The last time Ethereum gas was this low—as far as I remember—was the start of 2020, around the time of the initial launch of Aave.

A lot has changed in that time for Ethereum and DeFi. Let's recap.

A 🧵

A lot has changed in that time for Ethereum and DeFi. Let's recap.

A 🧵

Ethereum now settles over $45 billion in transaction volume each day, between ETH and stablecoins alone.

At the start of 2020, this value was closer to $900 million, lower than Bitcoin's $ throughput at the time as per CoinMetrics data.

At the start of 2020, this value was closer to $900 million, lower than Bitcoin's $ throughput at the time as per CoinMetrics data.

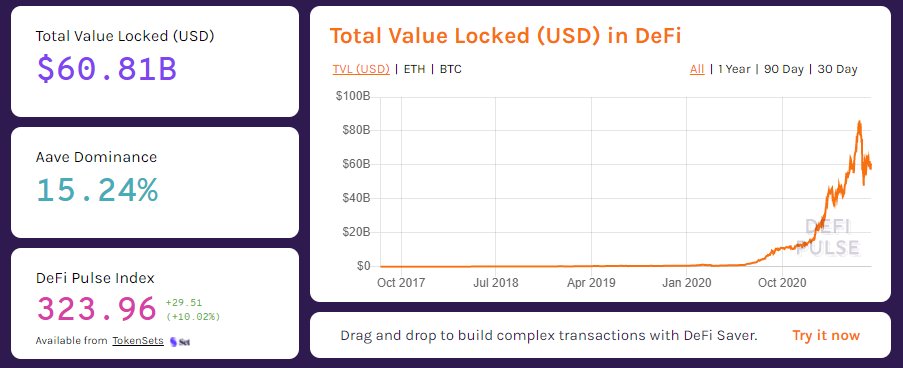

There is now over $60 billion locked in Ethereum DeFi today.

At the start of January 2020, that value sat at $700 million, most of which was ETH and a smattering of ERC-20 tokens deposited in Maker to mint DAI.

At the start of January 2020, that value sat at $700 million, most of which was ETH and a smattering of ERC-20 tokens deposited in Maker to mint DAI.

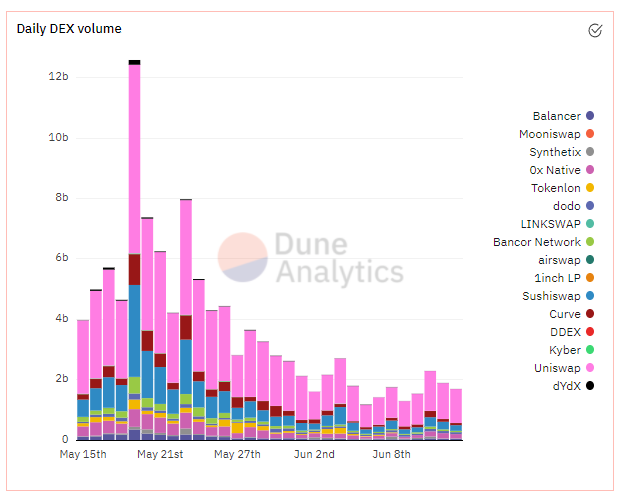

DEXs today have begun to encroach on centralized exchanges.

Benefits include but are not limited to permissionless access, support for long-tail assets, and sometimes, deeper books.

Yesterday, Uniswap processed over $1.1b in volume, outpacing Bitfinex, Bitflyer, and Bitstamp.

Benefits include but are not limited to permissionless access, support for long-tail assets, and sometimes, deeper books.

Yesterday, Uniswap processed over $1.1b in volume, outpacing Bitfinex, Bitflyer, and Bitstamp.

The Truffle development environment has surpassed five million downloads as developers continue to flock to Ethereum.

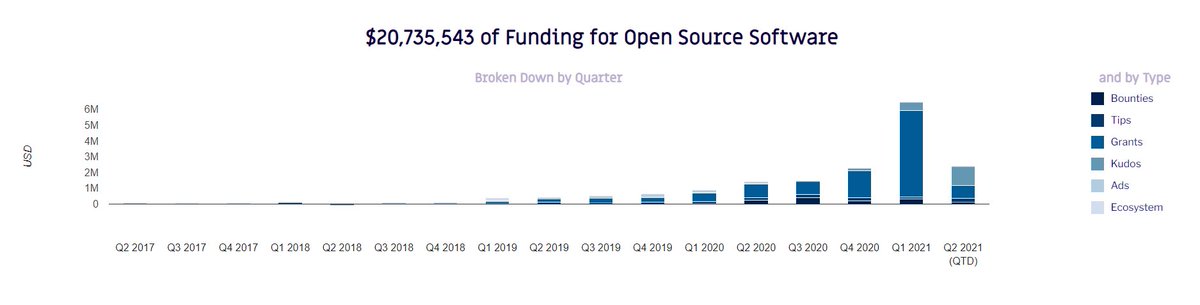

An additional $20 million was allocated to Ethereum developers and community members via @gitcoin since January 2020.

