Most forecasters are assuming output ends the year above its pre-pandemic trend while employment is still below. Which means *a lot* of productivity. Eg compare IHS Markit Dec-19 & Jun-21 forecasts for 2021-Q4:

GDP: +2.0%

Employment: -3.5%

Total hours: -2.3%

Productivity: +5.4%

GDP: +2.0%

Employment: -3.5%

Total hours: -2.3%

Productivity: +5.4%

The GDP +2.0% is extraordinary--it says that output will be higher than if we never went through the pandemic. A lot of other forecasts expect the same: Fed's Summary of Economic Projections, the Survey of Professional Forecasters, the OECD, IMF, etc.

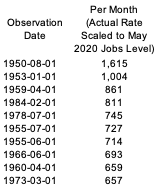

Moreover, we're getting to this increased output with a lot fewer people. No one expects the unemployment rate to be 3.5% and the participation rate to fully recovery by Q4 of this year (and I don't either).

Implicitly the extra productivity is partly pandemic-induced innovation (our local bagel store has online ordering now) and partly greater work intensity to satisfy demand (the people there appear to be working even harder/faster than usual).

Additional productivity seems plausible but the magnitudes in most forecasts are very large. So I would take the under on IHS Markit productivity at four-to-one odds.

I would also take the under on GDP (at two-to-one odds) and over on employment (need one-to-one for this bet).

I would also take the under on GDP (at two-to-one odds) and over on employment (need one-to-one for this bet).

I'll be looking at the Fed's new Summary of Economic Projections this week to see if it has this feature. (You can't read productivity directly, will have to make assumptions about average hours and labor force participation, but can still get a general ballpark.)

• • •

Missing some Tweet in this thread? You can try to

force a refresh