84K Followers. Mind blowing.

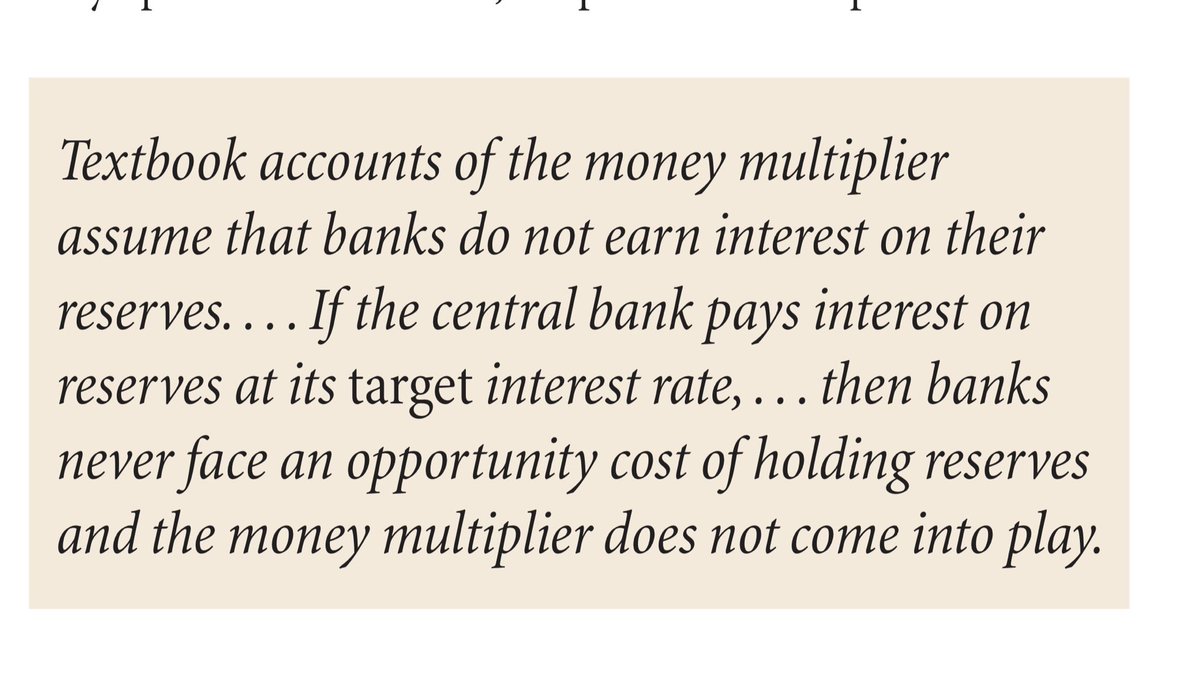

This must come as a bit of a surprise… but the day Post GFC in 2008… the Deposit Multiplier ceased to exist the day the Fed paid IOER…in other words there’s no opportunity cost of holding Reserves. #QEFloorSystem

The Fed & only Fed creates Money Supply in Aggregate. $XLF

The Fed & only Fed creates Money Supply in Aggregate. $XLF

Trying to tell people Liquidity & Money Velocity is subject to Basel III/QE Floor is exhausting.

• • •

Missing some Tweet in this thread? You can try to

force a refresh