Q1 2021 was the largest quarter yet, facilitating $6.5 million in funding, around $3,000 per hour over that quarter.

Q1 2021 was the largest quarter yet, facilitating $6.5 million in funding, around $3,000 per hour over that quarter.

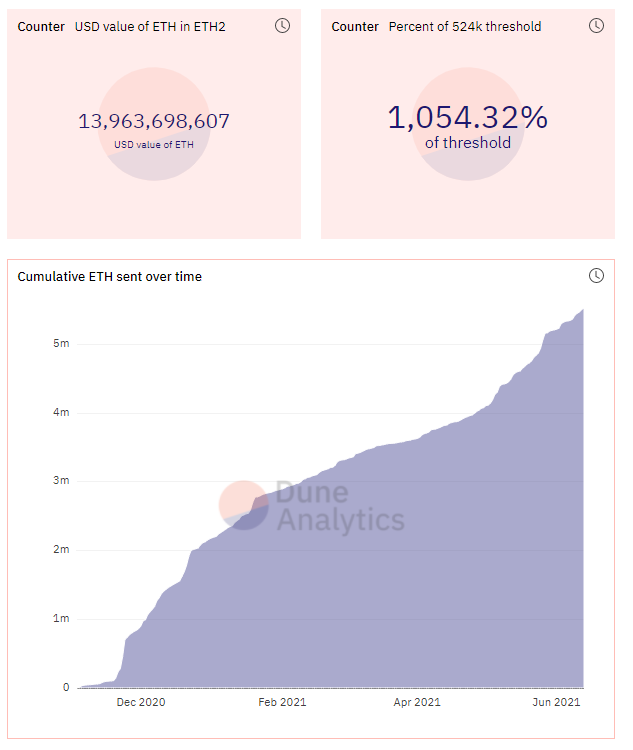

ETH2 has started to come to fruition.

At the start of 2020, there was heavy criticism of Ethereum 2.0 by the BTC crew and others due to a delayed timeline.

There is now $14 billion in ETH betting on the launch of ETH2.

At the start of 2020, there was heavy criticism of Ethereum 2.0 by the BTC crew and others due to a delayed timeline.

There is now $14 billion in ETH betting on the launch of ETH2.

Bitcoin is flocking to Ethereum.

Today, over 239,847 BTC—or over 1% of the total supply—exists on Ethereum.

At the start of 2020, the figure was closer to 1,000

Bitcoin.

Today, over 239,847 BTC—or over 1% of the total supply—exists on Ethereum.

At the start of 2020, the figure was closer to 1,000

Bitcoin.

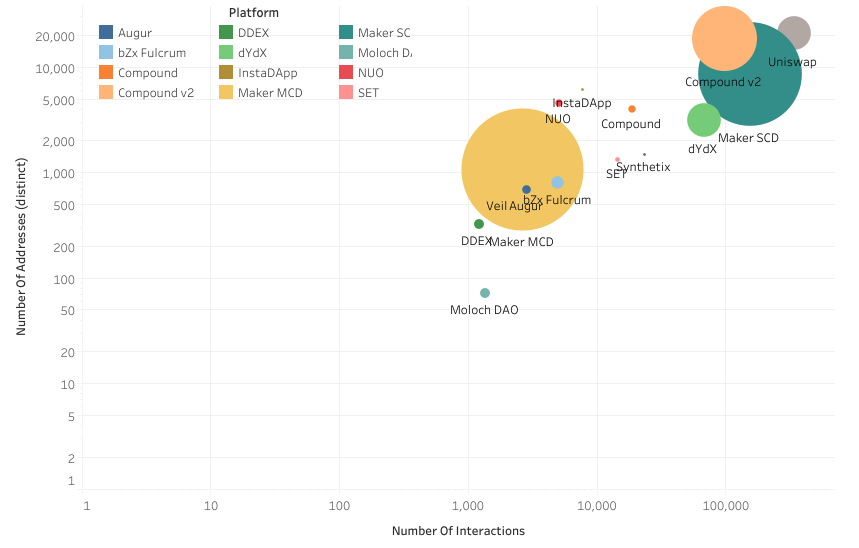

Thematically, early 2020 DeFi was primarily focused on one thing: borrowing, primarily through MakerDAO.

Today, we've seen the use cases for DeFi expand to trading, synthetics, asset management, and more.

And there's more to come. Derivatives👀

Today, we've seen the use cases for DeFi expand to trading, synthetics, asset management, and more.

And there's more to come. Derivatives👀

So what's behind the drop in gas prices?

Polygon happened. A bit of BSC and Solana too, probably. Prices dropped as well.

But is DeFi gone?

I don't think so. Polygon's consistently full blocks are a testament to that, as are the billions of $ still locked in smart contracts.

Polygon happened. A bit of BSC and Solana too, probably. Prices dropped as well.

But is DeFi gone?

I don't think so. Polygon's consistently full blocks are a testament to that, as are the billions of $ still locked in smart contracts.

• • •

Missing some Tweet in this thread? You can try to

force a refresh