From our high horse, we (investors) assume we'll spot tell-tale signs of an impending revenue growth slow-down.

That's not true.

[Thread]: Why its nearly impossible to predict when a company's growth will stall, the myths of soft landings, and market cap consequences

That's not true.

[Thread]: Why its nearly impossible to predict when a company's growth will stall, the myths of soft landings, and market cap consequences

1/ The book "Stall Points" explains this concept perfectly.

We (investors) assume that we could spot the following to predict potential stall points:

- Revenue growth deceleration

- Gross margin compression

- Lack of business activity

None of these hold the answer.

We (investors) assume that we could spot the following to predict potential stall points:

- Revenue growth deceleration

- Gross margin compression

- Lack of business activity

None of these hold the answer.

2/ In fact, the reason why predicting stall points is impossible is because some co's do the EXACT OPPOSITE of what we think they should do.

Here's what I mean: Some businesses about to hit a stall point actually GROW revenues & margins!

Let's back this up with some data.

Here's what I mean: Some businesses about to hit a stall point actually GROW revenues & margins!

Let's back this up with some data.

3/ The book reveals what companies did right before the stall point:

- 40% Increased Margins

- 14% Maintained Margins

- 45% Accelerated Revenue growth

That's nearly half of the data showing the opposite of what we'd expect.

How is that possible?

- 40% Increased Margins

- 14% Maintained Margins

- 45% Accelerated Revenue growth

That's nearly half of the data showing the opposite of what we'd expect.

How is that possible?

4/ The "Oh S**t" Conundrum

The reason revenues tend to increase before the stall lies in the "Oh S**t" Conundrum. Management, realizing they might miss expectations, expands revenues by:

- M&A

- Channel stuffing

- Asset sales

All in hopes to keep that growth going. And yet..

The reason revenues tend to increase before the stall lies in the "Oh S**t" Conundrum. Management, realizing they might miss expectations, expands revenues by:

- M&A

- Channel stuffing

- Asset sales

All in hopes to keep that growth going. And yet..

5/ In other words, a rapid acceleration in revenue growth should prompt initial caution, not excitement.

What should investors do? Verify that revenue growth came from organic/planned business activity.

Watch out for past organic growers shifting to M&A-hungry expansion.

What should investors do? Verify that revenue growth came from organic/planned business activity.

Watch out for past organic growers shifting to M&A-hungry expansion.

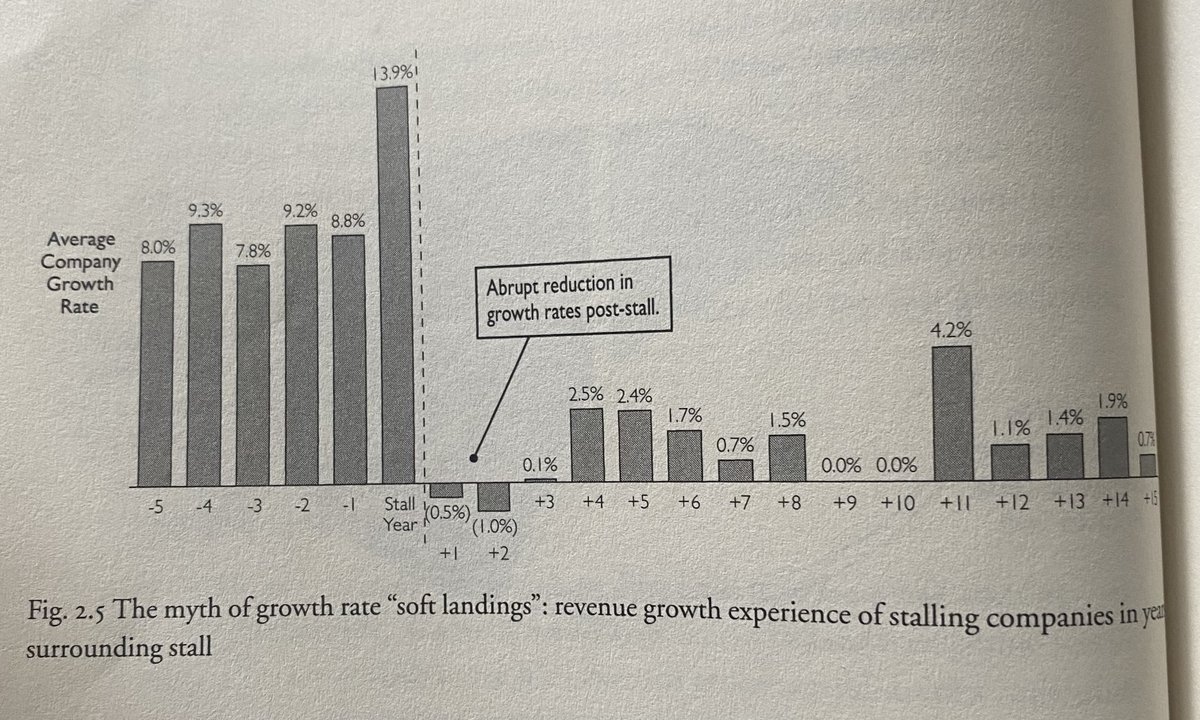

6/ You know what else sucks? Stall points aren't gradual declines. They're cliff-falling collapses.

The book calls it "The Myth of Soft Landings"

Put simply, soft landings are rare and most companies exhibit a steep, sudden revenue growth drop-off.

Like Taleb's Turkey

The book calls it "The Myth of Soft Landings"

Put simply, soft landings are rare and most companies exhibit a steep, sudden revenue growth drop-off.

Like Taleb's Turkey

7/ The Consequences of Stall Points

- 42% of stocks declined more than two years after initial stall

- 51% lost more than 75% of market cap post-stall

- 40% lost between 50-70% of market cap post-stall

Stall points offer delayed, but certain penalties.

- 42% of stocks declined more than two years after initial stall

- 51% lost more than 75% of market cap post-stall

- 40% lost between 50-70% of market cap post-stall

Stall points offer delayed, but certain penalties.

8/ Some Lessons

What should you take from this thread? A few things:

- Pay attention to type of revenue growth (not all growth created equal)

- Assign low probability of success to turnaround stories (hard to regain growth)

- Cut losses quickly at first sign of stall point

What should you take from this thread? A few things:

- Pay attention to type of revenue growth (not all growth created equal)

- Assign low probability of success to turnaround stories (hard to regain growth)

- Cut losses quickly at first sign of stall point

9/ Conclusion

Go buy the book. Here's the link.

I'm having a hell of a good time reading, underlining, and re-reading parts I don't understand.

H/t @CliffordSosin for the recommendation.

amazon.com/Stall-Points-C…

Go buy the book. Here's the link.

I'm having a hell of a good time reading, underlining, and re-reading parts I don't understand.

H/t @CliffordSosin for the recommendation.

amazon.com/Stall-Points-C…

• • •

Missing some Tweet in this thread? You can try to

force a refresh