%

Dec 2018 Recap:

Dec 2018 Recap:

Fed's dovish pivot in early Jan'19

Fed's dovish pivot in early Jan'19

https://twitter.com/TruthGundlach/status/1478924452209459201?s=20

Note: Quantitative Tightening = BS reduction whereas 'Tapering' is reducing pace of BS expansion (currently underway)

Note: Quantitative Tightening = BS reduction whereas 'Tapering' is reducing pace of BS expansion (currently underway)

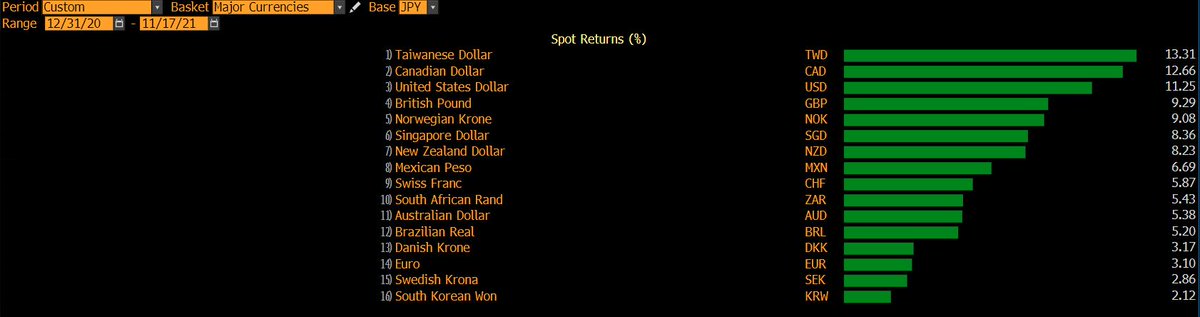

▪️ YTD Long CAD/Short JPY still best G10-JPY Dollar-neutral trade but rise in correls recently

▪️ YTD Long CAD/Short JPY still best G10-JPY Dollar-neutral trade but rise in correls recently

f/e Euro bond futures lower on doubling of limit to 150bn for cash as collateral=>possible easing of collateral shortage in repo mkt

f/e Euro bond futures lower on doubling of limit to 150bn for cash as collateral=>possible easing of collateral shortage in repo mkt

#Powell @ Jul-FOMC: "wouldn’t be still buying assets & raising rates...you’re adding accommod by buying & removing by raising.,,wouldn’t be ideal"

#Powell @ Jul-FOMC: "wouldn’t be still buying assets & raising rates...you’re adding accommod by buying & removing by raising.,,wouldn’t be ideal"

