(0) There aren’t that many apps that straddle multi-chain, multi-layer (“MCML”) yet, so this is an under-explored area, but I think teams should really start thinking about aggregating such data. Let’s take $SUSHI as an example.

(1) As for today, Sushi’s TVL on Matic makes up almost 30% of its overall TVL (from a standing start in early May). It’s not hard to imagine the same would apply to pending Arbitrum / Optimism roll-out also (and to the extent BSC returns).

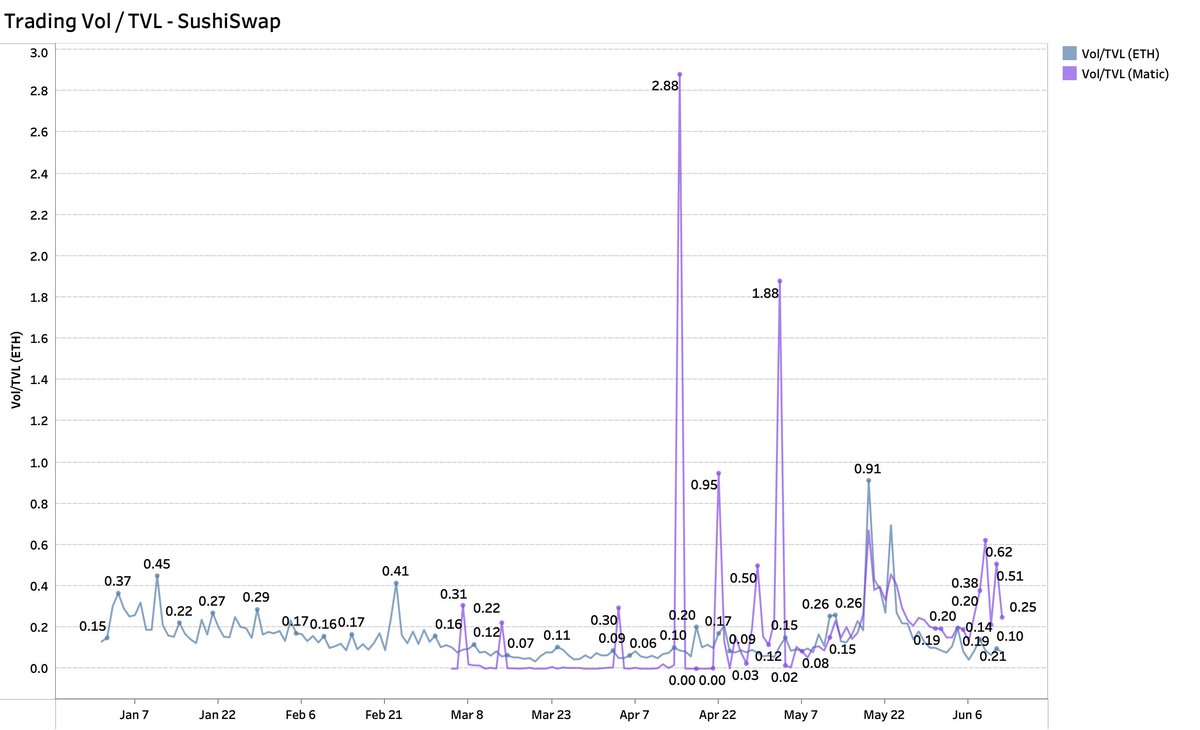

(2) The utilization is actually remarkably good – as of today Sushi on Matic is doing similar volumes as it does on ETH, making on-chain TVL almost 2-3x more efficient on Matic. In aggregate $SUSHI is doing more volume now vs. Feb and April. Ignoring FTM given only 2-5 mm volume.

(3) When analysts only look at the analytics.sushi.com site they’d almost be invariably ignoring MLMC side of things and undervaluing Sushi (left chart), in reality if we multiply such volume by 5 bps & by 365 days, Sushi’s circulating mkt cap / rev is closer to 11-12x today.

(4) Directionally SUSHI on MATIC also eclipsed QUICK volume, I suspect there’s some share gain here; but if one just eyeball Sushi’s aggregate volume, it actually doesn’t look half bad despite directionally vs. overall market that tanked ~40-60% in the past month.

(5) Where volume #’s go next obviously is important (exchanges are cyclical), fee compression could be upon us (judging by 5 bp swap on UNI v3 + CRV coming in), and obviously discussions to be had around longevity of inflation + x*y=k model + Matic ponzi farms…

(6) …but I think as MCML apps are upon us (YFI being another potential one), analysts will need to build proprietary dash that do a better job aggregating value-capture across apps and layers; personally think there’s definitely alpha in this.

(7) …or maybe projects could do it themselves <3, with Sushi especially given there’d be a lot more product launches (MISO + etc). HT to @0xUrsa for putting the data together!

• • •

Missing some Tweet in this thread? You can try to

force a refresh