Bull runs in small caps are usually fast and furious, and the cycle repeats itself every 3-4 years. Every time, retail is sold stories of business turnaround and stock charts look fantastic for meteoric wealth creation. For the class of 2020-21, here's a couple of past stars.

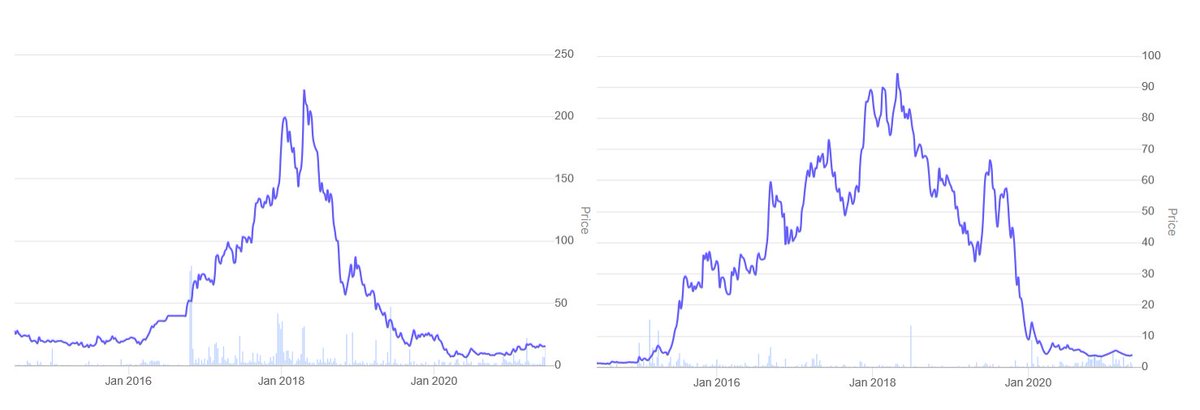

These small cap stocks with 30-40 crore market cap went up 23X and 11x in a span of 24 months between April 16 and April 18. The story looked great then, but subsequently once liquidity and interest disappeared, the prices went right back to where they came from.