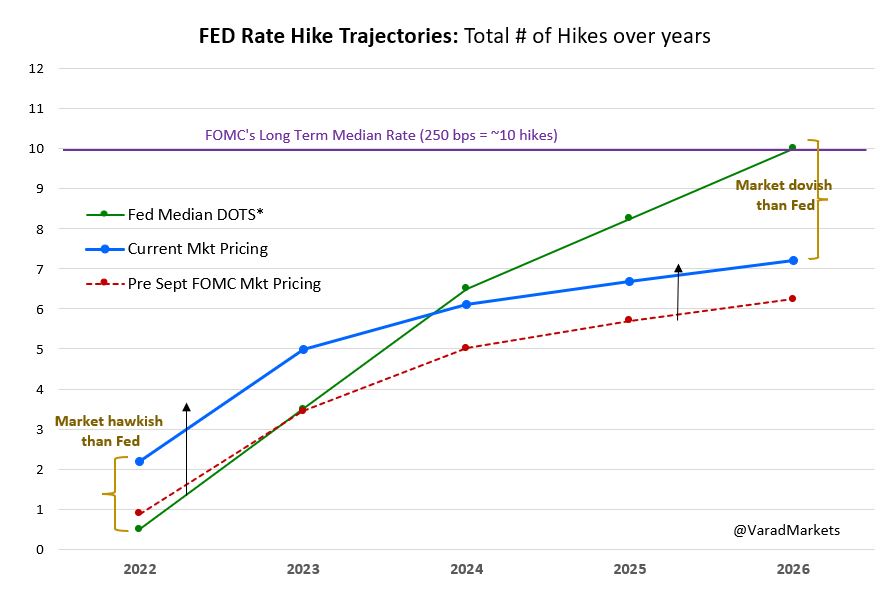

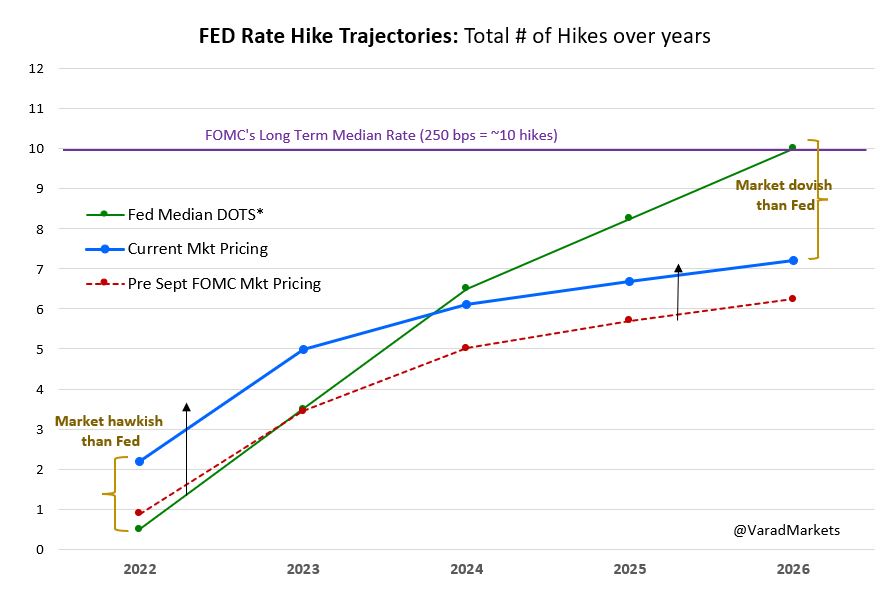

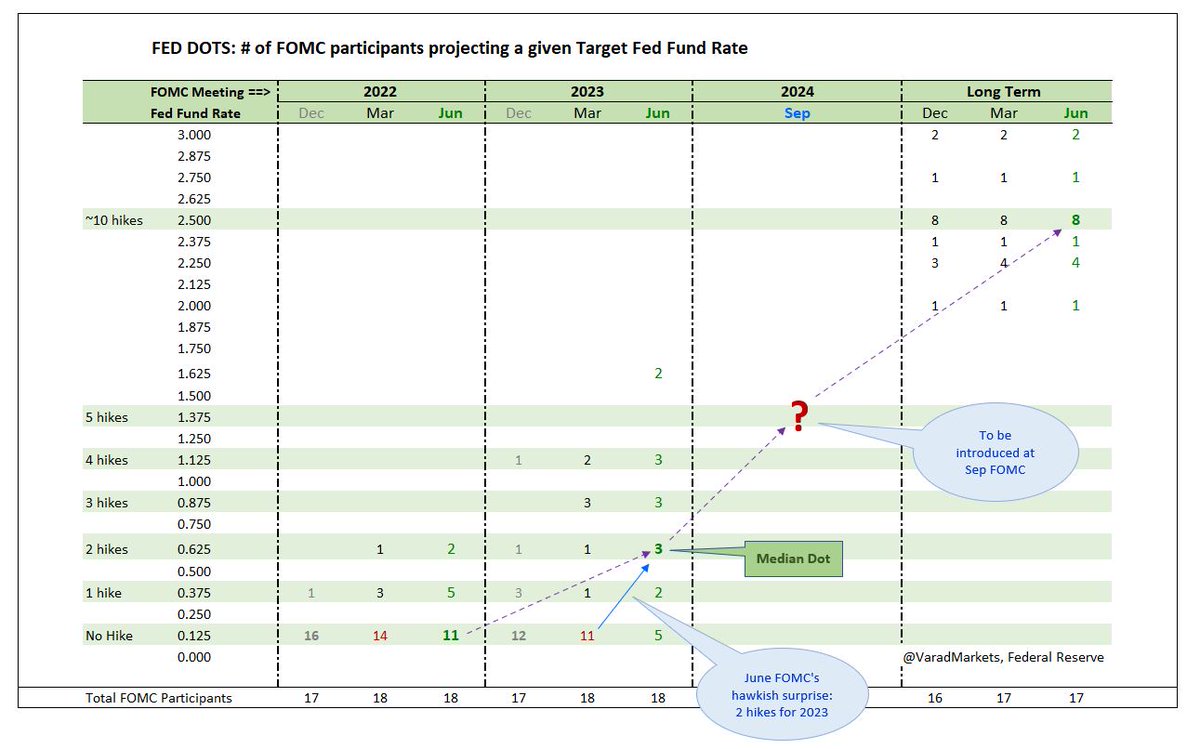

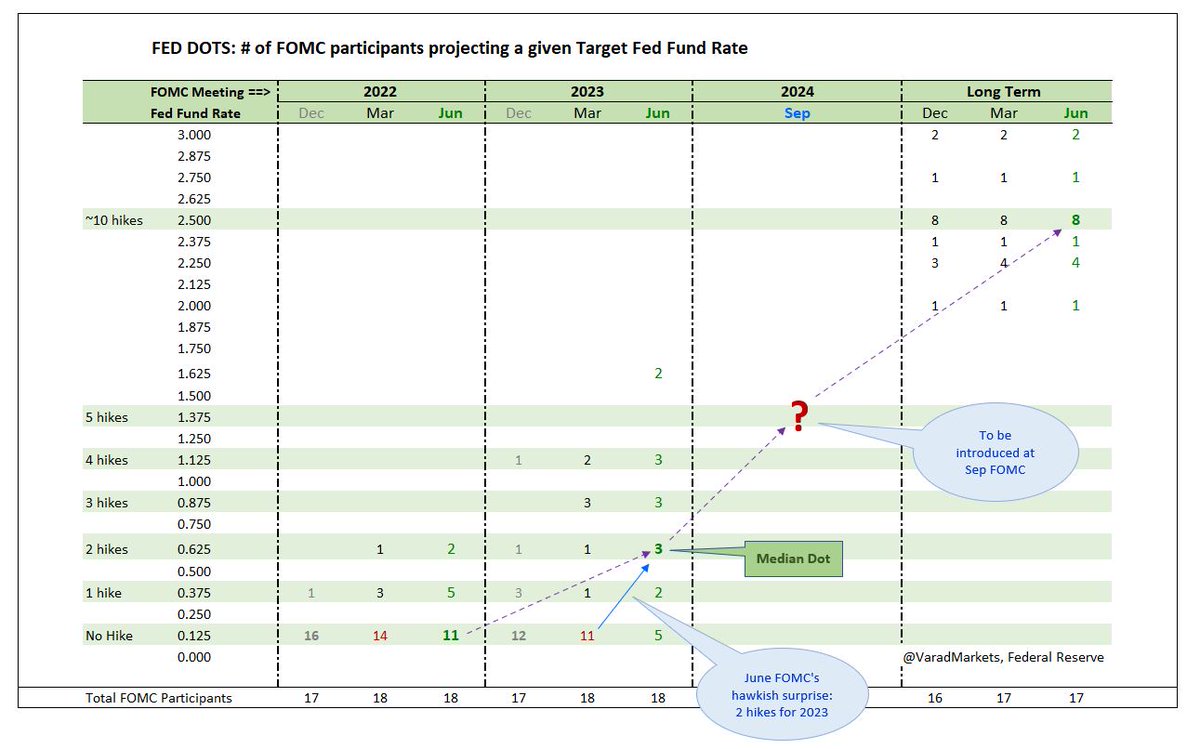

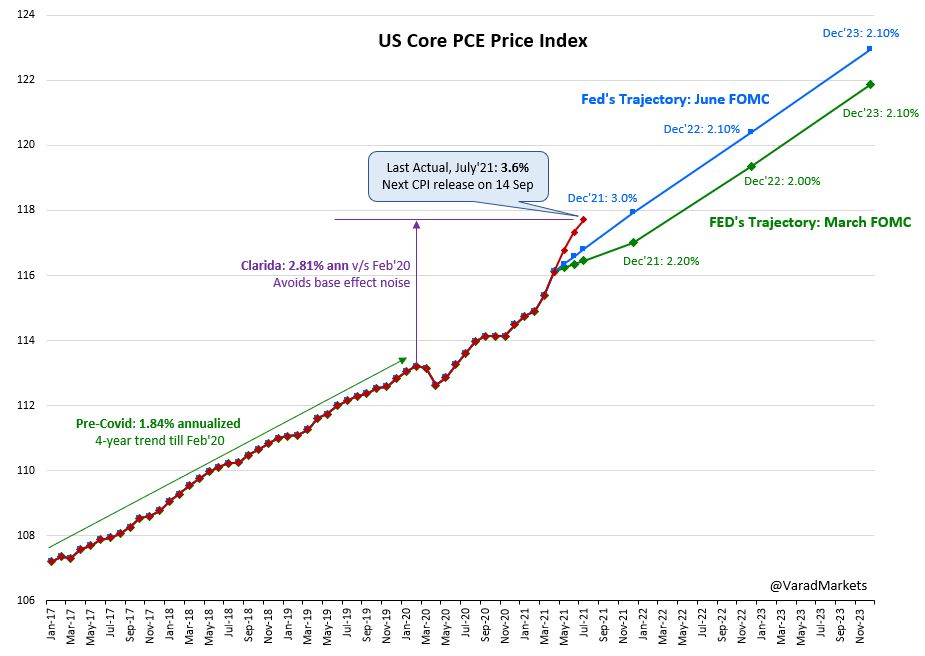

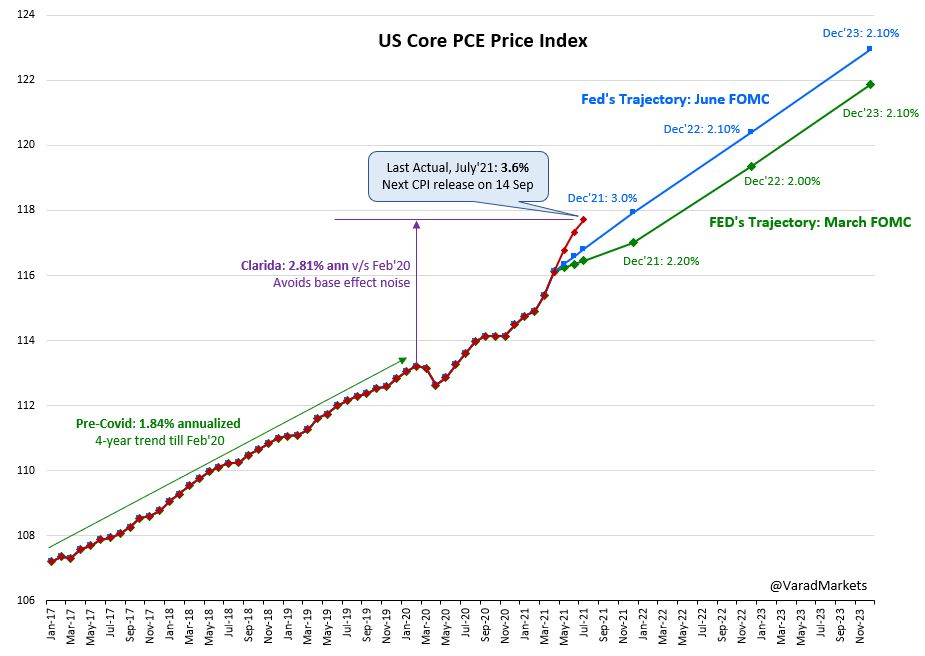

