"Former U.S. Treasury Secretary Lawrence Summers said he didn’t expect the recent fall in bond yields although he maintained his view that the economy is overheating."

The recent development of bond yields can be explained. Here is my take [thread]:

bloombergquint.com/global-economi…

The recent development of bond yields can be explained. Here is my take [thread]:

bloombergquint.com/global-economi…

The US government has to "pre-finance" its spending. Political rules force it to issue and sell t-bonds before it spends. This usually does not matter much in terms of effect on yields because the US government sells t-bonds and receives deposits at the @federalreserve ...

... only to then spend those deposits, which means that the banks receive them back (as reserves). The overall level of reserves (=clearing balances) in the banking system stays the same when government has spent. It does not, however, when the US government sells many t-bonds...

... but keeps the deposits sitting in its account. When the pandemic hit, the US government apparently thought it had to sell t-bonds quickly to prepare spending trillions of $ (which it did, it just took a while).

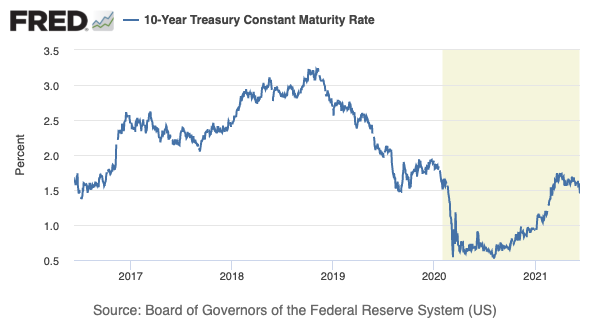

When the US government sold many t-bonds, banks were losing reserves. Their bids declined and so did t-bond prices. The yield, which is inverse to the market price, went up. This has happened since fall 2020 and caused people like Summers to be "concerned". However, ...

those that understand that the fall in t-bond prices / rise in yield was only temporary (because the US government "hoarded" deposits at the Fed) knew that when the spending increased the banks would be flooded with reserves which can be used to buy t-bonds...

... that would be relatively attractive since their yields is above the interest rate that the Fed now pays on excess reserves held with the Fed, which stands a 0.1 percent – much lower than 10y t-bond yield (1.5 percent). federalreserve.gov/monetarypolicy…

Larry Summers should not have been surprised that this would happen. Yields on t-bonds are determined by the interactions of the Fed, the Treasury, the banking system and other investors. @economics

This does not mean that we can predict where bond yields will go, but we can make informed guesses and assign a confidence level. 🦢

So, US bond yields might go up or down from here – I would not see it as a refutation of the chain of logic I presented here. 🦉

So, US bond yields might go up or down from here – I would not see it as a refutation of the chain of logic I presented here. 🦉

• • •

Missing some Tweet in this thread? You can try to

force a refresh