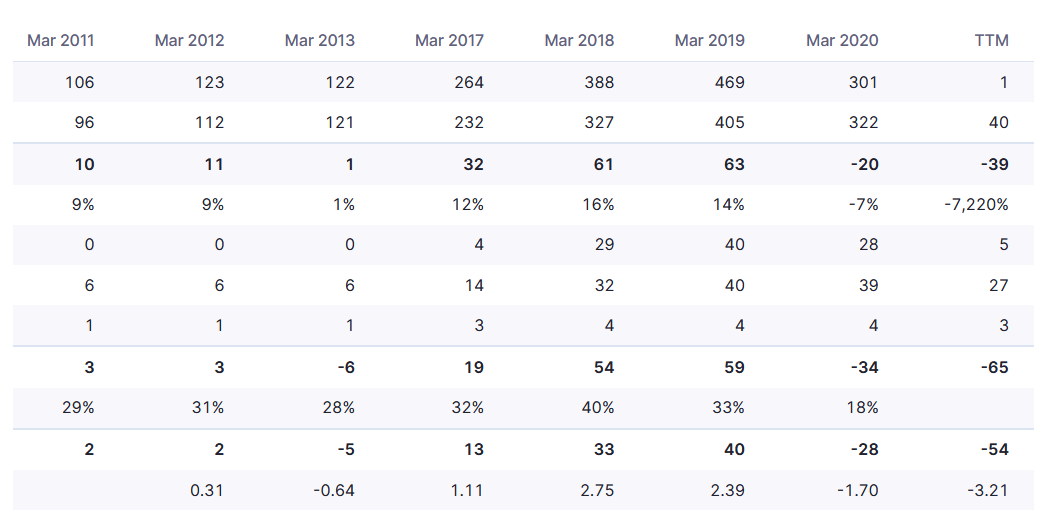

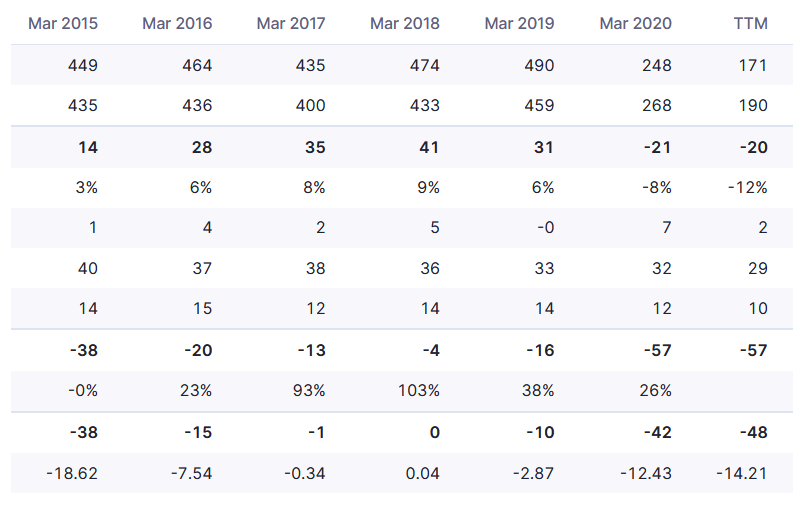

When in the thick of the action, it can be difficult to keep a level mindset. To keep the narrative believable, these companies are able to massage their top-line and bottom-line for a short period of time to show an imminent turnaround. Note the trends in these financials.

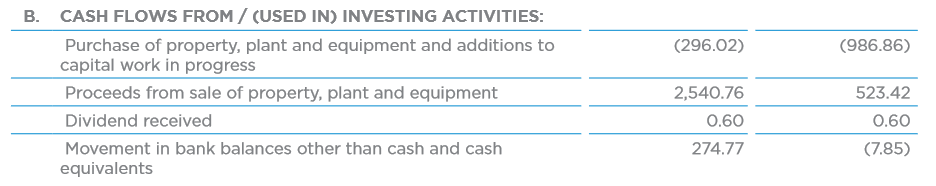

The company usually exhausts its ability to massage the financial statements very soon and the business health plummets dramatically. One collapsed so dramatically it has been selling fixed assets. The other one is Uniply Industries - a simple search on Twitter will suffice.

Newer small cap investors may be subscribed to many Twitter handles, Telegram channels, groups and even premium advisory services. Don't take anybody's word for the narrative being sold to you. On-the-ground-research and scuttlebutt can be plain fiction.

In small caps, liquidity (or the lack thereof) often drives the prices. Upper circuits happen frequently because there isn't enough liquidity. Supply can be snapped up in advance and offloaded slowly to retailers in the form of upper circuits by generating hype.

It doesn't take more than 10-20k shares worth 10-20 lakhs to send a share to upper circuit in many microcaps. Afterwards, it's easy convincing retailers with such a nice chart formation. Chaand bhi paas lagta hai.

Promoters are often themselves playing to increase market cap. Financial jugglery for more sales/profits is an established way to con banks into giving loans, which are siphoned off. The price rise is great too, you can offload or offer as collateral (if any bank will take it).

Advisory services and gurus on Twitter / social media also can use access to eager promoters to paint mind-blowing narratives on these companies. I use the word 'can' here because advisors and gurus always caveat their research, and everyone has the right to benefit of doubt.

This is in public interest - I have sat through several cycles of small caps shooting for the skies as a collective group, and leaving many retail investors swearing to never enter the markets ever again once the music ends.

Small caps can build wealth just like any category (with more risk of course). Some small caps I hold have grown to mid caps. Risk management and a leap of faith is necessary here, do check what/who your faith is on. Entries can always be made later when things are clearer.

• • •

Missing some Tweet in this thread? You can try to

force a refresh