▪️ Recall: Fed's surprise projection of 2 rate hikes for 2023 was primarily responsible for Jun FOMC's hawkish pivot => DXY spiked ~2% over 2 trading sessions post June FOMC

▪️ Recall: Fed's surprise projection of 2 rate hikes for 2023 was primarily responsible for Jun FOMC's hawkish pivot => DXY spiked ~2% over 2 trading sessions post June FOMChttps://twitter.com/VaradMarkets/status/1433684556859600898?s=20

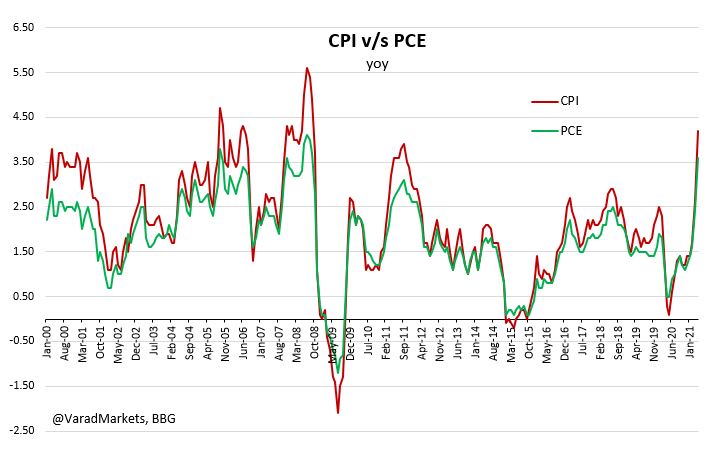

Core PCE MoM past its peak?

Core PCE MoM past its peak?

With 10y UST yield at 1.18% & TP at -0.10% => 1y yield is expected to avg ~1.28% over next 10 yrs

With 10y UST yield at 1.18% & TP at -0.10% => 1y yield is expected to avg ~1.28% over next 10 yrs

2⃣ Virus

2⃣ Virus

https://twitter.com/jasonfurman/status/1410946244361531398?s=20

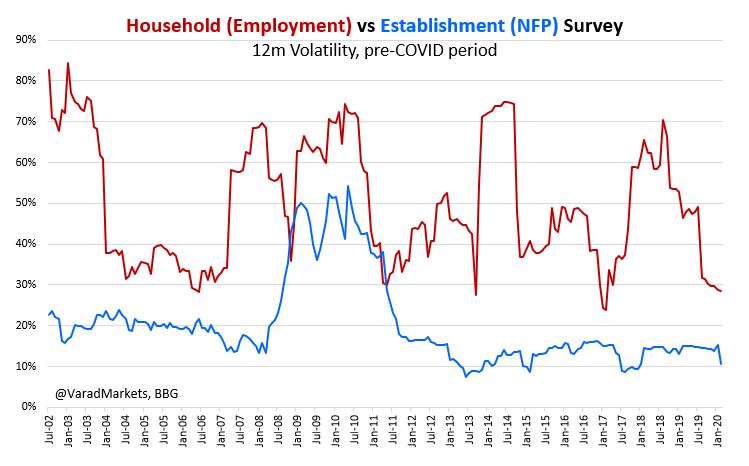

U3 v/s U6:

U3 v/s U6:https://twitter.com/AndreasSteno/status/1410957544042926080?s=20

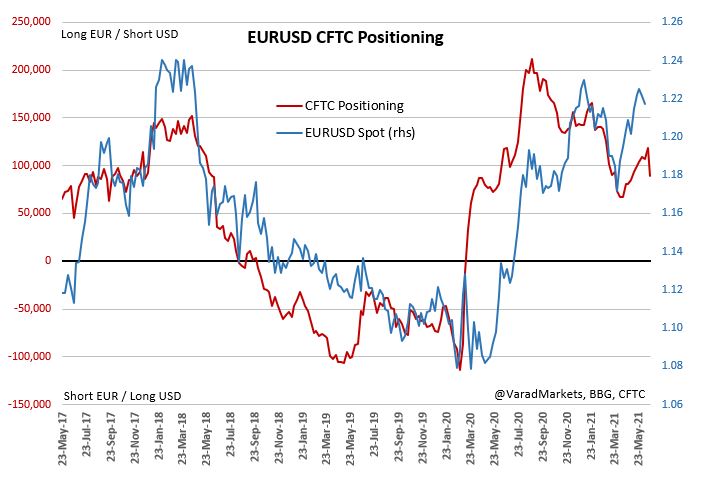

▪️ Post FOMC's perceived hawkishness, short USD position reduction expected

▪️ Post FOMC's perceived hawkishness, short USD position reduction expectedhttps://twitter.com/VaradMarkets/status/1401908703725457414?s=20

BoK's recent hawkishness => rates sell off (higher yld) v/s Received rates positioning:

BoK's recent hawkishness => rates sell off (higher yld) v/s Received rates positioning:

▪️ To start, target Fiscal Deficit 3.1% in 2021 v/s over 3.6% in 2020 => bound to be fiscal tightening by design

▪️ To start, target Fiscal Deficit 3.1% in 2021 v/s over 3.6% in 2020 => bound to be fiscal tightening by design

FX Transactions settled in CLS System (Continuous Linked Settlement)

FX Transactions settled in CLS System (Continuous Linked Settlement)

Four Sources of differences: Scope, Formula, Weight, Others Effects

Four Sources of differences: Scope, Formula, Weight, Others Effects